FedEx’s Free Cash Flow before Its Dividend Payment

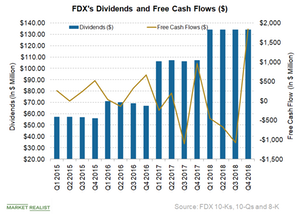

FedEx (FDX) reported an adjusted diluted EPS of $15.31 in fiscal 2018. On an annualized basis, the quarterly dividend of $0.65 accounts for $2.60 per share, which translates into a dividend payout ratio of 17%. FedEx’s current dividend payout is much lower than UPS’s (UPS) dividend payout ratio of 54%. FedEx has grown its dividend payout ratio consistently in the last few quarters.

Yahoo Finance

Yahoo Finance