Waste Management Inc. Surpasses Q1 Earnings and Revenue Estimates, Boosts Full-Year Outlook

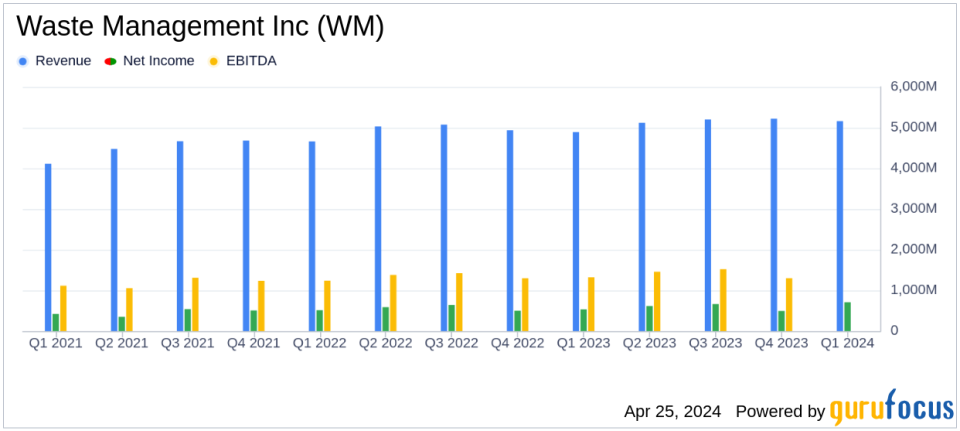

Revenue: Reported at $5,159 million for Q1 2024, up from $4,892 million in Q1 2023, surpassing estimates of $5,205.14 million.

Net Income: Reached $708 million, a significant increase from $533 million year-over-year, exceeding estimates of $607.57 million.

Diluted EPS: Increased to $1.75, up from $1.30 in the previous year, surpassing the estimated $1.50.

Operating EBITDA: Grew to $1,530 million from $1,330 million, with a margin expansion to 29.7% from 27.2% year-over-year.

Free Cash Flow: Revised upward in the full-year outlook to a range of $2.0 billion to $2.15 billion, from the previous forecast of $1.9 billion to $2.05 billion.

Full-Year Revenue Growth Outlook: Adjusted to 5% - 5.75%, down from the initial forecast of 6% - 7%.

Adjusted Operating EBITDA Margin Forecast: Updated to range between 29.7% and 30.2%, indicating an improvement from the initial forecast of 29.0% to 29.4%.

On April 24, 2024, Waste Management Inc (NYSE:WM) disclosed its first-quarter financial results through an 8-K filing, revealing a robust performance that exceeded analyst expectations. The company reported a significant increase in revenue and net income compared to the same period last year, alongside an optimistic adjustment to its full-year financial outlook.

For the quarter ended March 31, 2024, Waste Management Inc generated revenue of $5,159 million, surpassing the estimated $5,205.14 million and showing a 5.5% increase from $4,892 million in Q1 2023. Net income for the quarter stood at $708 million, significantly higher than the estimated $607.57 million and a substantial rise from $533 million in the prior-year quarter. Diluted earnings per share (EPS) also exceeded expectations at $1.75, compared to the estimated $1.50 and last year's $1.30.

Company Overview and Strategic Focus

As North Americas premier environmental solutions provider, Waste Management Inc operates the largest network of landfills and recycling facilities. The company is committed to sustainability, leveraging its vast infrastructure to offer innovative waste management and recycling solutions to residential, commercial, and industrial clients.

Operational Highlights and Future Outlook

President and CEO Jim Fish highlighted the quarter's success, attributing it to strategic cost optimizations and disciplined pricing programs within their Collection and Disposal business. The adjusted operating EBITDA grew by 14.6%, with margins expanding by 240 basis points to 29.6%. This performance has instilled confidence in achieving a full-year EBITDA margin between 29.7% and 30.2%, indicating over 100 basis points improvement from the previous year.

Were pleased with the strong operational and financial performance the WM team delivered in the first quarter, said Jim Fish. Our results are a testament to the investments we have made in talent, technology, and assets over the past several years.

Encouraged by these results, Waste Management has raised its full-year outlook for adjusted operating EBITDA and free cash flow by $100 million, now expecting adjusted operating EBITDA to be between $6.375 billion and $6.525 billion and free cash flow between $2.0 billion and $2.15 billion.

Financial Statements and Key Metrics

The income from operations rose impressively to $1,016 million from $825 million in the previous year. The balance sheet remains strong with total assets at $32,666 million and equity at $7,078 million. The company continues to maintain a robust cash flow, with net cash provided by operating activities at $1,367 million, up from $1,044 million in Q1 2023.

Waste Management's focus on enhancing shareholder value is evident from its active share repurchase program and consistent dividend payments, underscoring its financial health and commitment to returning value to its shareholders.

The company will host a conference call on April 25, 2024, to discuss these results in detail, providing an opportunity for investors and analysts to gain deeper insights into its performance and strategic initiatives.

For more detailed information and future updates, investors and stakeholders are encouraged to visit Waste Managements website.

With a clear strategic direction and proven operational excellence, Waste Management Inc is well-positioned to continue its trajectory of sustainable growth, benefiting shareholders and contributing positively to environmental stewardship.

Explore the complete 8-K earnings release (here) from Waste Management Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance