3 Diverse Stocks to Benefit from Booming Industries

Logically, companies can benefit from being in a strong business industry which typically boosts their stocks as well.

Let’s take a look at three diverse, highly-ranked stocks that are in top-tier Zacks industries at the moment.

Accenture (ACN)

Starting out is Accenture (ACN) which sports a Zacks Rank #2 (Buy) and its Consulting-Services Industry is currently in the top 13% of over 251 Zacks industries.

Accenture is the world’s top consulting firm in terms of revenue and its clients comprise 92 of the Fortune Global 100 and more than three-quarters of the Fortune Global 500.

The performance of Accenture stock and the Consulting-Services Market has been stellar in recent years. Trading at $281 per share, Accenture stock is up +69% over the last three years to top the S&P 500’s +55% but trail its Zacks Subindustry’s +82%.

Image Source: Zacks Investment Research

With Accenture being one of the leaders in its space investors may want to consider buying the stock for its steady top and bottom-line growth. Earnings are expected to rise 7% this year and jump another 8% in FY24 at $12.48 per share.

Sales are forecasted to be up 4% in FY23 and rise another 6% in FY24 to $68.06 billion. More impressive, fiscal 2024 would be 57% above pre-pandemic levels with 2019 sales at $43.21 billion.

AMETEK (AME)

Sporting a Zacks Rank #2 (Buy) Ametek is worthy of consideration with its Electronics-Testing Equipment Industry in the top 17% of all Zacks industries. Ametek is one of the leading manufacturers of electronic appliances and electromechanical devices.

Ametek’s products cater to the aerospace and defense industries, commercial and fitness equipment makers, food and beverage machine builders, and manufacturers of hydraulic pumps, industrial blowers, and vacuum cleaners.

As a beneficiary of a strong business environment and a diverse reach, Ametek’s earnings estimates have remained higher over the last quarter. Fiscal 2023 earnings estimates have gone up 2% with FY24 EPS estimates up 5%.

Image Source: Zacks Investment Research

Ametek’s earnings are now expected to pop 5% this year and rise another 5% in FY24 at $6.29 per share. Sales are forecasted to be up 5% in FY23 and edge up another 4% in FY24 to $6.77 billion. Fiscal 2024 would represent 31% growth from pre-pandemic levels with 2019 sales at $5.15 billion.

Trading at $135 per share, shares of AME have climbed +79% over the last three years to top the benchmark, and the Electronics-Testing Equipment Markets +55%.

Ashtead Group (ASHTY)

Rounding out the list is Ashtead Group (ASHTY) which is in the Industrial Services Industry, currently in the top 13%. Ashtead stock also sports a Zacks Rank #2 (Buy) as an equipment company that provides rental solutions primarily in the United States and the United Kingdom.

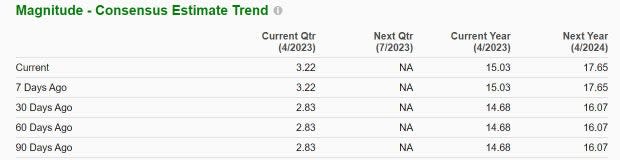

Ashtead’s earnings estimate revisions have climbed over the last 30 days with FY23 and FY24 EPS estimates up 2% and 10% respectively. This supports further upside in Ashtead stock which has now skyrocketed +156% over the last three years to crush the S&P 500 and the Industrial Services Markets -21%.

Image Source: Zacks Investment Research

Trading at $222 per share, Ashtead earnings are now projected to soar 23% this year and leap another 17% in FY24 at $17.65 per share. Sales are forecasted to climb 19% in FY23 and rise another 10% in FY24 to $10.52 billion. Plus, fiscal 2024 would be 79% growth from the pandemic with 2019 sales at $5.86 billion.

Takeaway

The top and bottom line growth of these stocks has been impressive since the pandemic which has led to stellar performances in their stocks. The rising earnings estimates confirm that business is still strong and this could very well lead to even more upside.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Accenture PLC (ACN) : Free Stock Analysis Report

AMETEK, Inc. (AME) : Free Stock Analysis Report

Ashtead Group PLC (ASHTY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance