Unveiling 3 UK Dividend Stocks Yielding Up To 4.5%

As London markets open higher, driven by low valuations and positive momentum across global indices, investors are keenly observing the financial landscape. Amidst this backdrop, dividend stocks in the United Kingdom present an appealing option for those looking to potentially enhance portfolio stability and income in these fluctuating market conditions.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 7.94% | ★★★★★★ |

Keller Group (LSE:KLR) | 3.98% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 7.62% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 6.03% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.76% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.03% | ★★★★★☆ |

NWF Group (AIM:NWF) | 3.58% | ★★★★★☆ |

James Latham (AIM:LTHM) | 3.01% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.50% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 4.02% | ★★★★★☆ |

Click here to see the full list of 55 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

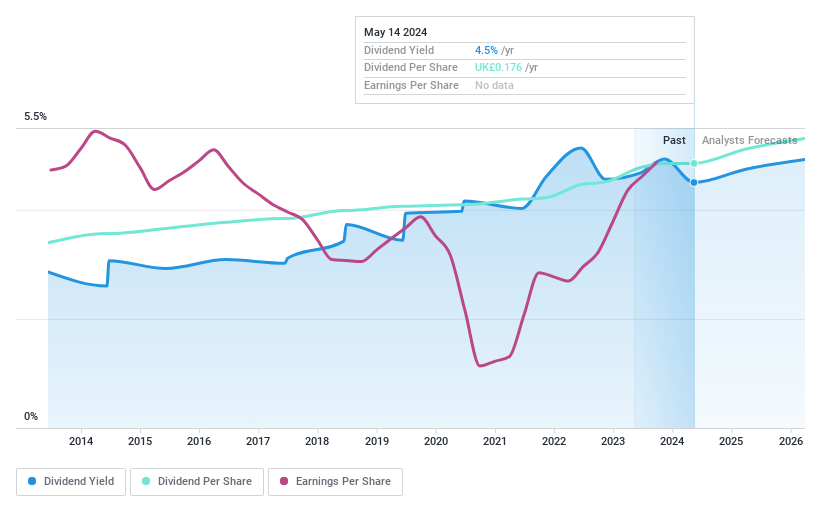

Castings

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Castings P.L.C. is a company involved in iron casting and machining, with a market capitalization of approximately £170.36 million.

Operations: Castings P.L.C. generates revenue primarily through its foundry operations, which brought in £253.63 million, and its machining operations, contributing £35.17 million.

Dividend Yield: 4.5%

Castings PLC has shown a stable dividend profile, maintaining reliability in its payouts over the past decade. The dividends are well-supported by both earnings and free cash flows, with payout ratios of 49.7% and 38.1%, respectively. Despite a modest annual earnings growth forecast of 2.21%, the company recorded a significant earnings increase of 51.3% last year. However, its dividend yield of 4.5% is below the top quartile of UK dividend stocks at 5.67%.

Dive into the specifics of Castings here with our thorough dividend report.

The valuation report we've compiled suggests that Castings' current price could be quite moderate.

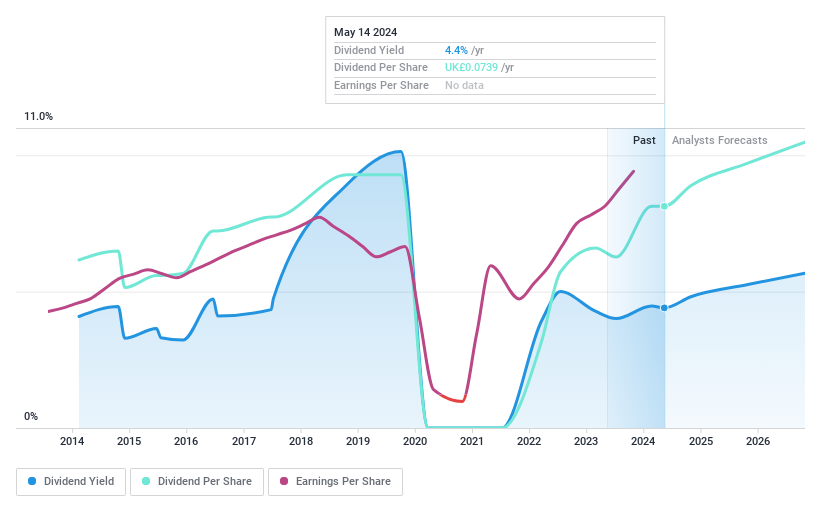

ME Group International

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ME Group International plc is a company based in the United Kingdom that operates, sells, and services a range of instant-service equipment, with a market capitalization of approximately £0.63 billion.

Operations: ME Group International plc generates revenue primarily from the Personal Services segment, totaling £297.66 million.

Dividend Yield: 4.4%

ME Group International's dividend history reveals inconsistency, with volatile payments over the past decade. Despite this, recent increases in dividends were approved at the AGM on April 26, 2024, reflecting a positive outlook from the board. The company's dividends are reasonably covered by both earnings and cash flows, with payout ratios of 55.2% and 82.6% respectively. However, its current yield of 4.4% is below the top UK dividend payers' average of 5.67%.

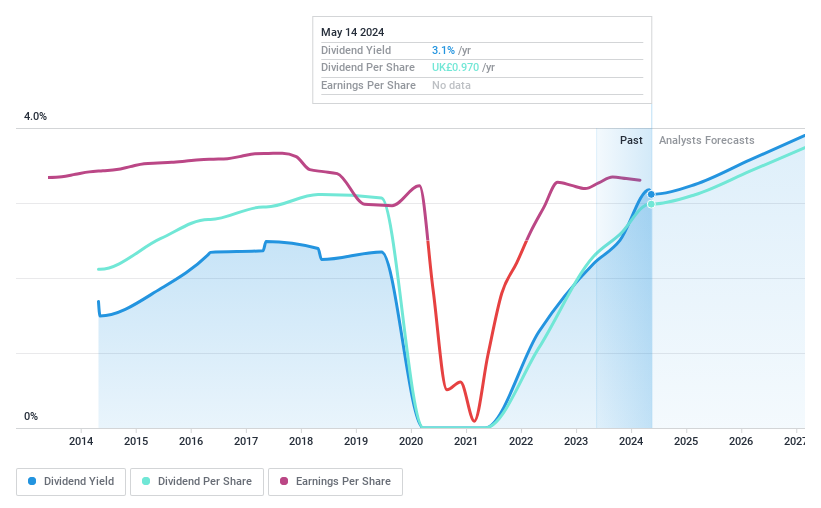

Whitbread

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Whitbread plc is a hospitality company that operates hotels and restaurants primarily in the United Kingdom and Germany, with a market capitalization of approximately £5.69 billion.

Operations: Whitbread plc generates £2.96 billion in revenue from its accommodation, food, and beverage segments.

Dividend Yield: 3.1%

Whitbread's recent financial performance shows a positive trajectory with sales rising to £2.96 billion and net income increasing to £312.1 million. Despite a low dividend yield of 3.12% compared to the UK market's top quartile, the company has proposed a significant 26% increase in its final dividend, reflecting confidence in its earnings stability, evidenced by an earnings coverage of 60.3% and cash flow coverage of 48%. Additionally, Whitbread is actively returning capital to shareholders through a £150 million share buyback program, enhancing shareholder value while maintaining investment-grade status for strategic acquisitions.

Get an in-depth perspective on Whitbread's performance by reading our dividend report here.

Our expertly prepared valuation report Whitbread implies its share price may be lower than expected.

Summing It All Up

Get an in-depth perspective on all 55 Top Dividend Stocks by using our screener here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:CGS LSE:MEGP and LSE:WTB.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance