2022 Outlook on the Cheese Market in India - Featuring GCMMF, Parag Milk Foods, Britannia and Mother Dairy

Indian Cheese Market

Dublin, May 12, 2022 (GLOBE NEWSWIRE) -- The "Cheese Market in India: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2022-2027" report has been added to ResearchAndMarkets.com's offering.

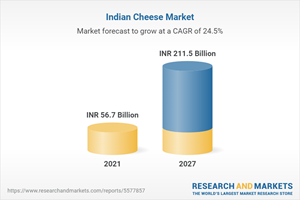

The cheese market in India reached a value of INR 56.7 billion in 2021. Looking forward, the market is projected to reach INR 211.5 billion by 2027, exhibiting a CAGR of 24.3% during 2022-2027. Keeping in mind the uncertainties of COVID-19, the analyst is continuously tracking and evaluating the direct as well as the indirect influence of the pandemic. These insights are included in the report as a major market contributor.

India is currently the world's largest producer of milk owing to which the cheese market holds significant growth potential. With the rising influence of western cuisines and inflating disposable incomes, consumers are now shifting from paneer towards cheese, thereby increasing its demand in the country. In addition to this, manufacturers are introducing a number of flavored cheese products including pepper, garlic, red chili flakes, and oregano pickle, which cater to the different tastes and preferences of consumers in India.

Although cheese is extensively used in fast food items like pasta, pizzas, burgers, sandwiches, wraps, tacos, cakes, garlic bread, etc., it is also being included in traditional Indian recipes such as dosa, uttapam and parathas. With the growing working population and their altering food patterns, the fast food industry is experiencing a healthy growth which, in turn, is augmenting the demand for cheese.

Apart from this, with an increase in the number of organized retail outlets, numerous global players are now investing in the Indian cheese market. Moreover, several manufacturers are engaging in marketing campaigns through different advertising media like newspapers, televisions and social media platforms to increase awareness among consumers about the benefits of cheese. These factors are anticipated to boost the consumption of cheese in the upcoming years.

Key Market Segmentation

This report provides an analysis of the key trends in each sub-segment of the India cheese market, along with forecasts at the country and state level from 2022-2027. The report has categorized the market based on type, format, application and retail/institutional.

Breakup by Type:

Processed Cheese

Mozzarella

Cheddar

Emmental

Ricotta

Others

On the basis of types, the market has been divided into processed cheese, mozzarella, cheddar, Emmental, ricotta and others. At present, processed cheese represents the most popular product type in India.

Breakup by Format:

Slices

Diced/Cubes

Shredded

Blocks

Liquid

Creme

Cheese Spreads

Based on formats, the market has been classified into slices, diced/cubes, shredded, blocks, liquid, creme and cheese spreads. Amongst these, cheese slices hold the dominant share as they are widely used in homes and restaurants for preparing sandwiches and burgers.

Breakup by Application:

Pizzas

Burgers

Sandwiches

Wraps

Cakes

Others

On the basis of applications, the market has been segregated as pizzas, burgers, sandwiches, wraps, cakes, and others. Currently, pizza represents the leading application area of cheese, accounting for the majority of the market share.

Breakup by Retail/Institutional:

Retail

Institutional

The cheese market in India has been bifurcated into retail and institutional sectors, wherein the institutional sector exhibits a clear dominance in the market. Cheese is supplied to food service chains and restaurants for use in various preparations.

Regional Insights:

Karnataka

Maharashtra

Tamil Nadu

Delhi

Gujarat

Andhra Pradesh and Telangana

Uttar Pradesh

West Bengal

Kerala

Haryana

Punjab

Rajasthan

Madhya Pradesh

Bihar

Orissa

On a geographical front, Maharashtra enjoys the leading position in the cheese market in India. Other regions include Karnataka, Tamil Nadu, Delhi, Gujarat, Andhra Pradesh and Telangana, Uttar Pradesh, West Bengal, Kerala, Haryana, Punjab, Rajasthan, Madhya Pradesh, Bihar and Orissa.

Competitive Landscape

The cheese market in India is highly concentrated in nature with the presence of only a few large manufacturers, such as GCMMF, Parag Milk Foods, Britannia and Mother Dairy. These players compete against one another in terms of prices and quality.

Key Questions Answered in This Report

How has the cheese market in India performed so far and how will it perform in the coming years?

What has been the impact of COVID-19 on the cheese market in India?

What are the key regional markets in the cheese market in India?

What are the major application segments in the cheese market in India?

What are the different formats in the cheese market in India?

What are the various product types in the cheese market in India?

What are the major sectors in the cheese market in India?

What are the price trends of cheese?

What are the various stages in the value chain of the cheese market in India?

What are the key driving factors and challenges in the cheese market in India?

What is the structure of the cheese market in India and who are the key players?

What is the degree of competition in the cheese market in India?

What are the profit margins in the cheese market in India?

What are the key requirements for setting up a cheese manufacturing plant?

How is cheese manufactured?

What are the various unit operations involved in a cheese manufacturing plant?

What is the total size of land required for setting up a cheese manufacturing plant?

What are the machinery requirements for setting up a cheese manufacturing plant?

What are the raw material requirements for setting up a cheese manufacturing plant?

What are the packaging requirements for cheese?

What are the transportation requirements for cheese?

What are the utility requirements for setting up a cheese manufacturing plant?

What are the manpower requirements for setting up a cheese manufacturing plant?

What are the infrastructure costs for setting up a cheese manufacturing plant?

What are the capital costs for setting up a cheese manufacturing plant?

What are the operating costs for setting up a cheese manufacturing plant?

What will be the income and expenditures for a cheese manufacturing plant?

What is the time required to break-even?

Key Topics Covered:

1 Preface

2 Scope and Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 India Dairy Industry

5.1 Market Overview

5.2 Market Performance

5.3 Market Breakup by Organised and Unorganised Segment

5.4 Milk Production and Consumption Trends

5.4.1 Current and Historical Trends

5.4.2 Production and Consumption Forecast

5.5 Milk Production by State

5.6 Milk Production by Cattle

5.7 Milk Utilization Patterns in India

5.8 Market Forecast

6 India Cheese Industry

6.1 Market Overview

6.2 Market Performance

6.2.1 Volume Trends

6.2.2 Value Trends

6.3 Impact of COVID-19

6.4 Price Trends

6.4.1 Milk Procurement Price Trends

6.4.2 Cheese Price Trends

6.5 Market Breakup by Region

6.6 Market Breakup by Type

6.7 Market Breakup by Format

6.8 Market Breakup by Application

6.9 Market Breakup by Retail/Institutional

6.10 Market Forecast

7 India Cheese Market

7.1 SWOT Analysis

7.1.1 Overview

7.1.2 Strengths

7.1.3 Weaknesses

7.1.4 Opportunities

7.1.5 Threats

7.2 Value Chain Analysis

7.3 Porter's Five Forces Analysis

7.3.1 Overview

7.3.2 Bargaining Power of Buyers

7.3.3 Bargaining Power of Suppliers

7.3.4 Degree of Rivalry

7.3.5 Threat of New Entrants

7.3.6 Threat of Substitutes

7.4 Key Market Drivers and Success Factors

8 Performance of Key Regions

9 Competitive Landscape

9.1 Competitive Structure

9.2 Market Share of Key Players

9.2.1 Retail Market

9.2.2 Institutional Market

10 Performance by Type

10.1 Processed Cheese

10.1.1 Market Trends

10.1.2 Market Forecast

10.2 Mozzarella

10.2.1 Market Trends

10.2.2 Market Forecast

10.3 Cheddar

10.3.1 Market Trends

10.3.2 Market Forecast

10.4 Emmental

10.4.1 Market Trends

10.4.2 Market Forecast

10.5 Ricotta

10.5.1 Market Trends

10.5.2 Market Forecast

10.6 Others

10.6.1 Market Trends

10.6.2 Market Forecast

11 Performance by Format

11.1 Slices

11.1.1 Market Trends

11.1.2 Market Forecast

11.2 Diced/Cubes

11.2.1 Market Trends

11.2.2 Market Forecast

11.3 Shredded

11.3.1 Market Trends

11.3.2 Market Forecast

11.4 Blocks

11.4.1 Market Trends

11.4.2 Market Forecast

11.5 Liquid

11.5.1 Market Trends

11.5.2 Market Forecast

11.6 Creme

11.6.1 Market Trends

11.6.2 Market Forecast

11.7 Cheese Spreads

11.7.1 Market Trends

11.7.2 Market Forecast

12 Performance by Application

12.1 Pizzas

12.1.1 Market Trends

12.1.2 Market Forecast

12.2 Burgers

12.2.1 Market Trends

12.2.2 Market Forecast

12.3 Sandwiches

12.3.1 Market Trends

12.3.2 Market Forecast

12.4 Wraps

12.4.1 Market Trends

12.4.2 Market Forecast

12.5 Cakes

12.5.1 Market Trends

12.5.2 Market Forecast

12.6 Others

12.6.1 Market Trends

12.6.2 Market Forecast

13 Performance by Retail/Institutional

13.1 Retail

13.1.1 Market Trends

13.1.2 Market Forecast

13.2 Institutional

13.2.1 Market Trends

13.2.2 Market Forecast

14 Cheese Manufacturing Process

14.1 Product Overview

14.2 Detailed Process Flow

14.3 Various Types of Unit Operations Involved

14.4 Mass Balance and Raw Material Requirements

15 Project Details, Requirements and Costs Involved

15.1 Land Requirements and Expenditures

15.2 Construction Requirements and Expenditures

15.3 Plant Machinery

15.4 Machinery Pictures

15.5 Raw Material Requirements and Expenditures

15.6 Raw Material and Final Product Pictures

15.7 Packaging Requirements and Expenditures

15.8 Transportation Requirements and Expenditures

15.9 Utility Requirements and Expenditures

15.10 Manpower Requirements and Expenditures

15.11 Other Capital Investments

16 Loans and Financial Assistance

17 Project Economics

17.1 Capital Cost of the Project

17.2 Techno-Economic Parameters

17.3 Product Pricing and Margins Across Various Levels of the Supply Chain

17.4 Income Projections

17.5 Expenditure Projections

17.6 Taxation and Depreciation

17.7 Financial Analysis

17.8 Profit Analysis

18 Profiles of Key Players

For more information about this report visit https://www.researchandmarkets.com/r/cofnie

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance