2 Stocks Trading Lower After Earnings

If you're on the hunt for stocks trading lower, earnings season is a great time to look. While some stocks may surge higher or even trade evenly after their earnings releases, there are some that dive lower. When this happens, the big questions are "Why?" and "Is this a buying opportunity?"

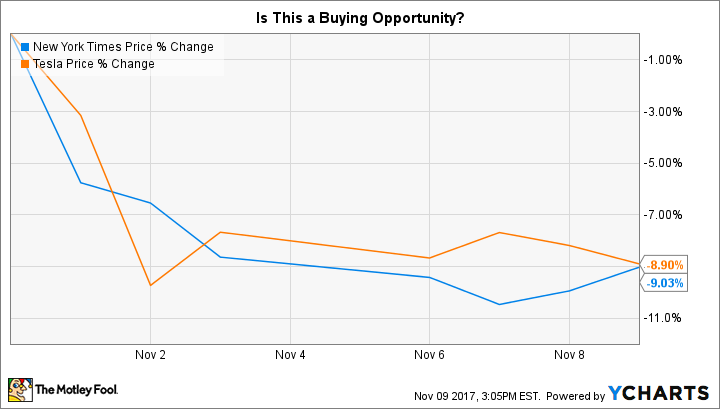

Two interesting companies that saw their stocks fall after earnings recently are New York Times (NYSE: NYT) and Tesla (NASDAQ: TSLA). Here's a look at why each stock fell, and what their lower stock prices mean for investors.

New York Times

Reporting results on Nov. 1, shares of New York Times fell about 5% immediately following the company's third-quarter earnings report. Shares are down about 8% since the end of October.

The stock's lower price likely reflected disappointment in its worse-than-expected revenue and a forecast for a double-digit percentage year-over-year decrease in advertising revenue during the holiday quarter.

New York Times' third-quarter revenue was $385.6 million, up 6.1% year over year but below a consensus analyst forecast for third-quarter revenue of $389 million. New York Times's adjusted EPS was $0.13, higher than a consensus analyst forecast for $0.08, and more than double its adjusted EPS of $0.06 in the year-ago quarter.

While New York Times's forecast for declining ad revenue in Q4 highlights the pressure the company is seeing on ad supply, an 8% decline in the stock since the end of October may represent an overreaction. New York Times's overall business ultimately looks poised to eventually achieve consistent and sustainable growth as digital subscriptions and advertising grow to represent a larger percentage of revenue. In its third quarter, New York Times demonstrated the strength of its digital business, adding 154,000 digital-only subscriptions.

For its fourth quarter, management expects digital-only subscription revenue to rise 40% year over year and digital advertising to be between flat to a slight decrease year over year.

Tesla

Also reporting its third-quarter results on Nov. 1, shares of Tesla were hit even harder. Shares fell nearly 9% immediately after the earnings release. The stock is down about 8% since the end of October.

Image source: author.

The stock's sell-off following the earnings report was likely primarily sparked by Tesla's wider-than-expected loss and an approximately three-month delay in its Model 3 production ramp-up timeline.

Tesla reported an adjusted loss per share of $2.92, far worse than its adjusted profit per share of $0.71 in the year-ago quarter. The significant loss was driven by high Model 3 production costs spread across limited production of the new vehicle.

While Tesla's total vehicle deliveries for the quarter were solid, Model 3 deliveries were a dismal 222. As a result, Tesla said its previous target for achieving a weekly production rate of 5,000 Model 3s by the end of the year was moved to late Q1 of next year.

Unlike New York Times' stock's post-earnings decline, Tesla's lower stock price is likely well-justified. A steep loss per share and a delayed timeline for its important Model 3 production ramp-up are good reasons for investors to be less confident in the company's ambitious growth targets. Investors may want to consider holding out until they get an update from Tesla after its fourth quarter -- or until the stock trades even lower.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Daniel Sparks owns shares of Tesla. The Motley Fool owns shares of and recommends Tesla. The Motley Fool recommends The New York Times. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance