Why Argenx's (ARGX) Stock Price Moved Up 11% on Thursday

Shares of Argenx ARGX rose 11.2% on Mar 21, after Japan-based Chugai Pharmaceutical posted disappointing results from a late-stage study evaluating Enspryng (satralizumab) as a potential treatment for generalized myasthenia gravis (gMG). This drug has been developed in collaboration with Roche RHHBY.

The Tokyo-based company evaluated the Roche-partnered drug in the phase III LUMINESCE study in patients with gMG, a rare autoimmune disease that leads to muscle weakness. While patients who received the Chugai-Roche partnered drug did show statistically significant improvements following 24 weeks of treatment, the results fell short of the companies’ “expectations on the degree of clinical benefit."

Detailed results from the LUMINESCE study are expected at the American Academy of Neurology (AAN) 2024 Annual Meeting on Apr 15.

The above results benefit Argenx, which markets Vyvgart (efgartigimod). The intravenously-administered Argenx drug was approved by the FDA in December 2021 to treat adults with gMG who test positive for the anti-acetylcholine receptor (AChR) antibody. Last June, the agency approved a subcutaneous formulation of Vyvgart for a similar indication, where the drug is being marketed under the brand name Vyvgart Hytrulo. Vyvgart and Vyvgart Hytrulo are the only products in Argenx’s portfolio.

The approval of Argenx’s Vyvgart/Vyvgart Hytrulo also marks the first and currently the only approval for a medication based on a neonatal Fc receptor (FcRn) blocker. The medication causes a reduction in overall levels of IgG, including the abnormal AChR antibodies that are present in myasthenia gravis indication.

Since its commercial launch in 2022, Argenx’s product sales have been encouraging. Argenx recorded $1.19 billion from product sales in 2023 compared with $400.7 million in 2022. With many companies evaluating their pipeline candidates in gMG indication, the failure of a potential competitor will likely lift some pressure off of ARGX and reaffirm its position as a market leader in gMG indication.

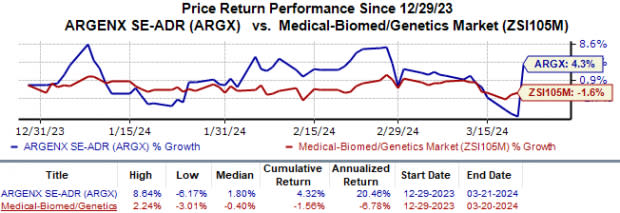

Year to date, Argenx’s shares have gained 4.3% against the industry’s 1.6% fall.

Image Source: Zacks Investment Research

Argenx is also evaluating Vyvgart in multiple proof-of-concept clinical studies, including thyroid eye disease (TED), lupus nephropathy (LN) and myositis indications. The FDA is currently reviewing the company’s regulatory filing seeking label expansion for the drug in chronic inflammatory demyelinating polyneuropathy (CIDP) indication. A final decision is expected by Jun 21.

We remind investors that Chugai/Roche’s Enspryng was approved by the FDA in 2020 for a rare condition known as seropositive neuromyelitis optica spectrum disorder (NMOSD). The above results do not impact this approval.

Another company that benefitted from the disappointing Enspryng results was Immunovant IMVT, whose shares rose 4.8% following the announcement. Immunovant’s lead pipeline drug, batoclimab, is being evaluated in a pivotal late-stage study for myasthenia gravis (MG) and TED indications. While Immunovant is expected to report topline data from the MG study by 2024-end, the TED data is expected early next year.

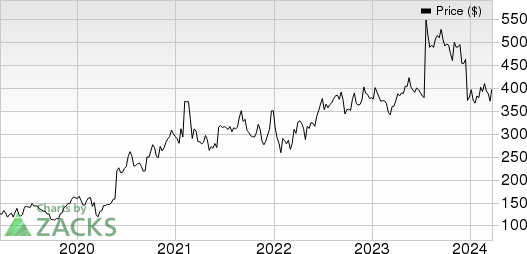

argenex SE Price

argenex SE price | argenex SE Quote

Zacks Rank & A Key Pick

Argenx currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the overall healthcare sector is ADMA Biologics ADMA, which sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ADMA Biologics’ 2024 earnings per share (EPS) have risen from 22 cents to 30 cents. During the same period, EPS estimates for 2025 have improved from 32 cents to 50 cents. Year to date, shares of ADMA have risen 37.0%.

Earnings of ADMA Biologics beat estimates in three of the last four quarters while meeting the same on one occasion. ADMA delivered a four-quarter average earnings surprise of 85.00%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

argenex SE (ARGX) : Free Stock Analysis Report

Immunovant, Inc. (IMVT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance