3 Euronext Amsterdam Dividend Stocks Yielding Up To 9.9%

Amidst a backdrop of global economic uncertainties and fluctuating markets, the Euronext Amsterdam has shown resilience, with defensive sectors like utilities and consumer staples holding up better. In this environment, dividend stocks can offer a reliable income stream and potential for capital appreciation. A good dividend stock typically combines consistent earnings with a strong balance sheet, making it well-suited for weathering economic volatility. Here are three Euronext Amsterdam dividend stocks yielding up to 9.9% that could be worth considering in today's market conditions.

Top 5 Dividend Stocks In The Netherlands

Name | Dividend Yield | Dividend Rating |

Koninklijke Heijmans (ENXTAM:HEIJM) | 3.88% | ★★★★☆☆ |

Aalberts (ENXTAM:AALB) | 3.37% | ★★★★☆☆ |

Randstad (ENXTAM:RAND) | 5.51% | ★★★★☆☆ |

ABN AMRO Bank (ENXTAM:ABN) | 9.92% | ★★★★☆☆ |

Signify (ENXTAM:LIGHT) | 7.65% | ★★★★☆☆ |

ING Groep (ENXTAM:INGA) | 6.89% | ★★★★☆☆ |

Acomo (ENXTAM:ACOMO) | 6.71% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

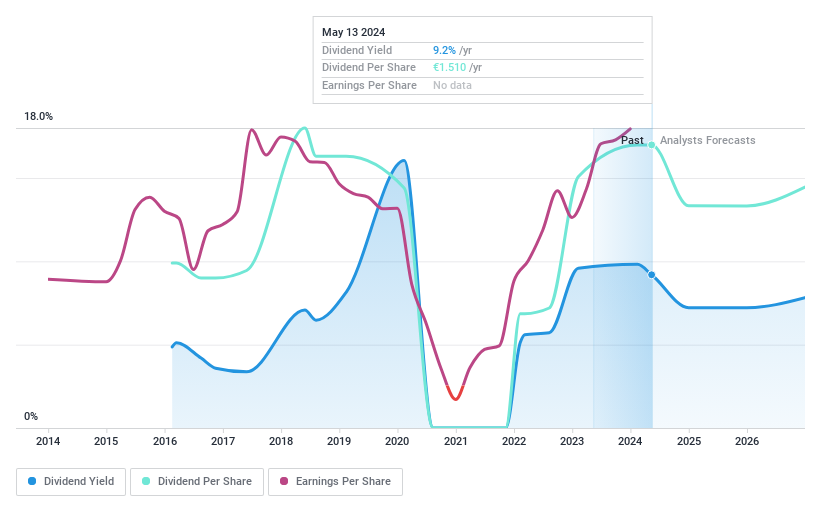

ABN AMRO Bank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a range of banking products and financial services to retail, private, and business clients both in the Netherlands and internationally, with a market cap of €12.67 billion.

Operations: ABN AMRO Bank N.V.'s revenue is primarily derived from Personal & Business Banking (€4.02 billion), Corporate Banking (€3.46 billion), and Wealth Management (€1.55 billion).

Dividend Yield: 9.9%

ABN AMRO Bank's dividend payments have been volatile over the past nine years, but they are currently covered by earnings with a payout ratio of 50.5%. The interim dividend was recently set at €0.60 per share, totaling €500 million. Despite a slight decline in net income to €1.32 billion for H1 2024, the bank maintains a strong position among Dutch dividend payers with its yield in the top 25%.

Acomo

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Acomo N.V., with a market cap of €507.65 million, is involved in sourcing, trading, processing, packaging, and distributing conventional and organic food ingredients and solutions for the food and beverage industry across the Netherlands, other European countries, North America, and internationally.

Operations: Acomo N.V. generates revenue from various segments, including Tea (€124.04 million), Edible Seeds (€246.52 million), Food Solutions (€23.47 million), Spices and Nuts (€445.76 million), and Organic Ingredients (€429.28 million).

Dividend Yield: 6.7%

Acomo's dividend yield of 6.71% is among the top 25% in the Dutch market, but its high payout ratio of 95.7% raises concerns about sustainability. Despite reasonable cash flow coverage (51%), earnings are insufficient to cover dividends. Recent earnings showed a slight decrease in net income to €17.94 million for H1 2024, with basic EPS dropping to €0.61 from €0.75 year-on-year, highlighting potential volatility and reliability issues in future payouts.

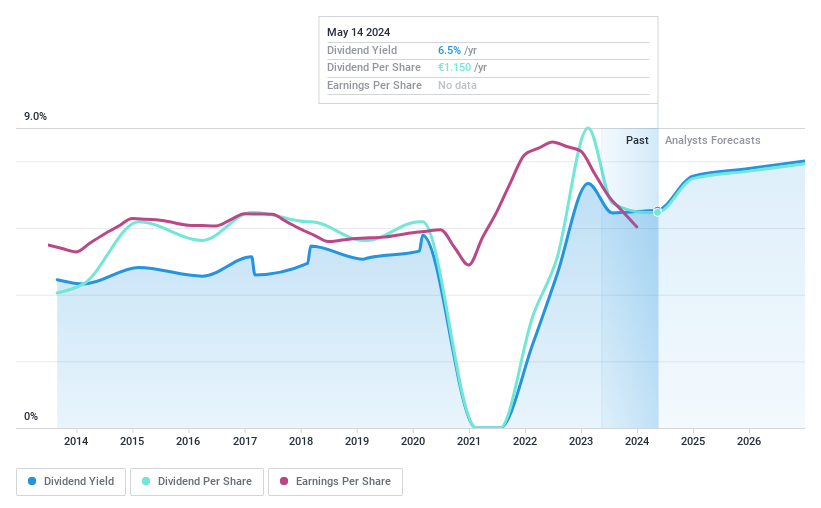

ING Groep

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ING Groep N.V. offers a range of banking products and services across the Netherlands, Belgium, Germany, other parts of Europe, and internationally with a market cap of approximately €50.98 billion.

Operations: ING Groep N.V.'s revenue segments include Retail Banking in the Netherlands (€4.97 billion), Belgium (€2.61 billion), and Germany (€2.97 billion), as well as Wholesale Banking (€6.69 billion) and Corporate Line Banking (€334 million).

Dividend Yield: 6.9%

ING Groep's dividend yield of 6.89% is among the top 25% in the Dutch market, supported by a reasonable payout ratio of 69.8%. However, its dividend history has been unstable over the past nine years with periods of volatility. Recent earnings for Q2 2024 showed a decline in net income to €1.78 billion from €2.16 billion year-on-year, and ongoing share buybacks totaling €2.03 billion may impact future dividend sustainability.

Unlock comprehensive insights into our analysis of ING Groep stock in this dividend report.

Our valuation report here indicates ING Groep may be undervalued.

Turning Ideas Into Actions

Embark on your investment journey to our 7 Top Euronext Amsterdam Dividend Stocks selection here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:ABN ENXTAM:ACOMO and ENXTAM:INGA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com