3 Auto Stocks Poised to Outpace Q1 Earnings Estimates

The first-quarter earnings season for the Auto-Tires-Trucks sector has shifted to high gear this week. So far, four S&P 500 sector components — Tesla, Genuine Parts, General Motors, LKQ Corp— have reported quarterly numbers. Results have been mixed so far. While Tesla and LKQ missed earnings estimates, General Motors and Genuine Parts surpassed the same.

Per the Earnings Trend report dated Apr 17, the auto sector’s earnings for the first quarter of 2024 are expected to decline 29.5% on a year-over-year basis. Revenues are estimated to rise 0.9% year over year.

With a host of companies left to release quarterly results, we have identified — with the help of the Zacks Stock Screener — a few auto players, which are positioned to outshine the Zacks Consensus Estimate in first-quarter earnings. These include Oshkosh Corp OSK, PACCAR PCAR and Lear Corp. LEA. Before we discuss the companies, let’s take a look at the factors shaping the quarterly performance of automotive companies.

Things to Note

U.S. vehicle sales grew 5.1% to 3.75 million units in the first quarter of 2024, per GlobalData. March's seasonally adjusted annual rate is anticipated to reach 15.5 million units, compared with 15.02 million in March 2023. Per J.D. Power and GlobalData, in March, light-vehicle retail inventory reached 1.7 million, up 4.2% from February 2024 and 39% from March 2023. Total inventory surpassed 2.5 million for the first time since 2021. Per J.D. Power, average transaction prices of vehicles in March declined 3.6% year over year to $44,186.

The generous incentives offered by automakers are expected to have played a crucial role in boosting retail deliveries in the first quarter of 2024, offsetting the impact of high interest rates. However, discounts might have impacted margins. Also, commodity costs, forex woes, tough labor market and logistical challenges are likely to have played spoilsport. Moreover, high operating expenses, including R&D, to develop technologically advanced products to adapt to the changing dynamics of the auto industry are expected to have dented earnings.

Picking Potential Winners

While it is not possible to be sure about which companies are well positioned to beat earnings estimates, our proprietary methodology — Earnings ESP — makes it relatively simple. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. Earnings ESP shows the percentage difference between the Most Accurate Estimate and the Zacks Consensus Estimate.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Our research shows that for stocks with the abovementioned combination, the chances of an earnings beat are as high as 70%.

Our Choices

Oshkosh: The acquisitions of Pratt Miller, CartSeeker Technology, JBT's AeroTech business, Hinowa have expanded Oshkosh’s manufacturing and electrification capabilities and are expected to have bolstered revenues in the to-be-reported quarter. The company’s record consolidated backlog of $16.8 billion (approximately $4.52 billion in Access Equipment, $6.76 billion in Defense and $5.45 billion in Vocational) also instills confidence.

Frequent business wins and a comprehensive offering of innovative new products are set to buoy sales. In response to the demand for innovative products, OSK is strategically committing to capacity expansion throughout its operations. Noteworthy investments include Spartanburg, South Carolina, dedicated to Next Generation Delivery Vehicles; Murphysboro, Tennessee, focused on Volterra ZSL production; and Jefferson City, Tennessee, earmarked for the augmentation of telehandler capacity. This targeted expansion initiative is poised to fortify Oshkosh's market presence and drive the company’s upcoming results.

Oshkosh has an Earnings ESP of +0.11% and carries a Zacks Rank #2. The company is scheduled to release first-quarter results on Apr 25. The Zacks Consensus Estimate for OSK’s to-be-reported quarter’s earnings and revenues is pegged at $2.26 per share and $2.51 billion, respectively. The EPS and revenue estimates imply year-over-year growth of 42% and 10.6%, respectively. OSK surpassed earnings estimates in the trailing four quarters, with the average surprise being 46.8%.

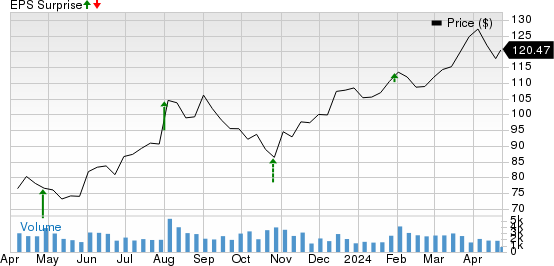

Oshkosh Corporation Price and EPS Surprise

Oshkosh Corporation price-eps-surprise | Oshkosh Corporation Quote

PACCAR: It is one of the leading names in the trucking business, with reputed brands like Kenworth, Peterbilt and DAF. We expect first-quarter 2024 pretax profit for the Truck segment to be $1 billion, up from $894.3 million reported in the year-ago period. We expect revenues from the Financial Services segment to be around $470.4 million, implying a rise of 11% year over year.

Continued growth in the aftermarket parts due to the widespread adoption of its proprietary MX engine bodes well. High truck utilization and increased average fleet age are expected to have positively impacted Parts’ results in the first quarter of 2024. Our projection for first-quarter revenues from the Parts segment is pegged at $1.69 billion, indicating a rise of 4.5% year over year. The estimate for pretax profit of the segment is pegged at $457.2 million, suggesting a rise from $438.6 million. Improved performance across segments is likely to have bolstered the company’s performance in the to-be-reported quarter.

PACCAR has an Earnings ESP of +1.25% and sports a Zacks Rank #1. The company is scheduled to release first-quarter results on Apr 30. The Zacks Consensus Estimate for PCAR’s to-be-reported quarter’s earnings and revenues is pegged at $2.17 per share and $8.08 billion, respectively. The EPS estimate for the first quarter has moved up by 2 cents in the past 30 days. PACCAR surpassed earnings estimates in the trailing four quarters, with the average surprise being 17.07%.

PACCAR Inc. Price and EPS Surprise

PACCAR Inc. price-eps-surprise | PACCAR Inc. Quote

Lear: The Kongsberg acquisition has strengthened Lear’s Seating business and has added innovative technologies to differentiate its product offerings. The acquisition of Xevo has enhanced Lear’s capabilities in software, services and data analytics, in turn, bolstering its market position in connectivity. The buyout of IGB has expanded Lear’s product offerings in the growing thermal comfort solutions market. These buyouts are expected to buoy Lear’s revenues in the quarter-to-be-reported.

Rising consumer demand for vehicle content— requiring signal, data and power management— and increasing electrification efforts by the company bode well for the upcoming results. Frequent business wins because of innovative product launches like Battery Disconnect Units and Intercell Connect Boards are likely to boost revenues. Also, the company’s Lear Forward plan is expected to generate cost savings. A sales backlog of around $2.8 billion through 2024-2026 augurs well for growth.

Lear has an Earnings ESP of +0.55% and carries a Zacks Rank #3. The company is scheduled to release first-quarter results on Apr 30. The Zacks Consensus Estimate for LEA for the to-be-reported quarter’s earnings and revenues is pegged at $3.04 per share and $5.99 billion, respectively. The EPS and revenue estimates imply year-over-year growth of 9.3% and 2.5%, respectively. Lear surpassed earnings estimates in three of the trailing four quarters and missed once, with the average surprise being 6.11%.

Lear Corporation Price and EPS Surprise

Lear Corporation price-eps-surprise | Lear Corporation Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance