2 Stocks I'll Hold Forever

Warren Buffett's wisdom is often shared in short quips that straddle the line between jokes and deep investment insight. For example, the Oracle of Omaha has noted that his preferred holding period is "forever." That said, even he admits that things change and that no investment gets a free pass for, well, ever. But the wisdom he's sharing is that you should go into an investment with a forever mindset, and that's how I look at Eaton Corporation (NYSE: ETN) and Nucor Corporation (NYSE: NUE). Here's why...

Using power wisely

Eaton is a large and diversified industrial company. Its main businesses include electrical products (roughly 35% of third quarter 2017 sales), electrical systems and services (27%), hydraulics (12%), aerospace (8%), and vehicles (16%). Although this may seem like an odd combination, the overarching theme is power management. Each division is focused on helping customers make the most efficient use of energy. Importantly, its business spans the globe, allowing it to take advantage of growth beyond the shores of the United States.

Eaton and Nucor are two stocks that underpin my nest egg. Image source: Getty Images

Unless the world stops using power, I don't see Eaton's business focus going out of style anytime soon. And it's on solid financial footing, with long-term debt at a modest 30% (or so) of its capital structure. Its industrial business is cyclical, so I expect the top- and bottom-lines to fluctuate over time. And it adjusts its business as end markets dictate; note that it started off making axels for trucks, and has clearly branched out in new directions over time.

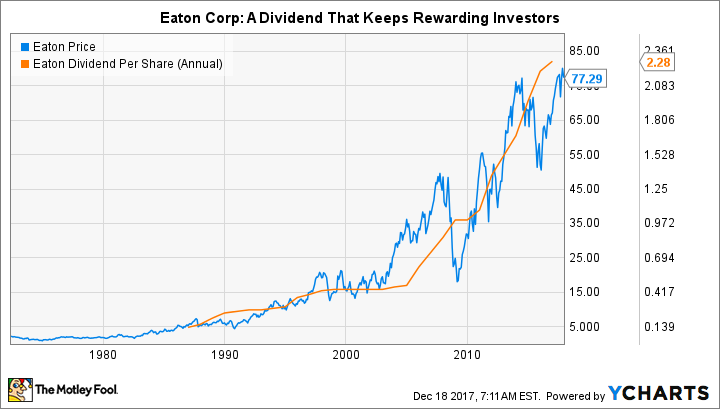

That's why I'm paying more attention to the dividend, which has been paid every year since 1923. It hasn't gone up every year (the company paused recently after a big acquisition), but it has been trending higher over time and remains a core focus for the company as it looks to reward investors for sticking around.

I bought the stock when it was yielding over 4%, so it's not as great a deal today with a yield of 3.1%. But it looks like it's at least fairly valued, with a P/E ratio that's below its five-year average, a price to book ratio that's roughly in line with the average, and a yield that's spot on with its five-year average. If you are looking for an industrial stock, Eaton is one that I think you can put in the lock box for the grandkids.

The best in steel

The next company on my list is U.S. steel giant Nucor. I bought this stock several years ago when the yield was over 4%. Today the yield is 2.5%, and, frankly, the shares look a little pricey. For example, the company's price to sales ratio is about 25% above its five-year average, and the dividend yield is well below the five-year average of 3.1%. So you don't need to rush out and buy Nucor -- but I would put it on my wish list if I were you. And since steel is a cyclical industry, there's a good chance that you'll get an opportunity to buy if you are patient.

Why bother waiting when there are other stocks out there? Not many are as good as Nucor. For example, the company has increased its dividend for an incredible 44 consecutive years while operating in a cyclical industry. No other steel company that I know of can boast a record like that. In fact, there are very few companies of any type that have records like that...

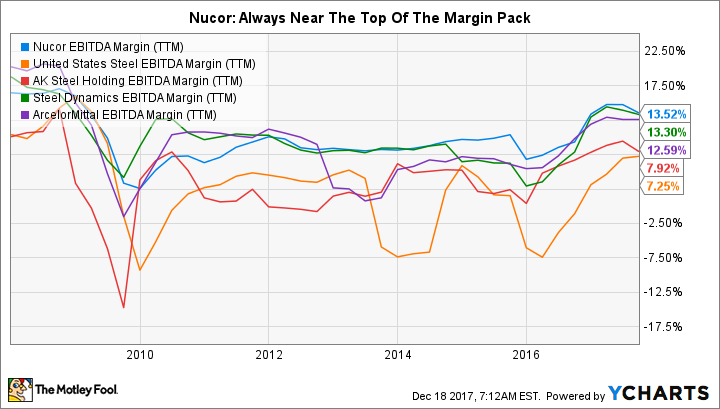

Part of Nucor's success has to do with the way the company is run. For example, Nucor uses electric arc minimills, which are less costly to operate than the blast furnaces that underpin many of its competitors. It also makes use of a unique profit sharing pay structure that rewards employees when the company is doing well and asks them to share in the pain when times are lean. This allows Nucor to reduce costs right when it needs the help on the bottom line, helping it maintain industry-leading margins in good times and bad.

NUE EBITDA Margin (TTM) data by YCharts

And then there's the company's focus on using downturns to invest for the future, always looking to exit a downturn in better shape than it entered. It also has a penchant for diversification, with a goal of moving up the value chain so it can charge more for its wares over time. All of this is backstopped by a conservative balance sheet, with long-term debt around 30% of the capital structure. There's no reason that Nucor can't keep executing the same playbook that has rewarded investors so well for so long -- and I'm planning on sticking around as long as it sticks to that playbook.

Now and later

If you are looking to own great companies for a long time, including Buffett's "forever," then I think you need to put Eaton and Nucor on your wishlist. Eaton is one that can be bought at a fair price today, with Nucor worth watching for a better entry price. Both have proven that they can change and adjust over time while rewarding investors for sticking around. As long as they continue to operate their businesses the way they have for decades, they'll stay in my portfolio even if top- and bottom-line results move around. Like me, though, I suggest you pay more attention to the dividends here.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Reuben Gregg Brewer owns shares of Eaton and Nucor. The Motley Fool recommends Nucor. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance