1 growth stock to consider buying at $1 that could be the next Nvidia

After an insane 1,882% rise in five years, Nvidia has been an incredible growth stock.

I’ve been hunting for shares that could replicate this kind of performance. Here’s one potential contender — down 48% since I first invested — that I’d consider buying at $1 today.

Programmable DNA

The stock is Ginkgo Bioworks (NYSE: DNA). Since going public in 2021, it has endured a torrid time, falling around 90%.

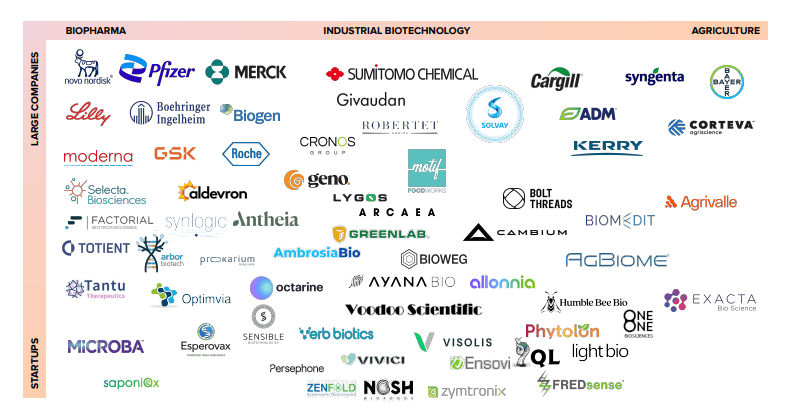

This is a synthetic biology company that engineers cells for its customers. Its automated biofoundry is built on software, laboratory robotics and artificial intelligence (AI).

The potential applications of synthetic biology range from biodegradable plastic and lab-grown meat to drought-resistant crops and novel antibiotics.

Indeed, a start-up called Light Bio used Ginkgo’s platform to put DNA from luminous mushrooms into petunias to make them glow in the dark. I’m after buying some of these cool plants myself!

The TSMC of biology?

Essentially, the company is attempting to become in biology what Taiwan Semiconductor Manufacturing (TSMC) is to the global chip industry.

Tech firms utilise TSMC’s state-of-the-art foundries and this has enabled some to scale spectacularly.

Take Nvidia, which has become a $2.2trn company without manufacturing its own chips. Instead, it outsources this to TSMC, which itself is a $640bn colossus.

Today though, such infrastructure doesn’t really exist in healthcare. Most companies still have their own in-house labs filled with scientists running experiments. Ginkgo’s platform enables these firms to reduce R&D cycles and scale faster.

It makes money through a combination of upfront fees, milestone payments, royalties and equity. It could eventually receive around $2.4bn in potential downstream royalty payments.

Financial performance

In 2023, it added 78 new cell programmes, up from 59 in 2022. And its expects to add another 100-120 this year.

However, revenue fell 47% last year to $251m, due to declining Covid tests. And its loss from operations was a massive $864m (including stock-based compensation).

Lower losses are expected in future as it scales. Meanwhile, it finished 2023 with $944m in cash, reducing any immediate liquidity concerns.

On 10 April, the firm announced an extension of its partnership with healthcare giant Novo Nordisk for up to five years.

Such deals validate the quality of Ginkgo’s platform and many of its customers are leaders in their respective industries.

After nearly 20 years of engineering cells, the company has accumulated mountains of biological data. It has just created a service offering this data to firms building AI models. This could juice the top line.

Looking ahead, analysts forecast strong revenue growth.

2024 | $223m |

2025 | $309m |

2026 | $422m |

2027 | $605m |

Uncertainty

Where do I think the next amazing revolution is going to come? And this is going to be flat out one of the biggest ones ever. There’s no question that digital [synthetic] biology is going to be it.

Jensen Huang, co-founder and CEO of Nvidia

Despite its shares trading for $1, Ginkgo still has a $2.1bn market-cap. This gives the stock a price-to-sales (P/S) multiple of 8, which isn’t exactly cheap. So this is a high-risk, high-reward stock.

But if Ginkgo can reignite revenue growth and prove its AI-powered business model works, then I think it can mimic the share price growth of Nvidia in the coming years.

The post 1 growth stock to consider buying at $1 that could be the next Nvidia appeared first on The Motley Fool UK.

More reading

Ben McPoland has positions in Ginkgo Bioworks and Taiwan Semiconductor Manufacturing. The Motley Fool UK has recommended Novo Nordisk, Nvidia, and Taiwan Semiconductor Manufacturing. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024

Yahoo Finance

Yahoo Finance