The 3.1% return this week takes Roku's (NASDAQ:ROKU) shareholders three-year gains to 767%

Roku, Inc. (NASDAQ:ROKU) shareholders might be concerned after seeing the share price drop 25% in the last quarter. But that doesn't change the fact that the returns over the last three years have been spectacular. In fact, the share price has taken off in that time, up 767%. As long term investors the recent fall doesn't detract all that much from the longer term story. The only way to form a view of whether the current price is justified is to consider the merits of the business itself. We love happy stories like this one. The company should be really proud of that performance!

Since it's been a strong week for Roku shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for Roku

We don't think that Roku's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last 3 years Roku saw its revenue grow at 44% per year. That's well above most pre-profit companies. In light of this attractive revenue growth, it seems somewhat appropriate that the share price has been rocketing, boasting a gain of 105% per year, over the same period. It's always tempting to take profits after a share price gain like that, but high-growth companies like Roku can sometimes sustain strong growth for many years. So we'd recommend you take a closer look at this one, or even put it on your watchlist.

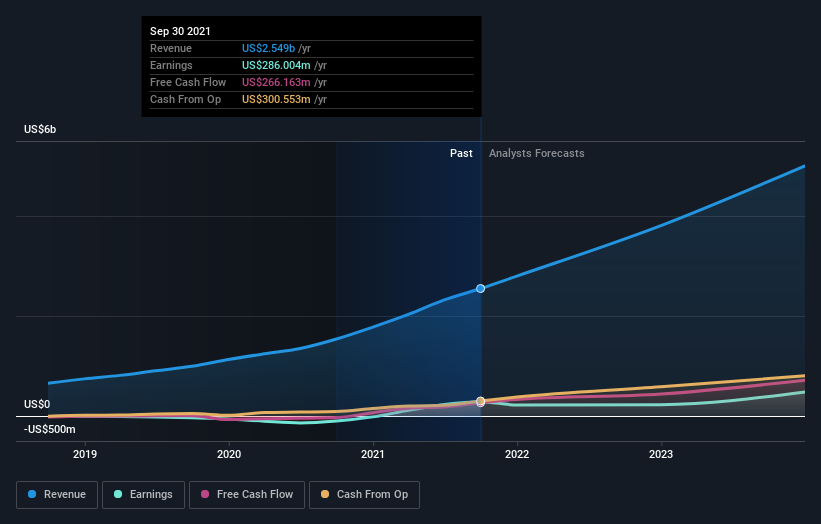

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Roku is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

Over the last year, Roku shareholders took a loss of 31%. In contrast the market gained about 18%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Fortunately the longer term story is brighter, with total returns averaging about 105% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Roku that you should be aware of before investing here.

But note: Roku may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance