1 Top Mortgage REIT Stock to Consider Buying Now

As the name implies, a mortgage REIT is a real estate investment trust that primarily owns mortgages or mortgage-backed securities, as opposed to owning properties. Although they pay some of the highest dividends in the stock market, mortgage REITs are a generally higher-risk type of investment.

Having said that, some mortgage REITs are more stable and better hedged than others. Annaly Capital Management (NYSE: NLY) is the largest mortgage REIT in the industry, and it has profitability and stability advantages over its peers. If you're looking for a high-income investment and have a relatively high risk tolerance, Annaly could be worth a look.

Image source: Getty Images.

How mortgage REITs make money

The general idea is that mortgage REITs aim to profit from the difference in long-term mortgage rates and short-term borrowing rates. For example, if a REIT can buy a 30-year mortgage that yields 4.5%, and can borrow the money to buy it at an interest rate of 3%, the 1.5% difference represents the "spread," or profit margin.

Now, mortgage REIT investors aren't content with returns of 1% or 2%. In fact, mortgage REITs are some of the highest-paying dividend stocks in the market. The way they do this is to use leverage, a.k.a. borrowed money, to amplify returns. Many mortgage REITs use leverage ratios of 5-to-1 or more, meaning that for every $1 million in assets they own, they borrow $5 million or more to buy mortgage-backed securities or other investments.

Within the mortgage market, there are a few varieties of investments mortgage REITs can make. Agency mortgage-backed securities, or agency MBSes, are the most common example. These are mortgages on residential properties that are backed by Fannie Mae or another government agency. "Non-agency MBS" refers to residential mortgages that don't conform to Fannie Mae or Freddie Mac's lending standards. Commercial MBSes are mortgages on commercial properties.

Within each of these categories, there's significant variation. For example, agency MBSes are available in 30-year, 15-year, and other terms. Interest rates can be fixed or variable. Mortgages can be distressed or performing well. In addition, other mortgage-related investments such as mortgage servicing rights are possible.

Of course, this is a simplified explanation. There's a lot more to many mortgage REITs than the basic function of borrowing money to buy mortgages. For example, many purchase interest-rate swaps and other hedging vehicles to protect themselves against rapid moves in interest rates.

Interest-rate risk

One of the biggest risks that threatens the mortgage REIT business model is interest-rate risk. Since mortgage REITs take advantage of short-term borrowing rates, rising rates can narrow the spreads between borrowing rates and the yields of the mortgages they own.

As I mentioned, mortgage REITs have ways of hedging against rising rates, but this is still a risk factor to be aware of.

Annaly: The largest mortgage REIT

Annaly Capital Management is the largest mortgage REIT in the stock market, with a market capitalization of approximately $13 billion. In fact, there are 34 mortgage REITs in the industry, and Annaly is bigger than the smallest 24 combined. The company has more than $112 billion in investments as of this writing.

The company's massive portfolio consists of agency MBSes (77%), non-agency residential mortgage assets (10%), commercial mortgages (8%), and middle-market lending (5%), which is a type of business financing.

Competitive advantages

Because of its scale, Annaly enjoys efficiency and stability advantages over its peers. The company's operating expenses are just 16.1% of its adjusted earnings, compared with a 21.3% average for its peers.

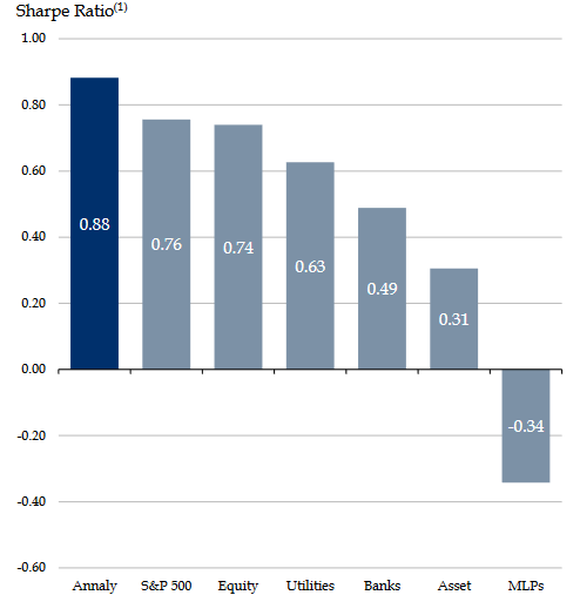

Plus, its book value and returns tend to fluctuate less over time than other mortgage REITs. Annaly's Sharpe Ratio, which is essentially a measurement that compares a stock's risk-adjusted returns with the returns' standard deviation over time, handily beats that of equity REITs, utilities, banks, and even the S&P 500 itself. In other words, a high Sharpe ratio tells us that an investment's returns are not only strong, but are smooth over time.

Image source: Annaly Capital Management.

Annaly's scale also allows it to use a more comprehensive hedging strategy than most of its peers. In addition to interest-rate swaps, Annaly uses mortgage derivatives, Treasury futures, and mortgage servicing rights, among other tools.

What about during challenging times?

While it's not completely immune to interest-rate risk, Annaly does a great job of remaining profitable while interest rates rise. In fact, during the current rate-increase cycle that began in late 2015, Annaly's total return has outperformed the S&P 500, 51% versus 30%. To be fair, mortgage rates and Annaly's borrowing rates haven't changed as much as you might expect after several Federal Reserve rate increases, but this is still a better result than many market experts had expected.

In addition, the company has a track record of performing well during volatile markets. During the financial-crisis period from December 2007 through May 2009, Annaly outperformed the S&P 500 and its mortgage REIT peers by a significant margin.

What Annaly hopes to achieve

Annaly plans to use its scale and diverse investment approach to decrease its leverage and grow returns at the same time. Simply put, Annaly's investments other than agency MBSes pay significantly higher returns, so this is definitely possible. For example, Annaly's commercial mortgage portfolio employs less than 2-to-1 leverage and generates returns in the 8%-10% range.

Annaly currently employs overall leverage in the 6 to 7 range (over 9 in agency MBSes) and generates returns of approximately 10% on its investments, so if it successfully achieves this, it could make the company an even more stable and attractive investment.

To be clear, Annaly Capital Management isn't a low-risk investment. Mortgage REITs are an inherently volatile asset class, as there isn't a perfectly stable way to generate double-digit dividends. However, Annaly is the best in breed and could be a good fit for income-seeking investors with a high risk tolerance.

More From The Motley Fool

Matthew Frankel has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance