3 High Insider Ownership Companies With Minimum 24% Earnings Growth

Amidst a cautiously optimistic global backdrop, the Indian stock market has demonstrated resilience with modest gains, reflecting investor sentiment influenced by international economic cues and domestic monetary policies. In such a market environment, growth companies with high insider ownership can be compelling as they often signal confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Growth Rating |

Archean Chemical Industries (NSEI:ACI) | 22.9% | ★★★★★★ |

Pitti Engineering (BSE:513519) | 33.6% | ★★★★★★ |

Triveni Turbine (BSE:533655) | 28.6% | ★★★★★★ |

Rajratan Global Wire (BSE:517522) | 19.8% | ★★★★★★ |

Jupiter Wagons (NSEI:JWL) | 11.1% | ★★★★★★ |

Dixon Technologies (India) (NSEI:DIXON) | 25% | ★★★★★★ |

Paisalo Digital (BSE:532900) | 16.3% | ★★★★★★ |

MTAR Technologies (NSEI:MTARTECH) | 38.4% | ★★★★★★ |

Steel Strips Wheels (BSE:513262) | 35.9% | ★★★★★☆ |

Aether Industries (NSEI:AETHER) | 31.1% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

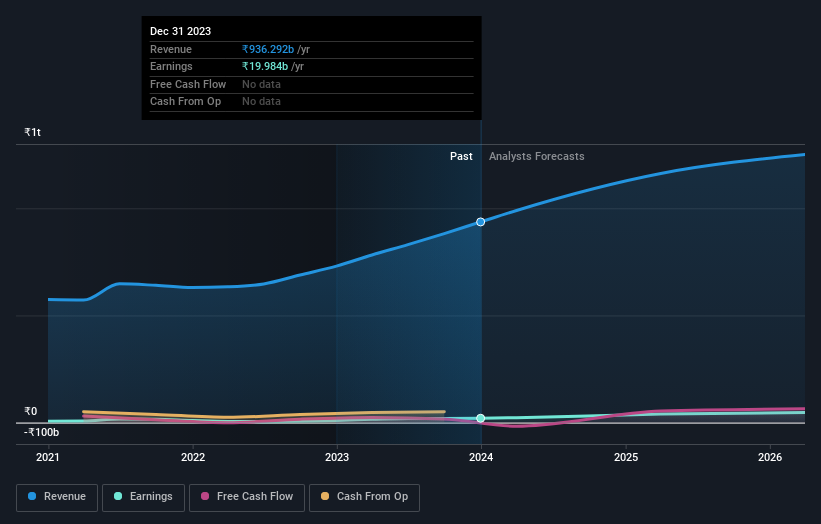

Samvardhana Motherson International

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Samvardhana Motherson International Limited manufactures and sells automotive components for original equipment manufacturers both in India and globally, with a market capitalization of approximately ₹881.95 billion.

Operations: The company's revenue is derived from Vision Systems (₹187.06 billion), Wiring Harness (₹308.01 billion), Emerging Businesses (₹76.16 billion), and Modules and Polymer Products (₹483.23 billion).

Insider Ownership: 14.1%

Earnings Growth Forecast: 39.3% p.a.

Samvardhana Motherson International, a key player in the automotive components industry, is actively expanding through strategic initiatives like the incorporation of a new wholly-owned subsidiary for leasing activities. Despite recent executive changes and the dilution of stakes by Sumitomo Wiring Systems, which is reducing its ownership below 10%, Samvardhana Motherson continues to show robust financial performance with significant earnings growth over the past year. However, it maintains a high level of debt and an unstable dividend track record, posing challenges amidst its growth trajectory.

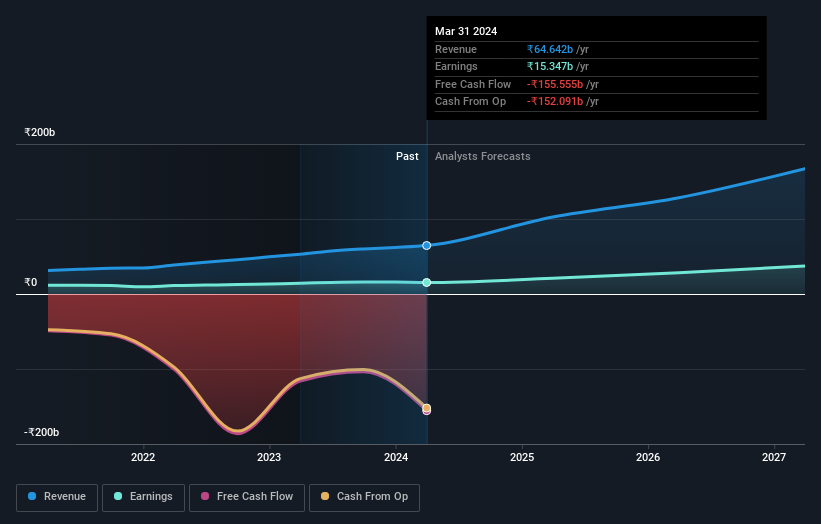

AU Small Finance Bank

Simply Wall St Growth Rating: ★★★★★☆

Overview: AU Small Finance Bank Limited offers a range of banking and financial services across India, with a market capitalization of approximately ₹479.29 billion.

Operations: The bank's revenue is generated from three main segments: Treasury (₹17.04 billion), Retail Banking (₹91.18 billion), and Wholesale Banking (₹11.61 billion).

Insider Ownership: 24.3%

Earnings Growth Forecast: 24.3% p.a.

AU Small Finance Bank, a notable entity in India's financial sector, has demonstrated substantial growth with a 24.9% annual increase in revenue and 24.3% in earnings forecasted to outpace the Indian market significantly. Despite recent underperformance in Q4 earnings compared to last year, the bank maintains a competitive edge with a lower Price-To-Earnings ratio than the market average. Insider activities have been moderate without substantial buying or selling over the past three months, indicating stable insider confidence amidst ongoing corporate developments including leadership changes and strategic mergers like that with Fincare SFB.

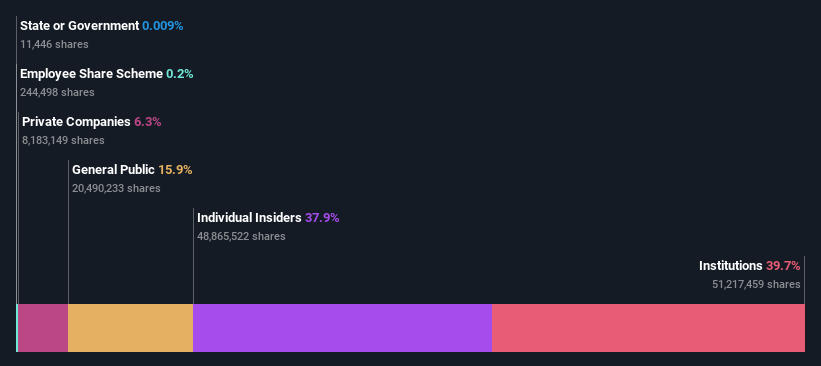

Info Edge (India)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Info Edge (India) Limited, with a market cap of approximately ₹781.98 billion, operates as an online classifieds company in India and internationally, focusing on recruitment, matrimony, real estate, and education sectors.

Operations: The company generates revenue primarily from Recruitment Solutions (₹18.59 billion) and 99acres for Real Estate (₹3.34 billion).

Insider Ownership: 37.9%

Earnings Growth Forecast: 33.5% p.a.

Info Edge (India) Limited, while showing a promising 33.5% annual earnings growth forecast, surpasses the Indian market's average. However, its revenue growth at 11.7% annually is modest compared to high-growth benchmarks and is coupled with significant insider selling recently, raising concerns about insider confidence in the company's trajectory. Additionally, recent leadership changes with Kapil Chaudhary's appointment as General Counsel may influence future strategic directions amidst fluctuating profit margins and one-off financial impacts affecting earnings quality.

Dive into the specifics of Info Edge (India) here with our thorough growth forecast report.

Our valuation report here indicates Info Edge (India) may be overvalued.

Taking Advantage

Dive into all 87 of the Fast Growing Companies With High Insider Ownership we have identified here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities.

Companies discussed in this article include BSE:517334NSEI:AUBANKNSEI:NAUKRI and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance