3 High-Yield Dividend Stocks On Euronext Paris With Up To 7.0% Yield

Amidst a backdrop of rising inflation and economic uncertainty across Europe, the French stock market, as reflected by the CAC 40 Index, has experienced notable fluctuations. In such a climate, high-yield dividend stocks on Euronext Paris may offer investors potential resilience and steady income streams.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Rubis (ENXTPA:RUI) | 6.00% | ★★★★★★ |

Samse (ENXTPA:SAMS) | 8.40% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.32% | ★★★★★★ |

Fleury Michon (ENXTPA:ALFLE) | 5.37% | ★★★★★☆ |

Métropole Télévision (ENXTPA:MMT) | 9.18% | ★★★★★☆ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 3.83% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 3.87% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.17% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 3.87% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 7.09% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top Euronext Paris Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

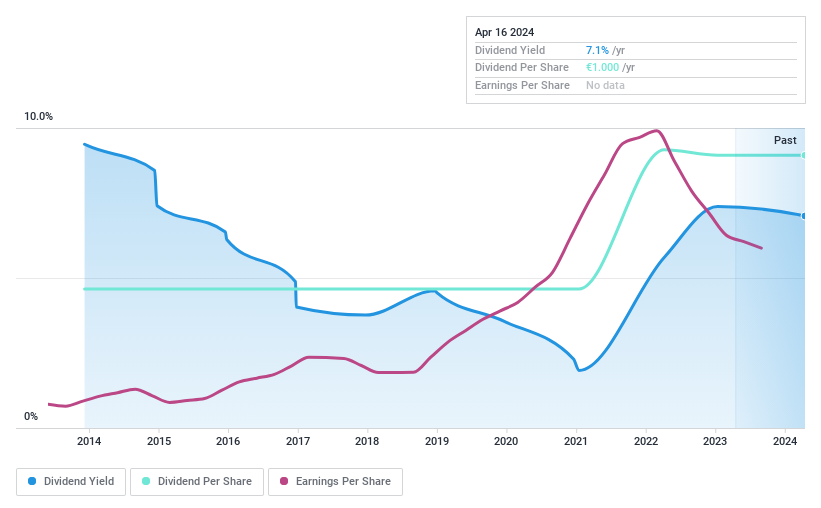

Piscines Desjoyaux

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Piscines Desjoyaux SA is a company based in France that specializes in the design, manufacture, and marketing of swimming pools and related products globally, with a market capitalization of approximately €126.54 million.

Operations: Piscines Desjoyaux SA generates €138.65 million from its swimming pools segment and €0.09 million from real estate.

Dividend Yield: 7.1%

Piscines Desjoyaux offers a compelling 7.09% dividend yield, ranking in the top 25% of French dividend payers. Over the past decade, dividends have shown consistent growth and stability with a reliable payout pattern. The company's payout ratio stands at 55.6%, ensuring dividends are well-covered by earnings despite insufficient data on coverage by cash flows or free cash flow calculations. Additionally, its Price-To-Earnings ratio of 7.8x is attractive compared to the broader French market average of 17.1x.

Take a closer look at Piscines Desjoyaux's potential here in our dividend report.

Our valuation report here indicates Piscines Desjoyaux may be overvalued.

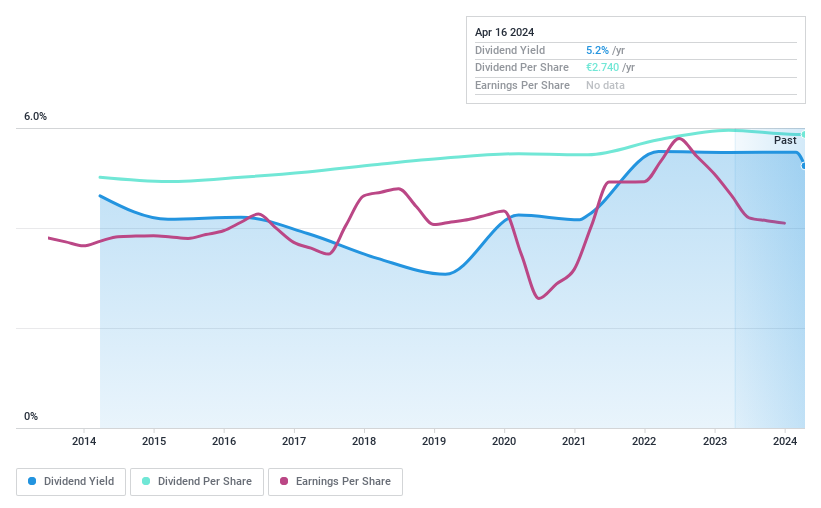

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a range of banking products and services to a diverse clientele in France, with a market capitalization of €1.07 billion.

Operations: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative generates €505.07 million from its retail banking operations in France.

Dividend Yield: 5.1%

Caisse Régionale de Crédit Agricole Mutuel du Languedoc offers a stable dividend yield of 5.08%, slightly below the top quartile for French stocks. Over the past decade, dividends have not only been reliable but also showed growth, supported by a sustainable payout ratio of 30.9%. Despite trading at 60.2% below its estimated fair value, data on long-term dividend coverage remains unclear. Recently, it announced an ex-dividend date for a €2.74 cash payment due in April 2024.

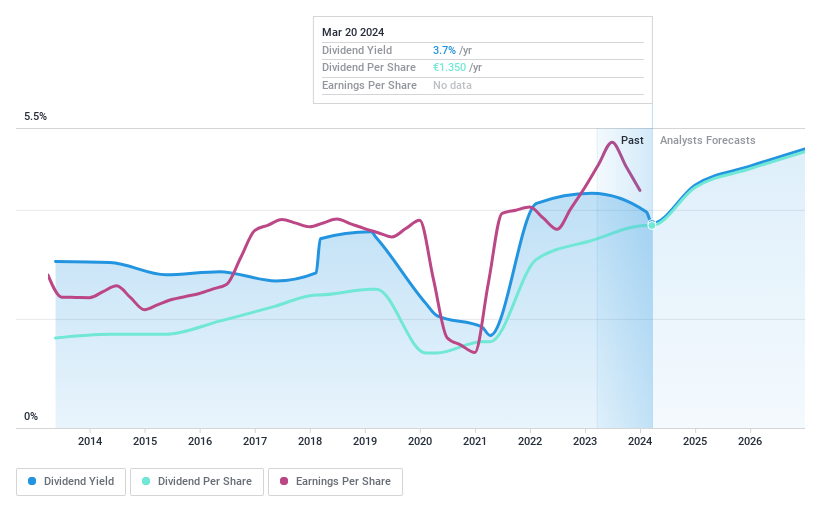

Compagnie Générale des Établissements Michelin Société en commandite par actions

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Compagnie Générale des Établissements Michelin Société en commandite par actions, operating globally, primarily manufactures and sells tires with a market capitalization of approximately €26.48 billion.

Operations: Compagnie Générale des Établissements Michelin Société en commandite par actions generates €14.34 billion in revenue from its Automotive and Related Distribution, €6.98 billion from Road Transportation and Related Distribution, and €7.03 billion from Specialty Businesses and Related Distribution.

Dividend Yield: 3.6%

Compagnie Générale des Établissements Michelin recently completed two fixed-income offerings totaling nearly €1 billion, strengthening its financial position. Despite a low dividend yield of 3.64% compared to the French market's top quartile, Michelin maintains a sustainable payout with coverage from both earnings and cash flows (payout ratio: 48.7%, cash payout ratio: 31.6%). However, its dividend track record over the past decade has been unstable and unreliable, reflecting some volatility in payments despite overall growth in dividends during this period.

Next Steps

Click here to access our complete index of 33 Top Euronext Paris Dividend Stocks.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:ALPDXENXTPA:CRLAENXTPA:ML and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance