3 Growth Stocks That Could Put Shopify's Returns to Shame

Any retail business worth its salt these days has to have an online presence. Whether it's a multibillion-dollar behemoth or an artisan craft shop on Main Street, a business that doesn't have an online presence is leaving gobs of money on the table. Shopify's (NYSE: SHOP) online retail platform makes it possible for any company of any size to have an online presence, and the stock's performance has been a reflection of the opportunity this business has.

After a 557% run-up in Shopify's stock price since its IPO, investors might start looking for other upstart companies that could turn in a repeat performance -- or an even better one. So we asked three Motley Fool investors to highlight a stock they see as one that could have the legs to outperform Shopify. Here's why they picked Baozun (NASDAQ: BZUN), Weibo (NASDAQ: WB), and SolarEdge Technologies (NASDAQ: SEDG).

Image source: Getty Images.

The Shopify of China?

Keith Noonan (Baozun): The Chinese e-commerce industry is booming, with sales climbing 32% year over year in 2017 and 35% year over year in the first quarter of 2018. That points to a big opportunity for investors.

Baozun is a company that provides businesses with customized online stores, marketing services, warehousing, distribution, and customer management. With those characteristics, it makes sense that the company is sometimes referred to as "the Shopify of China." There's certainly some overlap in the offerings and objectives of the two e-commerce platform providers. But it's also worth looking at some differences to see why Baozun might be poised to outperform Shopify over the long term.

The Chinese e-commerce market registered $1.15 trillion in sales last year, while online shopping in the U.S. grew 16% year over year to reach a gross volume of $453.5 billion. While Shopify currently derives most of its business from serving small-and-medium enterprises (SMEs), Baozun deals almost exclusively with large Western brands that are looking to build their position in China's high-growth e-commerce market. Right now, Baozun is focused on this mission, but it's also signaled that it could be devoting more effort to offering online-sales platforms for small businesses.

While both companies are still focusing on expanding their respective businesses at the expense of operating margins, Baozun is actually already consistently profitable and trades at roughly 47 times this year's expected earnings. Baozun's earnings will continue to be tamped down as the company invests to improve its offerings and build its customer base. But there's also a positive earnings catalyst at work as the e-commerce provider shifts away from its distribution-based business in favor of its higher-margin software and services segment.

Both companies look to have plenty of opportunities ahead, but with Baozun operating in the higher-growth Chinese market and trading at lower earnings and sales multiples, I think it can outperform Shopify.

Growing faster than Shopify, and more profitably

Rich Smith (Weibo Corporation): Since Shopify went public just a little more than three years ago, its shares have gained just over 550%. This is despite the fact that the company's losses are increasing, its cash flow is shrinking, and its rate of sales growth -- although impressive with 270% more sales recorded over the last 12 months than Shopify booked in 2015 -- is slowing. Sales growth, which hit 95% in the year of Shopify's IPO, slowed to 90% in 2016, then to 73% in 2017.

So where can you find a stock with the potential to outperform Shopify?

How about a stock that's accelerating its rate of sales growth, and growing sales profitably to boot? How about a stock like China's Weibo Corporation?

Often referred to as "the Chinese Twitter," Weibo's high-tech business model is just as asset-light as Shopify's. (In fact, the two companies' capital spending last year was almost identical.) Yet unlike Shopify, which reported $40 million in losses and burned more than $12 million in cash last year, Weibo reported profits of $352 million -- and free cash flow of $519 million!

On top of that, Weibo showed 75% sales growth in 2017, compared to 2016. And unlike Shopify, Weibo had sales growth last year that was better than the year before, roughly doubling from the 37% growth experienced in 2016. Given my druthers, I'd pick profitable Weibo over unprofitable Shopify any day of the week.

Growing faster than Shopify where it really matters

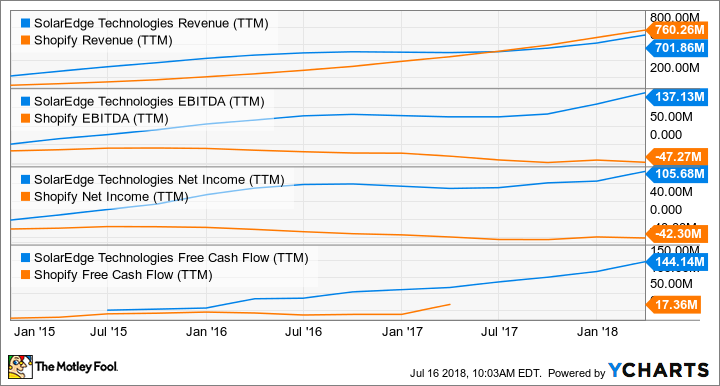

Tyler Crowe (SolarEdge Technologies): Shopify and solar power component manufacturer SolarEdge went public within a couple of months of each other in 2015. While Shopify's stock has so far been the better performer, SolarEdge's business has done better by just about every financial metric.

SEDG revenue data by YCharts. TTM = trailing 12 months.

SolarEdge Technologies manufactures crucial components for residential and commercial-scale solar power installations: inverters and power optimizers. These components translate the power from direct current (like that from a battery) to alternating current (what you find in a socket in your house). Components like these are typically commodity products, but SolarEdge has carved out a niche with components designed to allow optimization and monitoring of each individual panel at scale, which makes for a more efficient system and can deliver a lower cost per watt of installed capacity. This has translated into high-margin sales that have grown 58% annually over the past five years, and it now manufactures 42% of all residential inverters in the U.S.

Maintaining its position as a top manufacturer isn't going to be easy. Solar panels and components are notoriously commoditized products. However, the company continues to innovate to improve efficiency and lower the cost per watt of installed capacity. If it can maintain this position, then there is a path for the company to grow immensely over the next several years, and churn out hefty returns for investors.

More From The Motley Fool

Keith Noonan owns shares of Baozun. Rich Smith owns shares of Baozun, Shopify, and SolarEdge Technologies. Tyler Crowe owns shares of SolarEdge Technologies. The Motley Fool owns shares of and recommends Baozun and Shopify. The Motley Fool recommends Weibo. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance