3 Electronics Stocks With Bright Industry Prospects to Buy

The Zacks Electronics - Miscellaneous Components industry is benefiting from the ongoing automation drive, and increased spending by manufacturers of semiconductors, automobiles, machineries and mobile phones. Notably, industry players like nVent Electric NVT, CTS Corporation CTS and Rogers ROG remain well-poised to benefit from the solid adoption of AI and the democratization of IoT techniques, which are transforming robotics, industrial automation, transportation systems, retail and healthcare.

However, worldwide supply-chain disruptions and end-market dynamics due to the pandemic are concerns for the underlined industry. Rising inflationary pressure, growing geo-political tensions and foreign-currency headwinds are persistently taking a toll on industry players.

Industry Description

The Zacks Electronics - Miscellaneous Components industry primarily comprises companies providing a wide range of accessories and parts used in electronic products. The industry participants’ offerings include power control and sensor technologies to mitigate equipment damage, testing products for safety and advanced medical solutions. They cater to varied end markets, such as telecommunications, automotive electronics, medical devices, industrial, transportation, energy harvesting, defense and aerospace electronic systems, and consumer electronics. Its customers are mainly original equipment manufacturers, independent electronic component distributors and electronic manufacturing service providers.

3 Trends Shaping the Future of Electronics - Miscellaneous Components Industry

Automation Boom a Tailwind: The requirement for faster, more powerful and energy-efficient electronics is leading to increased automation. The use of control systems, such as computers and robots and information technologies for handling different processes and machinery, is driving the industry. The growing installation of collaborative robots, which add efficiency to production processes by working with production workers, will benefit industry participants. IoT-supported factory automation solutions are other contributing factors. The evolution of smart cars and autonomous vehicles is expected to drive growth for the industry.

Miniaturization Remains a Key Lever: The industry participants are benefiting from the ongoing transition in semiconductor manufacturing technology. Demand for advanced packaging, enabling the miniaturization of electronic products, remains strong. The consistent shift to smaller dimensions, the rapid adoption of new device architectures, like FinFET transistors and 3D-NAND, and the increasing utilization of new manufacturing materials to increase transistor and bit density are driving the demand for solutions provided by industry players.

Supply-Chain Disruptions Remain Worrisome: These companies are reeling under the impacts of the coronavirus-induced macroeconomic woes. Supply chains are still disrupted by the pandemic-led shelter-in-place measures and lockdowns. These disruptions are severely affecting industry players. Production delays and the underutilization of manufacturing capacities remain major concerns. The pandemic aggravated the concerns related to the economic downturn, persistently hurting these company’s spending patterns and new bookings.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Electronics – Miscellaneous Components industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #109, placing it in the top 44% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, basically the average of the Zacks Rank of all the member stocks, indicates bearish near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Before we present a few stocks worth considering for your portfolio, let’s look at the industry’s recent stock-market performance and the valuation picture.

Industry Underperforms S&P 500 & Sector

The Zacks Electronics - Semiconductors industry has underperformed the Zacks S&P 500 composite and the broader Zacks Computer and Technology sector over the past year.

The industry has lost 13.6% over this period compared with the S&P 500’s decline of 4.6% and the broader sector’s decrease of 6.3%.

One-Year Price Performance

Industry's Current Valuation

Based on the forward 12-month price to earnings, a commonly-used multiple for valuing electronics - miscellaneous components stocks, the industry is currently trading at 20.45X compared with the S&P 500’s 18.28X and the sector’s 22.62X.

In the past five years, the industry has traded as high as 25.96X, as low as 14.55X and recorded a median of 19.74X, depicted in the charts below.

Price/Earnings Ratio (F12M)

3 Electronics - Miscellaneous Components Stocks to Buy

Rogers: The Chandler, AZ-based company is riding on strong momentum across ADAS, general industrial and renewable energy markets. Its focus on bolstering customer engagement and developing and commercializing unique material solutions for leading-edge applications are constantly driving its business growth.

The Zacks Rank #1 (Strong Buy) company, which offers electronic and elastomeric materials that are used in applications for automotive safety and radar systems, EV/HEV, renewable energy, mobile devices, wireless infrastructure and energy-efficient motor drives among others, is well-poised to witness strong momentum among converters, fabricators, distributors and original equipment manufacturers on the back of its robust Advanced Electronics and Elastomeric Material solutions.

You can see the complete list of today’s Zacks #1 Rank stocks here.

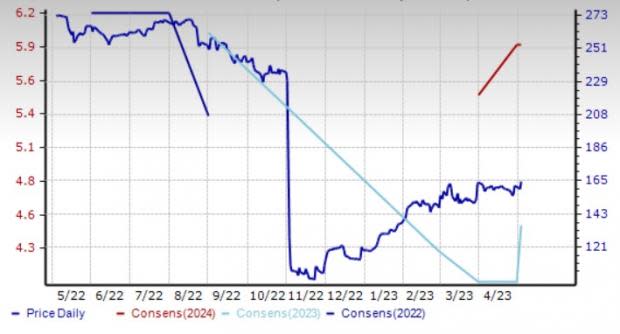

Rogers has lost 39.7% in the past year. The Zacks Consensus Estimate for ROG’s 2023 earnings has been revised 10.9% upward to $4.49 per share in the past 30 days.

Price and Consensus: ROG

nVent Electric: This London, U.K.-based entity has been gaining from portfolio strength and modular and digital platforms. NVT’s growth, profits and cash strategies remain noteworthy. Strengthening relationships with strategic channel partners are expected to drive its performance.

The Zacks Rank #2 (Buy) player, which is a provider of electrical connection and protection solutions, is optimistic about strong demand for its products and solutions. A solid execution of its strategy across high-growth verticals, product introductions, global expansion and strategic acquisitions are other tailwinds.

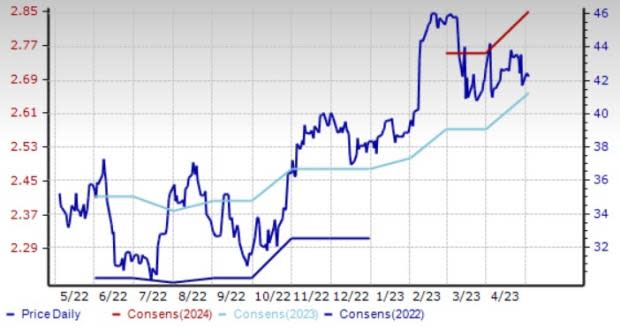

nVent Electric has gained 22.8% in the past year. The Zacks Consensus Estimate for NVT’s 2023 earnings has been revised 3.5% upward to $2.66 per share in the past 30 days.

Price and Consensus: NVT

CTS: The Lisle, IL-based company is well-positioned to keep gaining from solid momentum across premium non-transportation end markets. Disciplined capital allocation and strategic acquisitions bode well. The company’s TEWA Temperature Sensors acquisition, which has bolstered its presence in Europe, is anticipated to keep contributing to its financial performance in the days ahead.

This Zacks Rank #2 company manufactures sensors, actuators and electronic components and supplies these products to OEMs in the aerospace, communications, defense, industrial, information technology, medical and transportation markets. CTS is expected to continue gaining from its growing traction among new electric vehicle applications.

CTS has gained 13.6% in the past year. The Zacks Consensus Estimate for its 2023 earnings has been revised 2% upward to $2.60 per share in the past 30 days.

Price and Consensus: CTS

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

nVent Electric PLC (NVT) : Free Stock Analysis Report

CTS Corporation (CTS) : Free Stock Analysis Report

Rogers Corporation (ROG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance