2 amazing passive income shares I’d buy right now for the next decade

I reckon the best type of shares to buy right now are those offering meaty passive income and look dirt cheap. When it comes to putting your hard-earned cash to work, that’s one of the best ways to do it.

As always, I don’t invest in a company unless I could see myself holding onto its shares for a decade. It’s a tried and tested method that many investors have used and I’m confident it’ll work for me too.

Here are two stocks I think investors should consider buying.

Banking giant…

I own HSBC (LSE: HSBA) shares and if I had the cash, I’d snap more up today. The stock yields a whopping 7.3%. That’s the seventh-highest payout on the FTSE 100. Last year, its dividend rose by 90.6% to 61 cents per share while it put in motion a new $2bn share buyback.

It also recently announced a special 21 cents per share dividend after offloading its Canadian business. Taking that into account, the stock has a brilliant 10%+ yield.

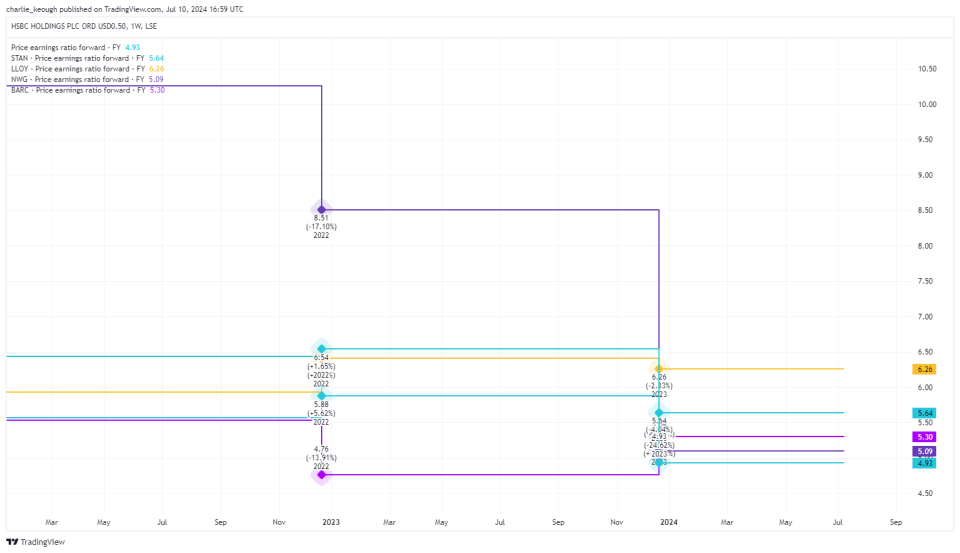

To go with that, its shares also look cheap as chips. HSBC has a price-to-earnings (P/E) ratio of 7.4, below the Footsie average of 11. As seen below, its forward P/E of 4.9 is the lowest of all FTSE 100 banks.

Created with TradingView

Its exposure to Asia and more specifically China has worried some investors. After years of monumental growth, the Chinese economy has wobbled recently, especially its housing sector which HSBC is invested in.

But I see the stock excelling over the next decade as Asian nations continue their impressive growth. It’s predicted that two in three members of the global middle class will be Asian by 2030.

That’s a massive market for HSBC to capitalise on. There’s no surprise the bank has earmarked billions to invest in the region for the years ahead.

…Housebuilding giant

One stock I don’t own but I’m keen to buy is Taylor Wimpey (LSE: TW.). If I had some investable cash, I’d add it to my portfolio today.

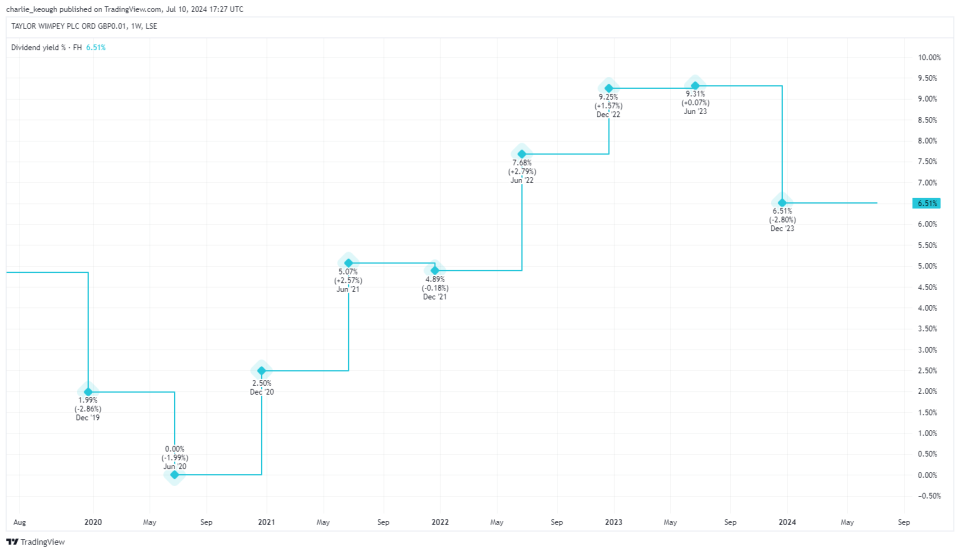

It yields slightly lower than HSBC, at 6.5%. But that’s nothing to scoff at. It’s still way clear of the Footsie average of 3.6%. And its total dividend payment rose 2% last year to 9.58p per share.

Created with TradingView

I back Taylor Wimpey to thrive over the long term given the current UK housing shortage. We saw just how much of an important discussion point this was leading up to the general election. Promising to tackle the shortage, the Labour Party aims to build at least 300,000 new homes annually over the next five years.

While we’ve seen a few positive signs out of the housing sector, it may be a while before it fully recovers. Higher interest rates have hampered Taylor Wimpey over the last couple of years. The housing market is cyclical and the economic uncertainty we’re still facing is a concern. Any delay in rate cuts would also most likely harm its share price.

But looking past that, I think we could see Taylor Wimpey prosper in the years ahead. As rates are cut, whenever that may be, this should provide its share price with a boost. I’m eager to open a position over the coming weeks before the Bank of England makes any more moves.

The post 2 amazing passive income shares I’d buy right now for the next decade appeared first on The Motley Fool UK.

More reading

HSBC Holdings is an advertising partner of The Ascent, a Motley Fool company. Charlie Keough has positions in HSBC Holdings. The Motley Fool UK has recommended HSBC Holdings. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024

Yahoo Finance

Yahoo Finance