2 Top Stocks to Start 2018

As 2018 gets under way, investors are no doubt thinking about where to put their money in the new year. Two of my favorite investment ideas right now are Paycom Software (NYSE: PAYC) and Arista Networks (NYSE: ANET), a couple of technology companies that look well-positioned to keep taking market share away from industry giants. While they're not household names, Paycom and Arista are disrupting their respective industries with better mousetraps. And thanks to their rapidly rising sales, healthy free cash flows, and excellent margins, I believe both have the potential to remain compounding machines for many years to come.

Why Paycom will keep eating ADP's lunch

Paycom's software solution combines payroll and HR tasks like hiring, time entry, expense tracking, performance reviews, and more into a single cloud-based application that employees can access on any device. For companies in the 50-to-2,000-employee range that typically cobble together products from multiple vendors, Paycom's all-in-one solution eliminates the need for any integration, saving time and money.

Image source: Paycom Software.

By focusing on this smaller-company niche, Paycom has been able to grow dramatically over the past several years, primarily at the expense of ADP (NASDAQ: ADP). And as Paycom continues to innovate and add new software modules, the comprehensiveness of its solution becomes more appealing. Recently, the company introduced an automated mileage tracker designed to eliminate the expense from employees who are likely to "round up." And last quarter, Paycom began creating employee training content, with 10 courses already available and more expected.

With its single-database solution fueling new customer wins, Paycom's growth streak has been nothing short of phenomenal. From 2012 to 2016, revenue grew at a compound annual growth rate (CAGR) of 43.9%. As the company has scaled up, that rate is naturally slowing a bit, but based on current guidance, the company is still on track to post 2017 revenue growth of 31%, above its long-term target of 30% annual growth. In addition, the company's margins have nearly doubled over the past five years, and the company's free cash flow is exploding.

As Paycom keeps opening sales offices over the coming years, I expect the company's rapid growth to continue. CEO Chad Richison has stated that despite the company's success, they haven't seen any significant changes in the competitive environment -- implying that the company's top-line momentum is likely to endure. And at a market cap of roughly $4.7 billion today, the company believes it currently represents just 2% of its total addressable market.

Why Arista will keep running rings around Cisco

Arista Networks is a bet on the world's insatiable (and growing) demand for data. Since going public in 2014, Arista Networks' shares have more than quadrupled as its cloud networking solutions have taken significant market share from industry leader Cisco Systems (NASDAQ: CSCO).

Arista provides hardware (network switches) and software (its Extensible Operating System, or EOS) that enable high-speed data centers to handle increasingly mind-boggling amounts of data. Arista has two primary advantages over Cisco and other competitors. Rather than using proprietary chips in its hardware like legacy providers, Arista uses off-the-shelf "merchant silicon" chips, which allows for a faster pace of innovation at lower price points. And while saving money on hardware is certainly attractive, it's the company's EOS that has been most responsible for its success.

Unlike legacy providers' offerings, the EOS is open-source, customizable, and built to scale -- exactly what network engineers are looking for. This has helped Arista land some of the largest cloud providers and tech companies in the world as customers -- including Microsoft, Facebook, Alphabet, and Netflix.

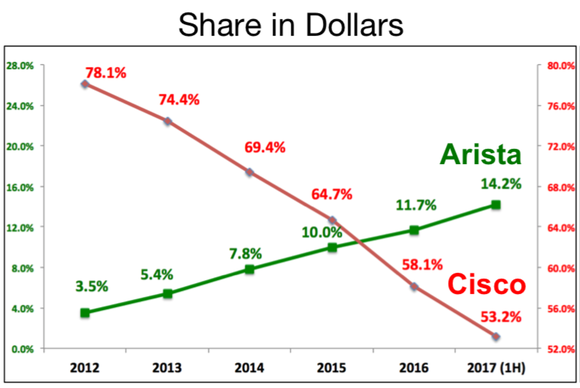

As a result, Arista's share of the high-speed data center switching market has grown from 3.5% in 2012 to 14.2% in Q2 2017. Over the same period, Cisco's share has fallen from 78.1% to 53.2%.

Image source: Arista Networks Q3 2017 investor presentation.

By the most important measures, Arista's growth over the last several years has been sizzling.

Metric | 2012 | 2016 | Compound Annual Growth Rate |

|---|---|---|---|

Revenue | $193.4 million | $1.1 billion | 54% |

Net income | $21.3 million | $184.2 million | 71% |

Free cash flow | $23.0 million | $110.0 million | 48% |

Data source: Arista Networks. CAGR calculations by author.

Through the first three quarters of 2017, the company delivered more of the same. In the third quarter (the most recently reported one), Arista reported year-over-year revenue growth of 50.8%, record operating margin, and net income growth of 160.6% as the company witnessed stronger-than-expected demand from its major cloud customers.

The company was just named by Fortune as the one of the top-10 fastest-growing companies in America. And as the demand for bigger, faster data centers continues to intensify, there's plenty more room for Arista to keep expanding. By 2021, the company estimates the data center switching market will grow to $16 billion in annual sales. For context, in 2016, Arista's revenue was just $1.1 billion.

Moreover, Arista is currently the No. 2 overall player with about 14% of the overall data center market. But according to most market studies, Arista is already the No. 1 player in the relatively new 100-gigabit switch market, with roughly 40% share. And with products literally designed to handle ever-increasing amounts of data and traffic, as 400-gigabit switches begin to hit the market in the coming years, I expect Arista to continue to steal share and thrive.

Stocks like these rarely look cheap -- except in hindsight

Though both Arista and Paycom trade at pricey valuations, these are two companies firing on all cylinders, with many years of significant growth still ahead. I believe both are good candidates to buy on dips, so long as investors are prepared to hold them for the long term, and can stomach the volatile price swings inherent to stocks with sky-high expectations baked in.

While anything can (and often does) happen in the short term, over the next several years I expect these two serial outperformers will keep disrupting their respective niches en route to much larger market caps.

More From The Motley Fool

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Teresa Kersten is an employee of LinkedIn and is a member of The Motley Fool's board of directors. LinkedIn is owned by Microsoft. Andy Gould owns shares of Alphabet (A shares), Alphabet (C shares), Arista Networks, Facebook, Netflix, and Paycom Software. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Arista Networks, Facebook, Netflix, and Paycom Software. The Motley Fool recommends Automatic Data Processing and Cisco Systems. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance