Chemours to Raise Its Debt: Good or Bad?

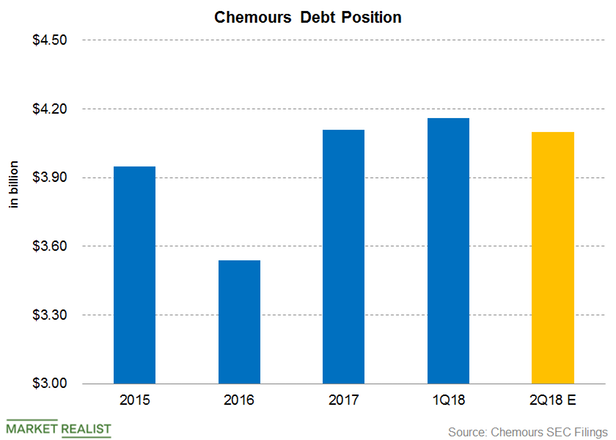

It is now on its way to adding 450 million euros in 4% senior notes due 2026 through a public offering. This offer is managed jointly by Citigroup Global Markets, Deutsche Bank Securities, Merrill Lynch, HSBC Securities, and many others, and the debt includes long-term debt and current maturities. The proceeds from the offer are expected to be ~$557.5 million based on the exchange rate stated in the company’s SEC (Securities and Exchange Commission) filing.

Yahoo Finance

Yahoo Finance