1st-Quarter Earnings Season Winds Down With Mixed Results From Retailers and One Big AI Darling ...

Economic data moving in the right direction

The above phrase was uttered countless times on Wall Street last week in response to the Consumer Price Index (CPI) and Retail Sales for April coming in worse than expected. The latest inflation reading showed that prices are finally starting to cool a bit, with CPI showing an increase of 0.3% MoM for April vs. expectations for a 0.4% increase and compared to the 0.4% uptick seen in March.[1] Retail Sales also showed that higher inflation was finally starting to slow consumer spending. Retail Sales for April came in flat, expectations were for a 0.4% rise on top of the 0.6% MoM increase seen in March.[2] Markets rejoiced with the release of this data as key inflation indicators start to fall more in-line with the Fed target rates, increasing the possibility of rate cuts coming sooner rather than later. As a result, the three major indices, S&P 500, DJIA and Nasdaq Composite all touched closing highs on Wednesday, with the Dow briefly crossing the 40,000 threshold on Thursday.

The last trickle of earnings from the retailers also started to come through last week, giving a very mixed picture of the health of that sector. Home Depot (NYSE:HD) kicked off the week by beating on the bottom-line but missing revenue estimates; the home improvement retailer noting they continue to see consumers delay home projects as a result of high interest rates.[3] On Thursday morning Walmart (NYSE:WMT), a big winner during this high inflation period, reported better-than-expected results on both earnings and revenues.[4] They continued to grab a larger share of high-income shoppers who are trading down in this environment. And then there was Under Armour (NYSE:UAA), which we flagged last week as having a later-than-usual earnings date, indicating the report might not be so rosy. Sure enough, UA reported that sales in its largest market, North America, fell 10% and that they expect things to get worse before they get better. They also announced a board restructuring plan and an unspecified number of job cuts.[5]

With 93% of S&P 500 companies having reported for Q1 2024, EPS growth has settled at 5.7%, the highest rate seen in almost two years.[6]

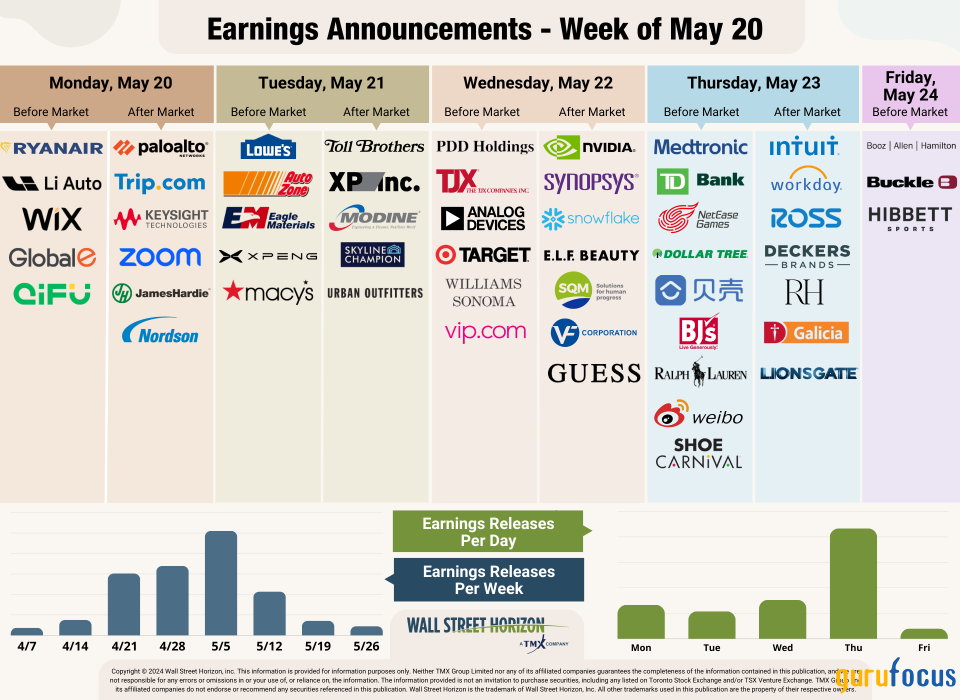

On deck this week The final trickle of retail and tech names

Despite peak earnings season officially being over, there are still a handful of interesting names to look out for in the coming weeks. Mainly this week, all eyes will be on Nvidia (NASDAQ:NVDA), the last of the Fab Four (AMZN, META, MSFT, NVDA) names to report for the first quater. The AI hype hit a fever pitch last week with OpenAI and Alphabet both announcing updates to their current generative AI offerings to much fanfare. Investors will want to see Nvidia providing the same exciting updates as the bar is already set very high for this name. Sell side analysts polled by FactSet are estimating YoY earnings growth of 412% and revenue growth of 241%.

Besides NVDA, there are also a handful of retailers out this week, including Lowe's (NYSE:LOW) and Macy's (NYSE:M) out on Tuesday, TJX Companies (NYSE:TJX) and Target (NYSE:TGT) on Wednesday, and Ross Stores (NASDAQ:ROST) on Thursday.

Source: Wall Street Horizon

Potential surprises for the remainder of the first-quarter season

Academic research shows that when a company confirms a quarterly earnings date that is later than when they have historically reported, it's typically a sign that the company will share bad news on their upcoming call, while moving a release date earlier suggests the opposite.[7]

For the remainder of earnings season, the only S&P 500 name that has pushed their first-quarter 2024 earnings dates outside of historical norms is Bath & Body Works (NYSE:BBWI). While former S&P constituent, Kohl's Corporation (NYSE:KSS), is also sporting a negative DateBreak Factor due to a delayed earnings date.

Kohl's Corp. (NYSE:KSS)Company Confirmed Report Date: Thursday, May 30, BMOProjected Report Date (based on historical data): Thursday, May 23, BMODateBreaks Factor: -2*

Kohl's is set to report first-quarter 2024 results on Thursday, May 30. This is a week later than expected, and the latest report date since we began tracking this name in 2006. This is also the first time a first-quarter report for Kohl's has moved into the 22nd week of the year, as the retailer has reported in the 21st week of the year since 2018.

Like other department stores, KSS has struggled with inflation and a consumer that is trading down to discounters and off-price retailers. According to FactSet data, Wall Street analysts are expecting EPS to decline 62% in the first quarter, with revenues remaining flat year over year after eight quarterly declines.

Bath & Body Works Inc. (NYSE:BBWI)Company Confirmed Report Date: Tuesday, June 4, BMOProjected Report Date (based on historical data): Thursday, May 23, BMODateBreaks Factor: -3*

Bath & Body Works is set to report first-quarter 2024 results on Tuesday, June 4. This is nearly two weeks later than expected based on historical reporting timelines. This is the latest they've reported for the first quarter since the separation of the Victoria's Secret business in 2021, but also the latest the company has ever reported in the last 10 years, including when they were L Brands.

After a couple of decent quarters, BBWI is expected to report flat year-over-year earnings for the first quarter, and a revenue decline of 2%, according to FactSet data.

* Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company's 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

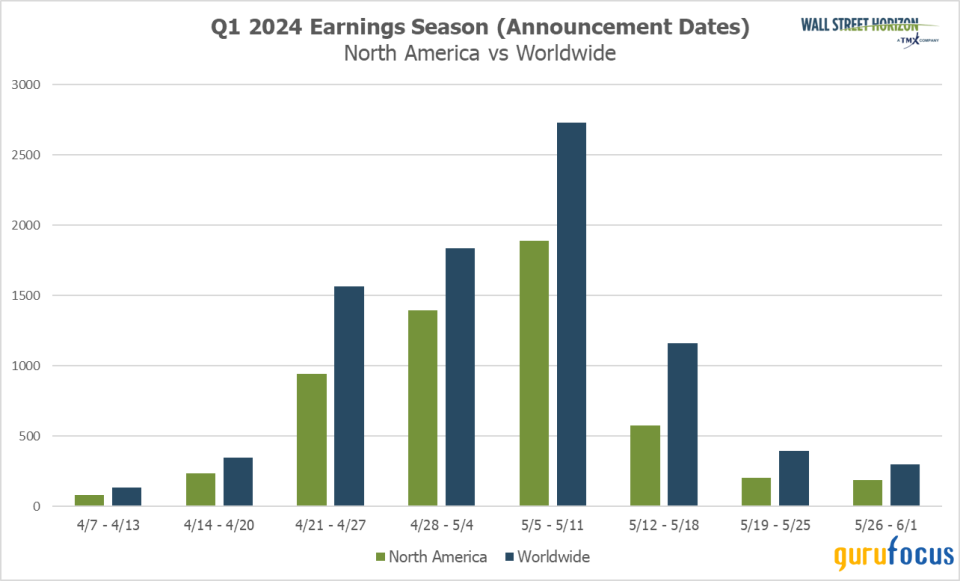

Q1 Earnings Wave

Earnings season continues to wind down from here on out. This week 867 companies are set to report. Thus far 83% of companies have reported (out of our universe of 11,000+ global names).

Source: Wall Street Horizon

1 Consumer Price Index Summary, U.S. Bureau of Labor Statistics, May 15, 2024, https://www.bls.gov/ 2 Advance Monthly Sales for Retail and Food Services, United States Census Bureau, May 15, 2024, https://www.census.gov3 THE HOME DEPOT ANNOUNCES FIRST QUARTER FISCAL 2024 RESULTS; REAFFIRMS FISCAL 2024 GUIDANCE, May 14, 2024, https://ir.homedepot.com4 Walmart Reports First Quarter Results, May 16, 2024, https://s201.q4cdn.com5 UNDER ARMOUR REPORTS FOURTH QUARTER AND FULL-YEAR FISCAL 2024 RESULTS; PROVIDES INITIAL FISCAL 2025 OUTLOOK, May 16, 2024, https://about.underarmour.com6 EARNINGS INSIGHT, FactSet, John Butters, May 17, 2024, https://advantage.factset.com7 Time Will Tell: Information in the Timing of Scheduled Earnings News, Journal of Financial and Quantitative Analysis, Eric C. So, Travis L. Johnson, Dec, 2018, https://papers.ssrn.com

Copyright 2024 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance