United States Steel Corp (X) Q1 2024 Earnings: Aligns with Analyst Projections

Net Earnings: Reported at $171 million, falling below the estimated $180 million.

Earnings Per Share (EPS): Achieved $0.68 per diluted share, below the estimated $0.83.

Revenue: Totaled $4,160 million, below the estimated $4,206.66 million.

Adjusted Net Earnings: Reached $206 million, surpassing the prior year's $195 million.

Adjusted EPS: Recorded at $0.82 per diluted share, meeting the higher end of the guidance range of $0.80 to $0.84.

Adjusted EBITDA: Reported at $414 million, slightly below the guidance of approximately $425 million due to unfavorable inventory impacts.

Future Outlook: Anticipates stronger adjusted EBITDA in the range of $425 million to $475 million for the next quarter.

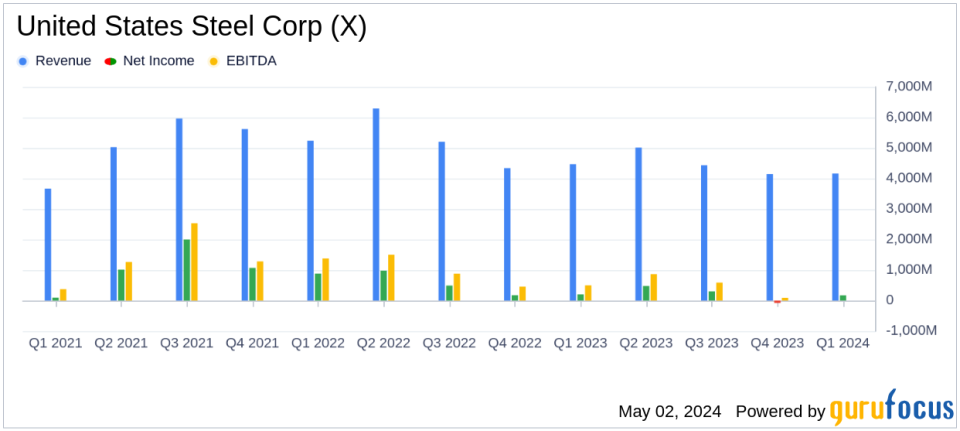

On May 2, 2024, United States Steel Corp (NYSE:X) disclosed its financial results for the first quarter of 2024, revealing earnings that closely aligned with analyst expectations. The company reported net earnings of $171 million, or $0.68 per diluted share, and adjusted net earnings of $206 million, or $0.82 per diluted share. These figures are in line with the estimated earnings per share of $0.83 and slightly above the estimated net income of $180 million. United States Steel Corp operates primarily in the United States with additional steelmaking capacity in Slovakia, focusing on several key segments including North American Flat-Rolled, Mini Mill, U.S. Steel Europe, and Tubular Products. For a detailed look at the earnings report, please view the 8-K filing.

Company Overview and Market Adaptation

United States Steel Corp's strategic operations across diverse segments have allowed it to maintain a robust market presence despite fluctuating conditions. The company's Flat-Rolled segment saw a significant improvement, turning a previous year's loss into a modest gain, while the Mini Mill segment capitalized on higher steel prices. However, challenges persist in the European market, impacting the U.S. Steel Europe segment with continued commercial headwinds.

Financial Performance and Future Outlook

The company's revenue for the quarter stood at $4,160 million, a decrease from the previous year's $4,470 million but still close to the estimated $4,206.66 million. Adjusted EBITDA was reported at $414 million, reflecting operational efficiencies and a diverse order book, albeit slightly impacted by inventory valuation adjustments. Looking ahead, United States Steel Corp anticipates stronger performance in the second quarter of 2024, with adjusted EBITDA expected to be between $425 million and $475 million.

Strategic Initiatives and Capital Investments

Under the leadership of President and CEO David B. Burritt, United States Steel Corp is advancing its strategic initiatives, including the nearing completion of Big River 2, a new mini mill in Arkansas. This project is set to enhance the company's operational capabilities and product offerings. The company also highlighted its ongoing merger process with Nippon Steel Corporation, which is expected to close in the second half of 2024, pending regulatory approvals.

Detailed Financials and Operational Metrics

The company's detailed financial statements reflect a disciplined approach to cost management and investment. Capital expenditures were significant, particularly in the Mini Mill segment, aligning with its strategic growth initiatives. The operational statistics indicate a mixed performance in terms of steel shipments and prices across different segments, with notable declines in the Tubular segment which faced softer market conditions.

Investor and Analyst Perspectives

While the earnings per share slightly missed the analyst target, the overall financial health of United States Steel Corp appears stable. The company's ability to meet near-term financial obligations remains intact, with a focus on strategic growth and operational efficiency likely to benefit long-term profitability and shareholder value.

Conclusion

As United States Steel Corp continues to navigate a complex global steel market, its focus on strategic initiatives and operational efficiency is crucial. With the anticipated benefits from new projects and potential synergies from the Nippon Steel merger, the company is well-positioned to leverage opportunities for expansion and enhanced profitability in the evolving industry landscape.

Explore the complete 8-K earnings release (here) from United States Steel Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance