21Shares Enters the US with new Crypto Product Launches

Key Insights:

21Shares entered the US market this week, with the launch of two cryptocurrency exchange-traded products (ETPs).

Last week, the firm launched the first Bitcoin (BTC) and Ethereum (ETH) ETFs in Australia.

21Shares built the first crypto ETP on the Six Swiss Exchange in 2018.

21Shares has enjoyed a strong European presence in recent years as the acceptance and adoption of digital assets gather momentum. ETP and ETF products have drawn plenty of investor interest.

In 2018, 21Shares rolled out the first crypto exchange-traded product on the Six Swiss Exchange.

Since then, 21Shares has evolved and currently offers 35 exchange-traded products available in CHF, EUR, GBP, and USD.

33 crypto exchange products are on offer to European investors, including The Sandbox ETP, Decentraland ETP, Crypto Basket Index ETP, and DeFi 10 Infrastructure ETP.

Among the 33 ETPs is also the Terra ETP, down 92% over the past 24-hours.

Despite the market angst from the TerraUSD (UST) de-pegging and the collapse of Terra LUNA, 21Shares continues to expand its product suite.

21Shares Launches Two US Crypto Index Funds Amidst Choppy Conditions

On Wednesday, 21Shares announced its entry into the US with the launch of two Crypto Index Funds.

The first fund offerings in the US will give accredited investors easy access to crypto. Accredited investors can invest into the Crypto Basket 10 Index Fund and the Crypto Mid-Cap Index Fund.

Big news for US investors!🇺🇸We're excited to announce the launch of @21Shares Crypto Basket 10 Index Fund & @21Shares Crypto Mid-Cap Index Fund. Our first fund offerings in the US provide accredited investors with easy access to crypto assets. Learn more: https://t.co/LQIh7quYpZ pic.twitter.com/tnoRudp3HO

— 21Shares (@21Shares) May 18, 2022

The Crypto Basket 10 Index Fund provides accredited investors with,

“An easy and efficient way to gain diversified exposure to bitcoin and other leading cryptocurrencies in a traditional private placement vehicle, which allows subscriptions and redemptions weekly and monthly, respectively.

The Fund seeks to track an index comprised of the top 10 largest cryptocurrencies based on market capitalization and available on US exchanges.”

At the time of writing, underlying assets included Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), Solana (SOL), Polkadot (DOT), Avalanche (AVAX), Polygon (MATIC), Litecoin (LTC), Bitcoin Cash (BCH), and Cosmos (ATOM).

The Crypto Mid-Cap Index Fund,

“seeks to track an index comprised of the mid-cap portion of the cryptocurrency market based on market capitalization.”

At the time of writing, the underlying assets included Cardano (ADA), Solana (SOL), Polkadot (DOT), Avalanche (AVAX), Polygon (MATIC), Litecoin (LTC), Bitcoin Cash (BCH), and Cosmos (ATOM).

Both of the Funds have an expense ratio of 2.5%.

The latest product launch offering follows last week’s launch of two crypto exchange-traded funds in Australia and heightened volatility across the crypto market.

The Bearish Crypto Market Gives 21Shares and Investors an Entry Point

21Shares launched its Australian and US crypto products at a difficult time for the crypto market.

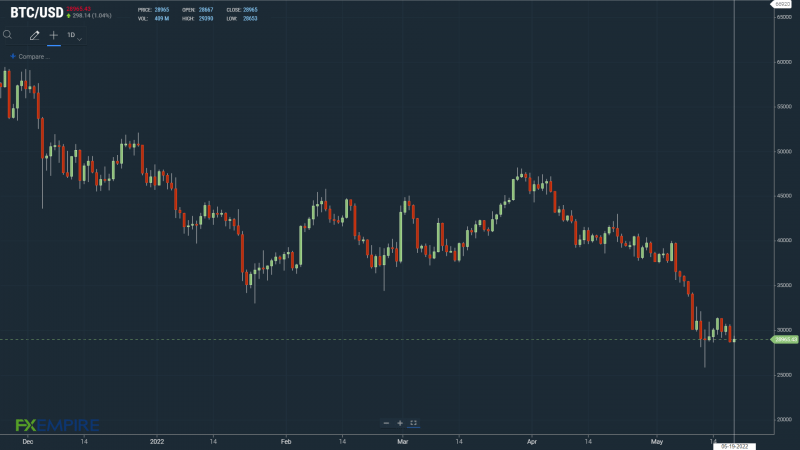

For May, bitcoin has tumbled 23.9% and by 38% year-to-date. From May 9 to May 18, bitcoin was down 15.8%, reflecting the impact of the TerraUSD (UST) de-peg and the Terra LUNA collapse.

21Shares CEO and co-founder Hany Rashwan said in an interview,

“We’ve been working on products in the US since we started, so we couldn’t be more excited to finally bring them.”

On the US debut, Hany has also said,

“Bear markets are wonderful times to consolidate, to build and to innovate, and we see this as a long-term investment.”

“Bear markets are wonderful times to consolidate, to build and to innovate, and we see this as a long-term investment,” @hany, CEO and co-founder, on US debut.

Read more: https://t.co/8YxWyIVHz9@VildanaHajric @crypto

— 21Shares (@21Shares) May 18, 2022

At the time of writing, bitcoin was up 1.04% to $28,965. A move through to $29,500 would support a breakout day ahead.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance