2 Reasons Under Armour's Warning Shouldn't Worry Nike -- and 1 Reason It Should

Under Armour (NYSE: UA) (NYSE: UAA) shares were pummeled last week after the company lowered its 2017 sales and profit forecasts for the second time this year. The sports apparel specialist booked a rare quarterly net loss while warning that weak demand in the industry is forcing more retailer price cuts heading into the critical holiday shopping season.

That pessimistic market reading isn't good news for rival Nike (NYSE: NKE). But the industry leader is better positioned to keep profits rising through the downturn.

Image source: Nike.

Weakness in the U.S.

For one thing, Under Armour's bad news was confined to the U.S. market, which is seeing lower customer traffic at retailers. Sales are flat this year and operating income has flipped to a loss over the past six months compared to a $68 million profit in the prior-year period.

In contrast, its international segments are booming. Revenue was up 57% in Under Armour's European geography and 89% in the China division. Overall, markets outside the U.S. were up 57% last quarter.

Yet Under Armour is far more dependent than Nike on the U.S. market. The country accounts for about 80% of its sales and a larger proportion of profits, while it makes up less than half of Nike's business.

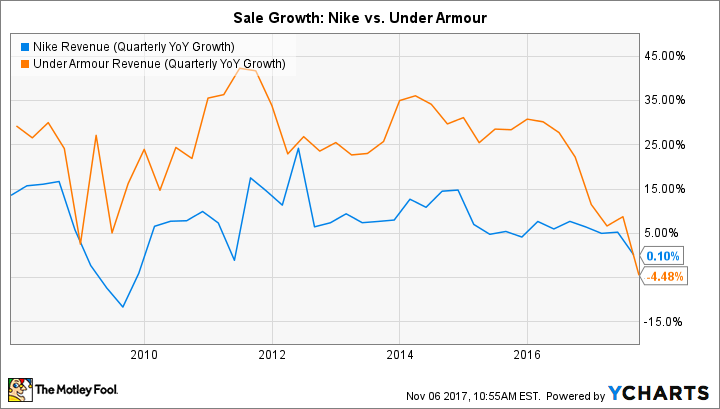

You can see the benefits of that diversification by comparing the two rivals' recent growth pace. Yes, Nike's expansion rate has fallen, but Under Armour's has collapsed from over 20% to negative 5% in the most recent quarter.

NKE Revenue (Quarterly YoY Growth) data by YCharts.

Nike is already financially fit

The harsh new selling environment is forcing Under Armour to find savings wherever it can. Management is laying off employees and scaling back on its retailing footprint, and CEO Kevin Plank has told investors that these moves will cleave as much as $130 million from earnings this year, due to severance charges and lease and contract termination fees.

The restructuring write-offs are a big reason why operating income will fall to $170 million this year from over $400 million in each of the prior two years. The moves should produce a stronger business over time, though, one that enjoys healthy returns on invested capital and strong operating margins, according to Plank.

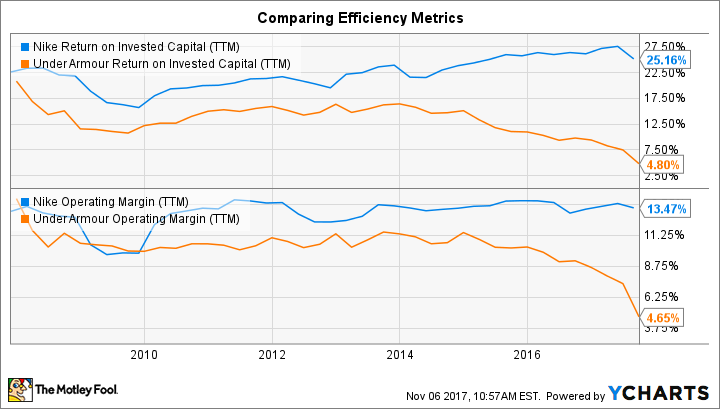

NKE Return on Invested Capital (TTM) data by YCharts.

In other words, they'll help Under Armour's finances look more like Nike's already do. The sports titan has raised its return on invested capital by over 10 percentage points in the past decade and its operating profitability is consistently strong in the low double digits. Nike brings other key financial advantages to this matchup, too, including the fact that its global marketing budget of over $3 billion is more than half of Under Armour's entire sales base.

The tough holiday season ahead

Still, Under Armour's comments on the upcoming holiday season don't leave much room for optimism about the U.S. market. Executives said elevated inventory levels are driving additional price cuts, so they're predicting sales growth to slow to between 11% and 12% as profit margins decline.

Nike's business isn't immune to those negative trends. In fact, a weaker U.S. market would pressure its revenue and profits while convincing management to keep plowing resources into the digital sales channel. The good news is Nike is relatively well-positioned to navigate through this industry downturn. But it still has to contend with poor selling conditions in its biggest single market. And if consumers decide to skip the shopping trips this holiday season in favor of buying most items online, Nike and Under Armour could both could post disappointing operating numbers at their next quarterly announcements in early 2018.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Demitrios Kalogeropoulos owns shares of Nike, Under Armour (A Shares), and Under Armour (C Shares). The Motley Fool owns shares of and recommends Nike, Under Armour (A Shares), and Under Armour (C Shares). The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance