3 High Insider Ownership Growth Companies On Chinese Exchange With Up To 117% Earnings Growth

Amidst a mixed performance in global markets, China's stock indices have shown varied responses to recent economic stimuli, particularly in sectors like real estate which are beginning to show signs of recovery. In such an environment, growth companies with high insider ownership on Chinese exchanges present a unique interest due to their potential alignment of management and shareholder interests, possibly enhancing resilience and long-term value creation in these uncertain times.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 24.5% |

Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.4% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Eoptolink Technology (SZSE:300502) | 26.7% | 39.4% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

Fujian Wanchen Biotechnology Group (SZSE:300972) | 15.3% | 75.9% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

Offcn Education Technology (SZSE:002607) | 26.1% | 65.3% |

Here we highlight a subset of our preferred stocks from the screener.

Guizhou Bailing Group Pharmaceutical

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guizhou Bailing Group Pharmaceutical Co., Ltd. is a company that operates in the pharmaceutical industry with a market capitalization of approximately CN¥5.11 billion.

Operations: The company generates revenue from various pharmaceutical products.

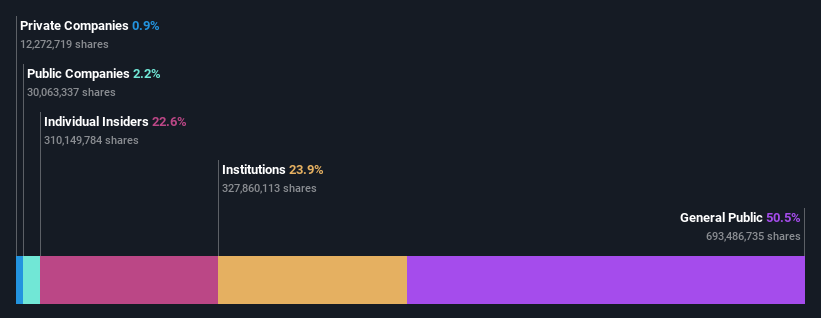

Insider Ownership: 22.6%

Earnings Growth Forecast: 118% p.a.

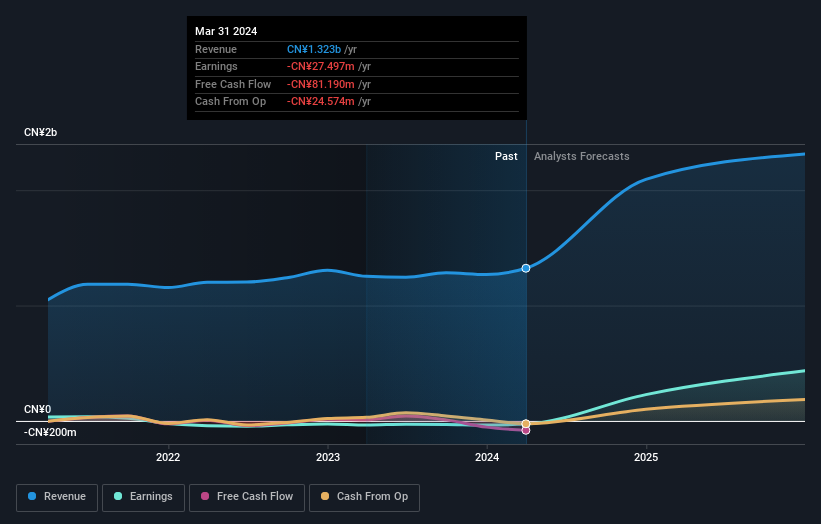

Guizhou Bailing Group Pharmaceutical, despite recent drops from major indices like the FTSE All-World and S&P Global BMI, shows promising financial indicators. The company's revenue increased to CNY 1.33 billion in Q1 2024, up from CNY 1.09 billion year-over-year, although net income declined to CNY 51.7 million from CNY 92.31 million. Forecasted revenue growth at a robust rate of 20.5% per year outpaces the Chinese market average of 13.9%, with expectations of profitability within three years reflecting potential in a competitive sector.

Xiamen Wanli Stone StockLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xiamen Wanli Stone Stock Co., Ltd. operates in the development, processing, and installation of stone products and handicrafts, serving markets in China, Japan, South Korea, the United States, and internationally with a market capitalization of approximately CN¥5.60 billion.

Operations: The company generates revenue from the development, processing, and installation of stone products and handicrafts across various international markets.

Insider Ownership: 18.9%

Earnings Growth Forecast: 113.3% p.a.

Xiamen Wanli Stone Stock Co., Ltd. has shown a significant turnaround, reporting a net income of CNY 4.35 million in Q1 2024 after a net loss the previous year, with revenue rising to CNY 272.4 million from CNY 217.9 million. The company is forecasted to achieve profitability within three years, with expected revenue growth at an impressive rate of 28.6% per year, well above the market average. These indicators suggest strong potential despite past challenges and no substantial insider trading activity recently reported.

Wens Foodstuff Group

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wens Foodstuff Group Co., Ltd., a leading livestock and poultry farming company in China, has a market capitalization of approximately CN¥143.44 billion.

Operations: The company generates its revenue primarily from livestock and poultry farming in China.

Insider Ownership: 32.4%

Earnings Growth Forecast: 76% p.a.

Wens Foodstuff Group is expected to achieve profitability within the next three years, with earnings growth forecasted at a robust rate annually. The company's revenue growth of 14.3% per year is slightly above China's market average. Despite high levels of debt, its return on equity is anticipated to be strong in three years' time. Recent financial reports show improvement as net losses have decreased significantly compared to the previous year, reflecting potential recovery and growth despite a recent dividend cut.

Summing It All Up

Investigate our full lineup of 398 Fast Growing Chinese Companies With High Insider Ownership right here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SZSE:002424 SZSE:002785 and SZSE:300498.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance