What Are Wall Street Analysts Recommending for EQT?

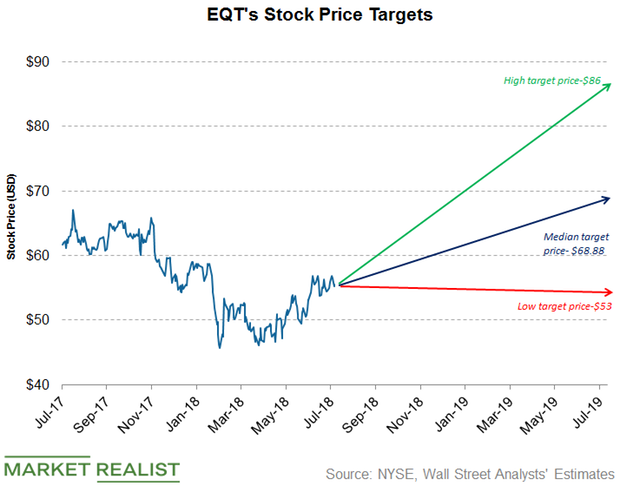

Approximately 61% of analysts have rated EQT (EQT) a “buy.” The remaining 39% have rated the stock a “hold.” The average broker target price of $68.88 for EQT implies a potential return of ~24% in the next 12 months. In comparison, Cabot Oil & Gas (COG) has a potential return of 18% over the next 12 months, Antero Resources (AR) has a potential return of 15.29% over the next 12 months, and Noble Energy (NBL) has a potential return of 29.61% in the same period. Chesapeake Energy (CHK) has implied returns of -12.84% over the next 12 months. The highest and lowest target prices for EQT stock are $86 and $53, respectively.

Yahoo Finance

Yahoo Finance