Warren Buffett’s stockpiling cash. Is this a warning sign for the UK stock market?

The UK stock market’s had a good few months. The FTSE 100 is nearly 10% higher than it was at the start of 2024.

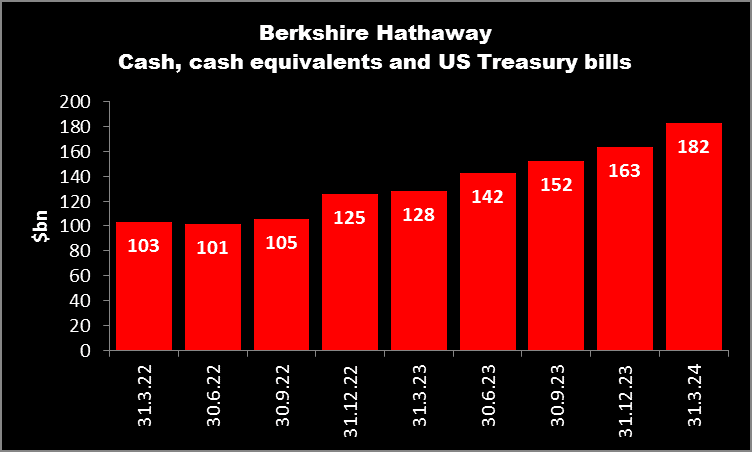

But on the other side of the Atlantic, Berkshire Hathaway — Warren Buffett’s investment company — has been building up cash. At the end of March 2024, it had cash and US Treasury bills (a proxy for cash) of $182bn on its balance sheet, an increase of 78%, compared to two years earlier.

This is surprising. Because inflation erodes the value of money, investors generally hold very little of it.

Yes, the company will be earning interest of around 5% on its government bills. But that’s a lot less than the 1965-2023 average annual growth rate of 19.8% in its stock price.

Some have interpreted this as a sign that the billionaire believes a crash is coming or — at least — a market downturn. And that matters to investors in the UK stock market because, as the saying goes, when America sneezes, the rest of the world catches a cold.

Don’t panic!

Fortunately for those of us that own UK shares, this isn’t the reason for the stockpiling of cash.

In May, at the company’s annual shareholder meeting, Buffett explained that his investment team didn’t know how to use it effectively and that “we only swing at pitches we like”.

But if the company did decide to deploy its cash, it could ‘go big’ — $182bn would enable it to buy any of the members of the FTSE 100, with the exception of AstraZeneca and Shell.

A possible candidate

Buffett advocates looking at a company’s long-term intrinsic value rather than its short-term earnings. He seeks out companies with competitive advantages that will help them grow.

Although the American tends to avoid the UK stock market, there’s one FTSE 100 stock that I think would meet his approval.

Unilever (LSE:ULVR) owns famous beauty, food, and household cleaning brands such as Dove, Ben & Jerry’s, and Cif. Operating in 190 countries — and with 58% of its revenue coming from emerging markets — it has a truly global footprint. It claims 3.4bn people use its products every day.

Buffett’s been a long-term investor in Coca-Cola Company and therefore understands the earnings potential of global brands.

During 2023, Unilever reported earnings per share of €2.58 (£2.22 at current exchange rates). This means the shares are currently trading on a historical multiple of 19 times earnings.

Although higher than the FTSE 100 average, it’s lower than, for example, Coca-Cola, which has a price-to-earnings (P/E) ratio of 25. Indeed, Unilever achieved a mid-twenties P/E ratio in 2020 and for most of 2021.

The company’s share price has fallen 10% since May 2019, which means now could be a good buying opportunity.

But inflation has damaged the company’s margins. And turnover was slightly lower in 2023 than in 2022. To combat this, the company’s recently embarked on a ‘Growth Plan’ seeking to improve productivity and create a leaner business. Of course, there’s no guarantee this will work.

Encouragingly, the company reported underlying sales growth of 4.4% during the first quarter of 2024. And a 2.2% rise in sales volumes.

Therefore, despite the risks, if I had some spare cash like Warren Buffett, I’d seriously consider taking a position.

The post Warren Buffett’s stockpiling cash. Is this a warning sign for the UK stock market? appeared first on The Motley Fool UK.

More reading

James Beard has no position in any of the shares mentioned. The Motley Fool UK has recommended AstraZeneca Plc and Unilever Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024

Yahoo Finance

Yahoo Finance