3 Dividend Stocks You'll Wish You'd Bought 10 Years From Now

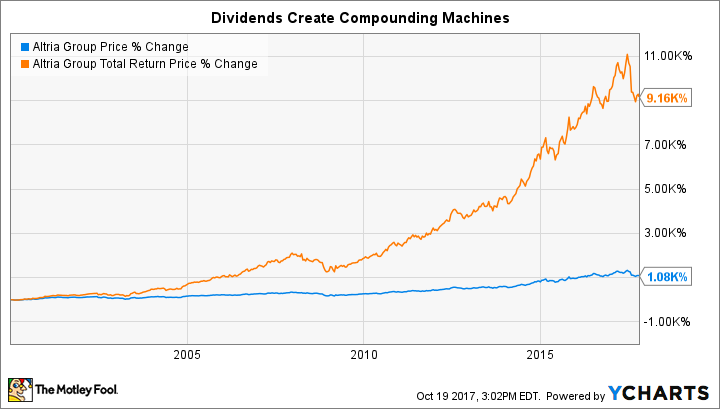

We chronically underestimate the astonishing power of compounding dividend reinvestment. From 2000 to today, for instance, shares of cigarette king Altria have returned a respectable 1,080%. When we factor in the dividends that the company has paid out during that time, however, the story changes considerably.

Here's what it looks like:

The takeaway is simple: investing in companies that provide safe, stable and -- hopefully -- growing dividends can make a world of difference for your retirement portfolio. Below, three of our Foolish investors tell you why General Motors (NYSE: GM), Magellan Midstream Partners (NYSE: MMP), and Lowe's (NYSE: LOW).

An electric car company

Tim Green (General Motors): The market is finally starting to give General Motors some credit for its strong results. The stock has soared about 24% in the past three months, pushing it up to a post-financial crisis high. Not only is GM's business continuing to thrive, but the company's recently announced plan to launch 20 new all-electric vehicles by 2023 is changing the narrative.

The auto industry is cyclical, so GM is not a company that will post earnings growth each and every year. The good news for dividend investors is that GM's dividend is sustainable under a wide range of scenarios. A downturn similar to the financial crisis would certainly threaten the dividend, but a less severe downturn probably won't.

Image source: Getty Images

GM stock currently yields about 3.4%, but the best part of the dividend story is the payout ratio. GM expects to produce adjusted earnings between $6.00 and $6.50 per share this year. The current quarterly dividend is just $0.38, or $1.52 over the course of a year. At the low end of guidance, just about 25% of earnings will go toward the dividend. Even a steep decline in earnings will leave the dividend unscathed.

The auto industry will likely change dramatically over the next decade. But I think buying GM today, especially if you're looking for a solid, sustainable dividend, is a great idea.

Incredible stable business + superior capital allocation

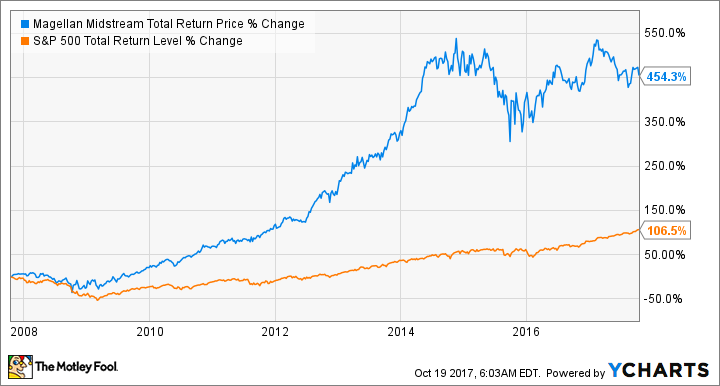

Tyler Crowe (Magellan Midstream Partners): Over the past decade, refined petroleum product pipeline company Magellan Midstream Partners has been an incredible wealth builder for its investors. Despite the simple business of moving gasoline and diesel from refineries to terminals across the middle of the country, it has soundly thumped the S&P 500 on a total return basis. Based on the company's business model and its management team, it's highly likely it will continue this pace for the next decade.

MMP Total Return Price data by YCharts

One critical aspect of Magellan's business is that a vast majority of its revenue -- about 85% -- comes from fixed-fee contracts. This takes a lot of the commodity price volatility out of the business and ensures a steady recurring revenue stream that grows at a predictable rate. In fact, much of its pipeline network is treated like a regulated utility because it is the only way to move gasoline and diesel to some parts of the country.

Magellan's business is so simple that an idiot could run it -- a Peter Lynch favorite. Fortunately, though, the company's management team is much better than that. For years, they have done a splendid job of allocating a lot of capital -- about $5 billion over the past decade -- to high-rate-of-return projects; all while keeping debt levels low and not issuing equity that dilutes shareholders. All of these factors are how the company has been able to raise its payout 12% annually since its IPO.

With that recurring revenue stream in place and another $1.6 billion in new assets slated to come online in the next couple of years, Magellan and its 5.2% distribution yield look like the kind of stock that you will be glad you bought several years down the road.

Betting on a growing dividend

Brian Stoffel (Lowe's): On the surface, Lowe's dividend isn't anywhere near as exciting as the previous two. Currently yielding just 2%, there are a lot of heavier hitters out there. But there's more than meets the eye here.

Crucially, I consider Lowe's to be in a relatively "Amazon-proof" industry, as customers like to see, touch, and hold the home furnishings and tools that they bring back from a home improvement store. With a powerful brand and the runner-up spot in terms of market share in America, there's a modest moat surrounding the company.

More importantly -- for the purposes of this article -- the company's dividend is very strong. Over the past year, only one-quarter of free cash flow was used on the payout. And this was no anomaly.

There's tons of room for continued growth in Lowe's dividend. In fact, that's already happened. Over the past five years, the payout has grown at a compounded rate of 20% per year.Even if we assume that it grows at a slower 15% per year over the next ten years, that leaves us with a dividend in 2027 of $5.10 per share. That's a 6.3% yield based on today's price.

While I don't own shares myself -- I tend more toward growth stocks as a younger investor -- potential like that can't be ignored!

More From The Motley Fool

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

NVIDIA Scores 2 Drone Wins -- Including the AI for an E-Commerce Giant's Delivery Drones

Brian Stoffel has no position in any of the stocks mentioned. Timothy Green owns shares of General Motors. Tyler Crowe owns shares of Magellan Midstream Partners. The Motley Fool recommends Lowe's and Magellan Midstream Partners. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance