2 Stocks to Add to Your Social Security Income

Many retirees rely on Social Security for financial support. But lots of retirees need more income than what their monthly Social Security checks provide. That means supplementing with other sources of income, like dividend checks from a portfolio of stock investments. If someone is going to be relying on dividends to help cover living expenses, they don't want to chase high-risk yields or forget about inflation by ignoring dividend growth. Luckily there are still good options out there, including companies like Dominion Energy (NYSE: D) and ONEOK Inc. (NYSE: OKE).

Forget the headlines

Dominion Energy is one of the largest U.S. electric and natural gas utilities. It offers a yield of 4.4%, which is toward the high end of the utility group and near its highest level since the deep 2007 to 2009 recession. The dividend has been increased annually for 15 consecutive years. All of this is great information.

Growing dividends can be just as important as a high yield. Image source: Getty Images.

A cursory look here will show that Dominion is trying to buy competitor SCANA Corporation (NYSE: SCG). This is pretty big news because SCANA is struggling to deal with the fallout after it chose to stop building a nuclear power plant following the bankruptcy of Westinghouse, its construction contractor. If the deal goes through, Dominion will be taking on SCANA's nuclear troubles. This is starting to sound like a less desirable dividend option.

Don't get too caught up in that news. For starters, Dominion is around eight times the size of SCANA. This is really just a bolt-on deal, not a transformational one. And Dominion's offer contains a plan for dealing with the nuclear mess. It says it won't go through with the purchase if regulators reject that plan. But if the merger deal goes through, Dominion believes its earnings growth will increase by as much as a third, going from 6% to 8% as it adds customers in high-growth southern states. There are more positives here than negatives, it seems.

Dominion Energy's SCANA offer. Image source: Dominion Energy Inc.

And regardless of whether or not the deal gets consummated, Dominion's spending plans across its diversified business suggest that it can still support 10% dividend growth through 2020. That's roughly three times the historical rate of inflation growth. A large yield, a catalyst for higher earnings growth rates, and solid dividend growth even if the SCANA deal falls apart -- that's worth a deeper dive.

Doing a lot all at once

ONEOK owns the pipes and other assets that help move, process, and store oil and natural gas. Although many of its competitors in the midstream space are structured as limited partnerships, ONEOK is not. That means people can own it without any complications in tax-advantaged retirement accounts. It yields an impressive 5.4%, with annual increases dating back 16 years.

Better yet, roughly 90% of its earnings are derived from fees. That means the price of the commodities it moves and stores is less important than demand. This is a very stable business, and ONEOK has notable plans to grow. For example, The Motley Fool's Matthew DiLallo recently noted that the midstream company has added nearly $2 billion of growth projects to its books since June 2017. That should take until 2019 to work through. But it has another $2 billion in the wings just waiting for the final green light as customers sign up to support the expansion plans.

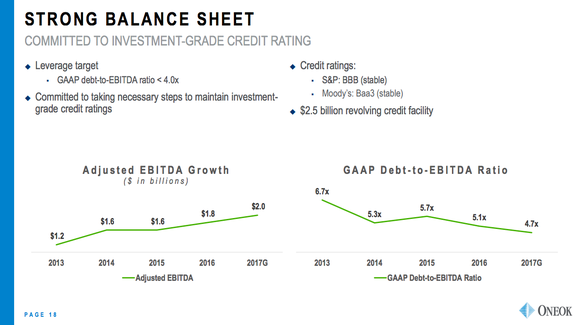

ONEOK is projecting 10% dividend growth over the next couple of years. ONEOK has a track record of success, as well, having invested $9 billion in growth projects between 2006 and 2016. The only problem here is ONEOK's debt load, which is too high for management's taste right now. The plan is to grow its business so that it can push debt to EBITDA down to around four times. It's made great progress toward this level in recent years, moving from 6.7 times in 2013 to around 4.7 in 2017.

ONEOK has been growing its way out of its leverage. Image source: ONEOK Inc.

ONEOK should be on the watch lists for people looking to add some extra income to augment their Social Security checks. It's targeting a number of goals, including building new projects, reducing leverage, and increasing the dividend. But so far it seems like it has the wherewithal to do all three at once.

A healthy balance

When it comes to generating income to supplement Social Security checks, it's important to find a mixture of income and income growth. Dominion and ONEOK are both solid options that don't push investors into risky territory. It's possible to find higher yields, but it's hard to find 10% dividend growth backed by the solid growth plans this pair have in the works.

More From The Motley Fool

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends ONEOK. The Motley Fool recommends Dominion Energy, Inc. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance