3 Growth Stocks for Forward-Looking Investors

None of us has a crystal ball, but when it comes to investing success, one of the most important -- and often most difficult -- things to do is to identify companies that have a clear path of success. If you're able to identify enough of these kinds of companies, the ones that you get right will more than make up for the ones that don't do so well.

With the idea that finding more than one company with a solid path to growth ahead of it enhances our odds of investing success, we asked three of our contributing investors to discuss a stock with solid forward-looking growth prospects. They gave us a homebuilder focusing on a huge growth market in Meritage Homes Corp. (NYSE: MTH), an engine giant that's making the transition to the future in Cummins Inc. (NYSE: CMI), and a tech giant with a long history of changing with the times in International Business Machines Corp. (NYSE: IBM).

Image source: Getty Images.

Supplying the houses where demand is growing

Jason Hall (Meritage Homes Corp.): After years of minimal activity, millennials are starting to buy homes. But there's a problem: There aren't enough entry-level houses to meet demand.

According to the National Association of Realtors (NAR), first-time buyers made up 29% of existing home sales in September, down from 34% last year. NAR chief economist Lawrence Yun said that "the primary impediments stifling sales growth are the same as they have been all year: not enough listings -- especially at the lower end of the market -- and fast-rising prices that are straining the budgets of prospective buyers."

Millennials want to buy houses. Meritage is helping meet that demand. Image source: Getty Images.

Meritage Homes is seizing this opportunity. Over the past year, Meritage has implemented a strategy of building more entry-level homes, a move that's started to pay off. The homebuilder reported 9.4% revenue and 16% earnings-per-share growth last quarter as its mix of starter homes increases.

Not only is there strong demand, entry-level houses often sell for higher margins than more custom, higher-end houses, a key behind Meritage's increased profits. Management is accelerating this focus, with plans to develop 70% of its recent land purchases as starter communities. Forward-looking investors could do very well to own Meritage over the next decade, as millennials more fully enter the housing market and drive Meritage's profits up along the way.

This stock is revving up its growth engines

Neha Chamaria (Cummins): Cummins has already established itself as a leading global engine manufacturer, but it's the company's latest innovation that positions it for tremendous growth in the coming years.

Cummins bears were all charged up after Tesla announced an electric semi-truck some months ago. Not one to put its innovative leadership crown at stake, Cummins soon unveiled its own electric heavy-duty Class 7 semi-truck cab prototype, dubbed the AEOS. Cummins stepped up its game further by acquiring electric drivetrain manufacturer Brammo last month.

Now, here's the thing: Electric trucks could still be years away from hitting the mainstream, but when they do, Cummins is likely to be a key player. Meanwhile, the company already dominates the diesel and natural-gas engine markets and is known to be among the front-runners in launching engines that conform to emission norms as they evolve. In other words, Cummins is unlikely to run out of steam as long as trucks remain a key mode of transportation.

Cummins just delivered a solid set of third-quarter numbers and continues to boast one of the strongest balance sheets in the industry. With an incredible track record of double-digit returns on equity and invested capital to boot, Cummins makes for an ideal growth stock for forward-looking investors today.

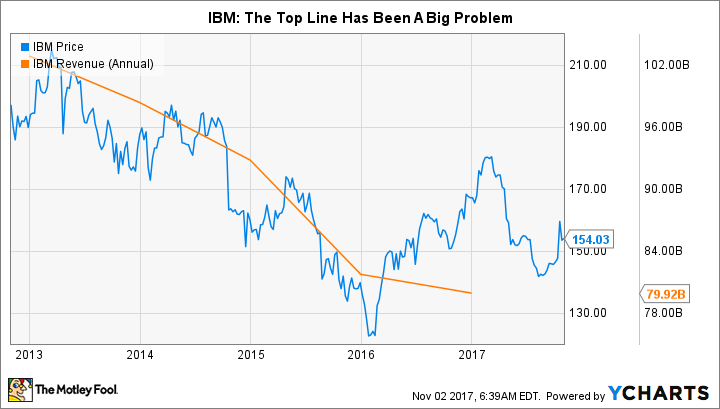

It's all about the future with Big Blue

Reuben Gregg Brewer (International Business Machines Corp.): IBM has been a tough stock to love for a long time. Sales have declined each quarter on a year-over-year basis for more than five years. The reason is a corporate makeover that's steadily -- if slowly -- shifting IBM out of lower-margin businesses such as making computers and into higher growth opportunities such as cloud computing, artificial intelligence (AI), and security.

But it looks as if the tide may be starting to turn. In the most recent quarter, sales were lower by less than 1%, effectively flat. And the company's new businesses are getting very close to 50% of revenue, which will be a key turning point for IBM's business. In other words, a return to top-line growth could be very close at hand. No wonder investors reacted so positively to IBM's third-quarter earnings announcement.

If you're a forward-looking investor who can see past the recent troubles to envision a brighter future ahead, IBM and its 3.9% dividend yield might be a good option for you. But there's a little more here than financials: IBM is working on technology that's expected to drive the future. Not only today, through applications such as Watson (AI) and blockchain, but also years from now, through research in quantum computing, among other things.

IBM, for all its faults, is still a leading researcher -- the business improvement is nice, but a big breakthrough on research side of the business could really change investor perceptions for the better.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Jason Hall owns shares of Meritage Homes. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer owns shares of IBM. The Motley Fool owns shares of and recommends Cummins. The Motley Fool recommends Meritage Homes. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance