Wolverine's (WWW) Q1 Earnings Coming Up: What Lies Ahead?

Wolverine World Wide, Inc. WWW is likely to register top and bottom-line declines when it reports first-quarter 2024 earnings on May 8, before market open. The Zacks Consensus Estimate for revenues is pegged at $360.3 million, suggesting a decrease of 39.9% from the prior-year quarter’s reported figure.

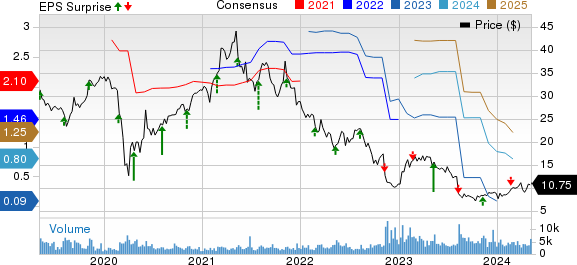

The consensus mark for the bottom line has increased by a penny in the past seven days to earnings of 5 cents per share, which indicates a 44.4% deterioration from the year-ago quarter’s reported earnings of 16 cents. However, WWW has a trailing four-quarter earnings surprise of 13.8%, on average.

Wolverine World Wide, Inc. Price, Consensus and EPS Surprise

Wolverine World Wide, Inc. price-consensus-eps-surprise-chart | Wolverine World Wide, Inc. Quote

Factors to Consider

Wolverine World Wide has been confronting a challenging retail environment, marked by shifts in consumer behavior and preferences, particularly affecting key brands such as Saucony and Merrell. These brands, which are integral to the company's portfolio in the outdoor and athletic segments, have faced market pressures that extend beyond internal strategies. These pressures mirror broader market trends influencing consumer spending patterns, highlighting the dynamic challenges faced by the industry.

For the first quarter of 2024, Wolverine projects revenues of $360 million, which indicates a substantial decline of 30% from that reported in the prior-year period. This sharp decline is likely to have resulted from several non-recurring factors from the previous year that significantly inflated the figures back then. These extraordinary gains are not expected to have recurred, thus heavily influencing year-over-year revenue comparisons.

Additional adjustments contributing to the revenue decline include a $40-million shift in international distributor shipments that previously boosted first-quarter revenues, which are not anticipated to recur. About $13 million in revenue impacts are expected to have occurred due to transitions in business models, notably the shift to licensing models for certain operations. These changes reflect Wolverine's strategic realignment to focus on more profitable and sustainable business practices.

Despite the anticipated decline in revenues, Wolverine expects a notable improvement in its gross margin for the first quarter. The gross margin is estimated at 46%, a substantial rise of 480 basis points from the previous year. This improvement is attributed to several factors, including significantly lower supply-chain costs, reduced sales of end-of-life inventory and a better distribution channel mix.

For the first quarter, the company anticipates a 3.5% operating margin and breakeven adjusted earnings per share. These projections underscore Wolverine’s strategic adjustments aimed at stabilizing the business in a rapidly evolving retail landscape.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Wolverine this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here.

Wolverine has an Earnings ESP of 0.00%, and it carries a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With Favorable Combination

Here are three companies worth considering, as our model shows that these have the correct combination to beat on earnings this time:

Levi Strauss & Co. LEVI has an Earnings ESP of +1.85% and currently sports a Zacks Rank of 1. LEVI is likely to register a bottom-line increase when it reports second-quarter fiscal 2024 numbers. The Zacks Consensus Estimate for quarterly earnings per share of 11 cents suggests an increase of 175% from the year-ago quarter’s reported number. You can see the complete list of today’s Zacks #1 Rank stocks here.

LEVI’s top line is expected to increase from the prior-year quarter’s reported number. The consensus estimate for quarterly revenues is pegged at $1.45 billion, suggesting an increase of 8.4% from the prior-year quarter’s reported figure. LEVI has a trailing four-quarter earnings surprise of 16.4%, on average.

Deckers Outdoor Corporation DECK currently has an Earnings ESP of +15.38% and a Zacks Rank of 3. The company is likely to register a top-line increase when it reports fourth-quarter fiscal 2024 numbers. The Zacks Consensus Estimate for Deckers’ quarterly revenues is pegged at $873.7 million, indicating a rise of 10.4% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for Deckers’ quarterly earnings of $2.61 suggests a decrease of 24.6% from the year-ago quarter’s reported level. DECK has a trailing four-quarter earnings surprise of 32.1%, on average.

NIKE Inc. NKE has an Earnings ESP of +0.06% and a Zacks Rank of 3. NKE is likely to register top and bottom-line growth when it reports the fourth-quarter fiscal 2024 numbers. The Zacks Consensus Estimate for Nike’s quarterly revenues is pegged at $12.9 billion, suggesting an increase of 0.7% from that reported in the prior-year quarter.

The Zacks Consensus Estimate for Nike’s earnings for the fourth quarter indicates a rise of 30.3% from the year-ago period reported figure. NKE delivered an earnings beat of 22.6%, on average, in the trailing four quarters.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NIKE, Inc. (NKE) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

Wolverine World Wide, Inc. (WWW) : Free Stock Analysis Report

Levi Strauss & Co. (LEVI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance