Ulta Beauty’s Operating Margin and Why It Could Keep Declining

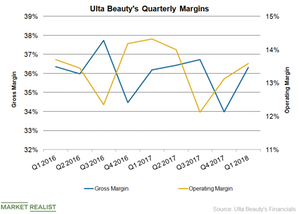

Its gross margin grew 10 basis points to 36.3%, driven by the impact of the new revenue recognition standard and leverage in fixed store costs on higher sales. Growth investments in the salon services and supply chain operations were also a drag on its fiscal first quarter gross margin. What impacted its operating margin?

Yahoo Finance

Yahoo Finance