3 Growth Stocks to Buy on a Dip

A quick look at the share price charts of Hexcel Corporation, Cognex Corporation and Owens-Corning suggests that all three stocks are seeing some sort of fundamental deterioration in their end markets. However, all three reported strong results, and their consensus analyst earnings estimates have gone up since the start of 2018. I think the share-price dips could be creating a good entry point for these growth stocks.

Growth companies

The following table shows analyst estimates for earnings per share, and as you can see, the next couple of years promise a lot of growth for each company:

Company | 2017 EPS | 2018 Est. EPS | 2019 Est. EPS | Growth, 2017-2019 |

|---|---|---|---|---|

Owens-Corning (NYSE: OC) | $4.40 | $5.76 | $6.69 | 52% |

Hexcel Corporation (NYSE: HXL) | $2.68 | $3.02 | $3.47 | 30% |

Cognex Corporation (NASDAQ: CGNX) | $1.22 | $1.42 | $1.85 | 28% |

Data source: Yahoo Finance.

Owens Corning

Roofing, insulation, and composites company Owens Corning has growth prospects from new housing construction and remodeling of existing roofs in a buoyant housing market. Meanwhile, margins in insulation should improve, as the industry finally looks set to recover from overcapacity caused by the slump in housing from the last recession.

The recent fourth-quarter earnings came in ahead of expectations and there's more growth to come. Management expects composites segment EBIT to improve by $20 million in 2018, driven by higher industrial production growth. Meanwhile, the margin improvement and better pricing environment for insulation are expected to generate a $150 million EBIT improvement in the segment.

Management didn't give a formal estimate for roofing -- it's very difficult to predict roofing demand, due to the uncertainty of hurricane season and its impact on roofing repair work. However, based on management's guidance for composites and insulation EBIT, and my calculations for roofing EBIT, Owens Corning is likely to generate double-digit growth in 2018 -- even if roofing EBIT declines as it may do in the model below.

Segment | 2016 EBIT | 2017 EBIT | 2018 Est. EBIT |

|---|---|---|---|

Roofing | $486 million | $535 million | $483 million to $541 million |

Composites | $264 million | $291 million | $311 million |

Insulation | $126 million | $177 million | $327 million |

Total | $876 million | $1.003 billion | $1.121 billion to $1.179 billion |

Growth | 33.1% | 14.5% | 11.8% to 17.5% |

Data sources: Company presentations and estimates; author's analysis.

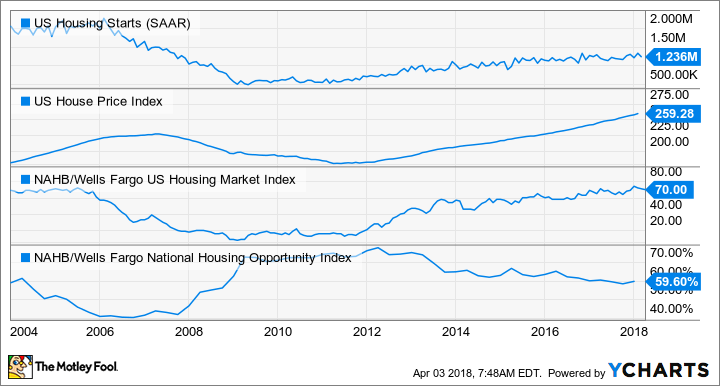

No worries from Housing

Rising interest rates are causing fear that the housing market will be choked off, leading to a drop in demand for new construction and remodeling work, in which insulation and roofing would suffer. However, a quick look at some major housing indicators suggests the market remains in good health.

Housing starts remain in growth mode, as do prices. Sentiment among home builders remains positive, while housing affordability is nowhere near the levels that preceded the slump in housing in 2006. Growth in the gross domestic product is improving, and unemployment is falling. Moreover, it's highly unlikely that the Federal Reserve will keep raising rates if the housing market falls into a funk. Simply put, a U.S. housing bust is unlikely right now.

U.S. Housing Starts data by YCharts.

Hexcel's growth potential

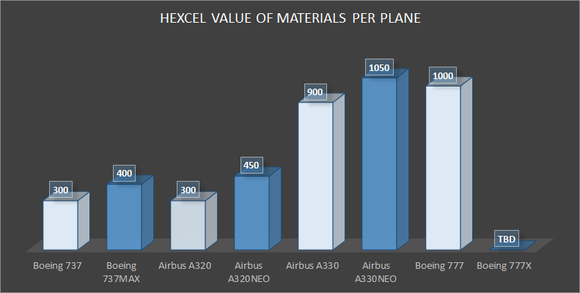

Advanced composite technology specialist Hexcel Corporation has strong long-term growth prospects from the increasing use of advanced composites in aircraft, multiyear backlogs at Airbus (NASDAQOTH: EADSY) and Boeing, and the possibility of a replacement cycle in widebody aircraft stimulated by Boeing's 777X.

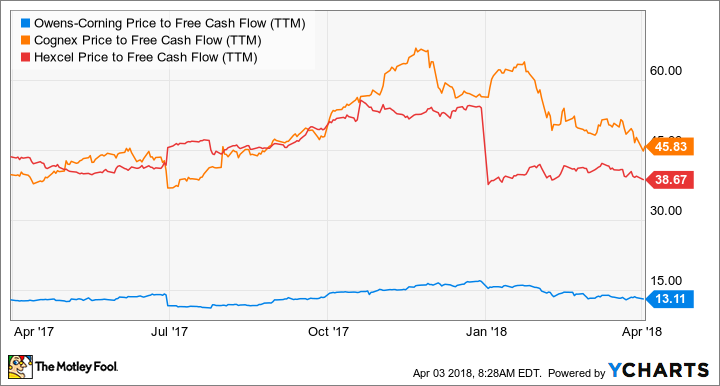

On a price-to-free-cash flow basis, Hexcel certainly doesn't look as cheap as Owens-Corning does, but free cash flow (FCF) is set to increase to $230 million in 2018 from $151 million last year. Revenue growth remains strong, and capital expenditures are dropping following a period of heavy investment.

OC Price to Free Cash Flow (TTM) data by YCharts.

Meanwhile, the announcement of a firm order from Emirates for 20 Airbus A380s, with an option to buy another 16, adds potential revenue for Hexcel. The A380 is a widebody aircraft that can generate $3 million in revenue for Hexcel and show that the company can win more orders.

Moreover, newer aircraft tend to have more graphite composites in them and therefore tend to generate more revenue for Hexcel. The chart below shows how the production of newer models leads to a step-up in revenue generation for Hexcel.

Data source: Hexcel Corporation. Thousands of U.S. dollars

As for the reason for the stock price falls? Aside from the general market weakness, the market is probably worried about the headline risk from slowing economic growth in air traffic. However, there isn't any evidence of a slowdown yet and air passenger growth remains strong. Hexcel remains attractive.

Cognex Corporation's prospects

Machine-vision company Cognex reported its best year ever in 2017, and the company continues to expand sales in key growth areas like logistics and consumer electronics. Cognex's logistics sales -- driven by retail and e-commerce fulfillment needs -- currently represent around 10% of revenue and are expected to grow at 50% per annum.

Meanwhile, its factory automation sales are expected to grow at 20% a year over the long term, boosted by consumer electronics companies (Apple is Cognex's largest customer) adopting machine vision in order to monitor and control automated production.

Another reason to like Cognex comes from its management's ability to expand the total addressable market for its products. Cognex has done a good job expanding sales into logistics and consumer electronics, and there's more growth to come in areas like handheld devices and airport baggage handling.

Turning to valuation, earlier in the year, Cognex looked expensive trading at 62 times current FCF, but now that the multiple has dropped to 45, I'd argue that it's approaching a decent value.

Image source: Getty Images.

The bottom line

Provided you don't believe that the housing market (Owens Corning), air passenger growth (Hexcel), or automation markets (Cognex) are going to slow down as a result of economic malaise, then I'd argue that all three are attractive stocks. Owens Corning is a very good value investment. Hexcel is attractive and offers long-term exposure to positive trends in aerospace. And Cognex's dip in stock price means the shares are approaching good value.

More From The Motley Fool

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends AAPL and Cognex. The Motley Fool has the following options: long January 2020 $150 calls on AAPL and short January 2020 $155 calls on AAPL. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance