Up 20% in a week! What on earth’s going on with the Ocado share price?

The Ocado (LSE: OCDO) share price has taken a severe punishment beating in recent years but it won’t give up. Some investors still believe in it.

Whenever there’s a spot of good news – either company-specific or macroeconomic – Ocado sparks into life. It’s the type of stock investors buy when they’re feeling upbeat and ready to take a punt. Yes, Ocado is a punt and yes, I’m still wondering whether I’m brave enough (or mad enough) to take it.

The pureplay online grocer is back in play with the shares jumping 20.66% in the last week. This time, I’m happy to say, it’s due to a rare slither of good news from the company itself.

FTSE 250 recovery play

On 8 July, it announced that it’s planning to build another of its high-tech customer fulfilment centres as part of its ongoing partnership with Japanese grocer AEON. That’s it third, building on their close partnership.

The Ocado Smart Platform (OSP) has now opened 22 customer fulfilment services for 13 online grocery retail partners across the US, Canada, Sweden, Spain, France, Poland, Saudi Arabia and Australia.

Its technology is clearly cutting edge. The opportunity here is massive. Unfortunately, the share price keeps banging against reality. It has crashed 37.64% over one year, and a thunderous 81% over three.

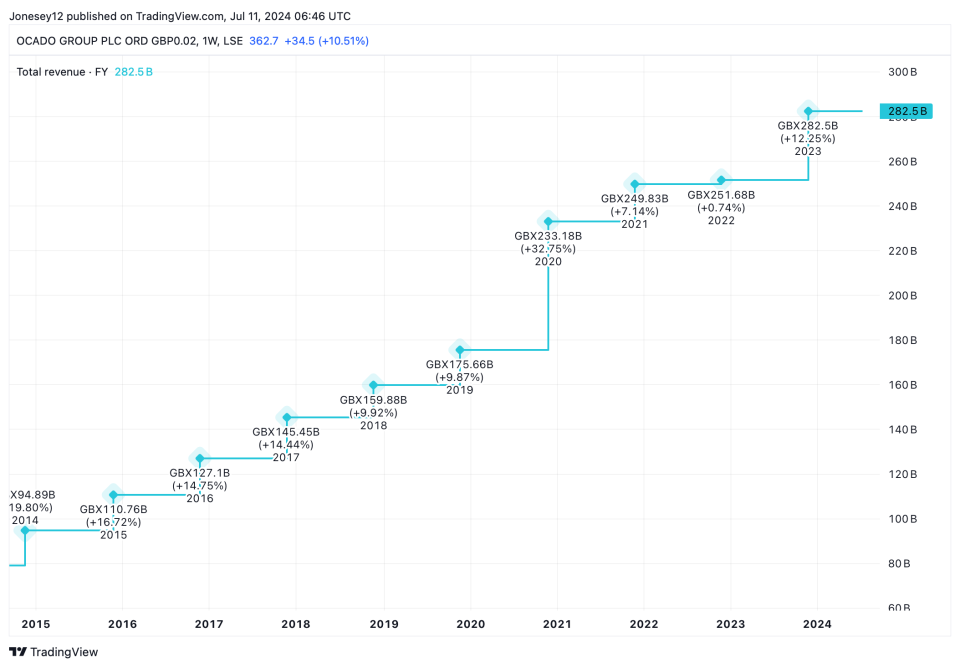

The good news is that total full-year revenues have been steadily rising, up 12.2% from £2.516bn to £2.825bn back in 2023. Let’s see what the charts say.

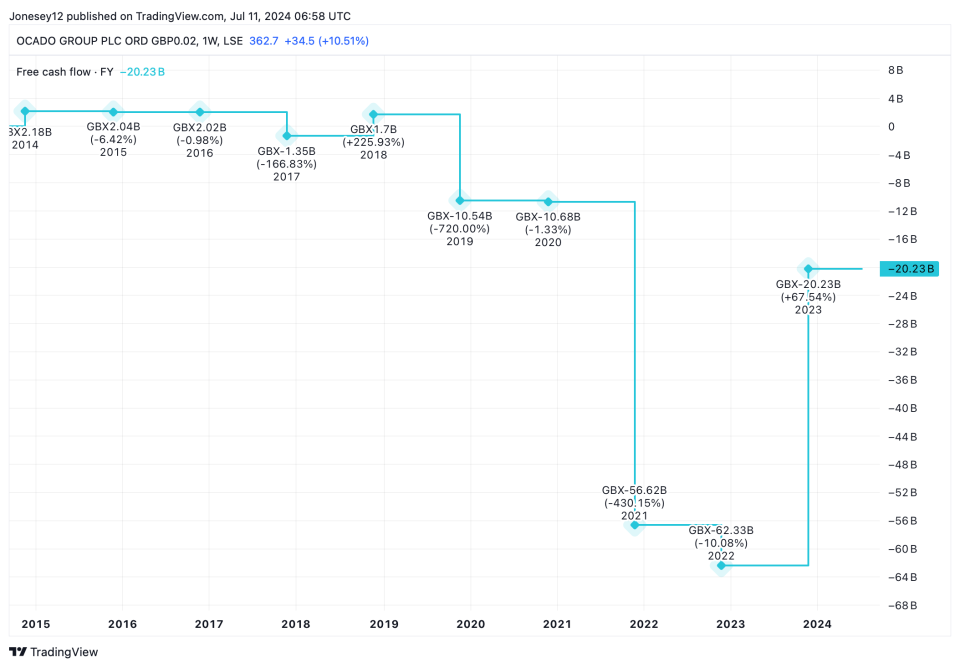

Revenues are one thing. Cash flow is quite another. Here, the news is bad.

Chart by TradingView

Chart by TradingView

The bad news is that Ocado continues to make losses, year after year, as it invests in building up the business, as my crude table shows.

2019 | 2020 | 2021 | 2022 | 2023 | |

Pre-tax loss | £214.5m | £52.3m | £176.9m | £500.8m | £403.2m |

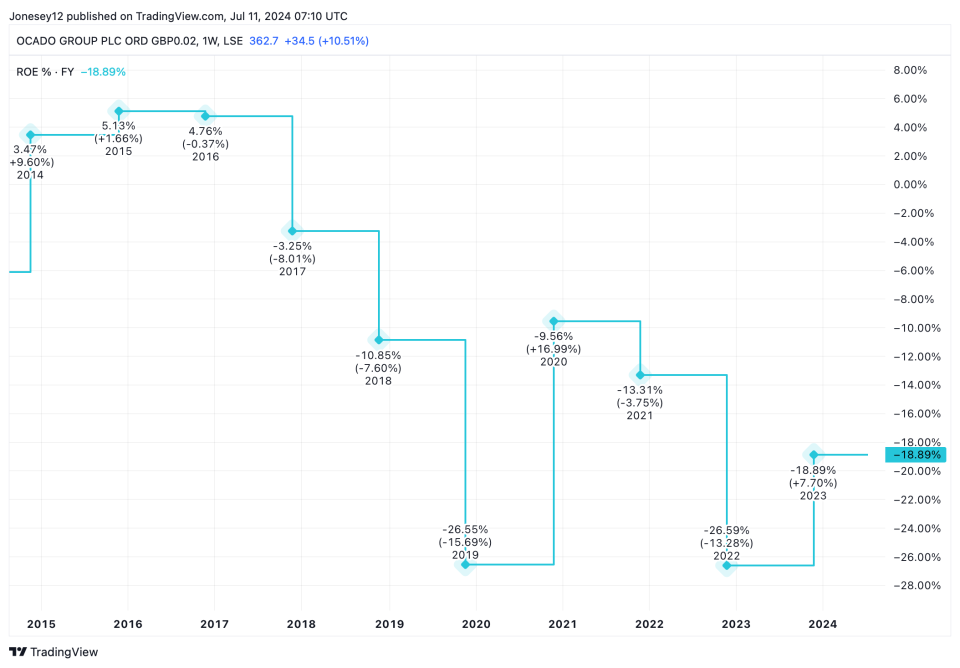

Return on equity is going the wrong way too. Here’s another chart.

Chart by TradingView

A risky punt? A glorious act of faith? A stunning long-term growth opportunity? Ocado Group is all these things.

An ultra-high-risk buy?

I can’t say what will happen to the share price from one month to the next, and I suspect co-founder and CEO Tim Steiner doesn’t know, either. He’s been controversial at times, but we should admire his resilience. Perhaps it would be a happier story if the stock was listed in the US, and had access to the vast pool of capital stateside.

More than most stocks I can think of, the decision over whether to buy a Ocado Group is a personal one. It very much depends on attitude to risk. Every portfolio has space for a bit of a gamble. I know mine does. It’s top-heavy with solid FTSE 100 dividend stocks.

My finger has hovered over the Buy button enough times. So far, I’m relieved I didn’t press it. Steiner and Ocado are in a race against time. They may get a boost from falling interest rates and an economic recovery, when they finally arrive. I’m keen to buy the stock but I won’t know for sure until I click that button. Do I feel lucky?

The post Up 20% in a week! What on earth’s going on with the Ocado share price? appeared first on The Motley Fool UK.

More reading

Harvey Jones has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024

Yahoo Finance

Yahoo Finance