3 High Yield Dividend Stocks Offering Up To 6.4%

The United States stock market has shown robust performance, rising 1.3% over the last week and achieving a 21% increase over the past year, with earnings expected to grow by 15% annually. In this thriving market environment, high-yield dividend stocks stand out as particularly appealing for investors seeking both growth and income stability.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.80% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.20% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.96% | ★★★★★★ |

Regions Financial (NYSE:RF) | 5.28% | ★★★★★★ |

Huntington Bancshares (NasdaqGS:HBAN) | 5.02% | ★★★★★★ |

Dillard's (NYSE:DDS) | 5.02% | ★★★★★★ |

Citizens Financial Group (NYSE:CFG) | 4.95% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 5.05% | ★★★★★★ |

Ennis (NYSE:EBF) | 4.79% | ★★★★★★ |

Peoples Bancorp (NasdaqGS:PEBO) | 5.62% | ★★★★★☆ |

Click here to see the full list of 211 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

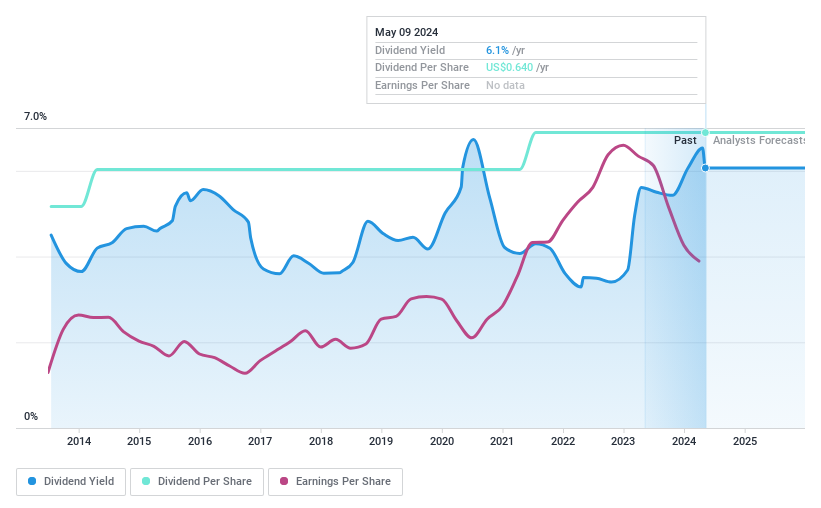

BCB Bancorp

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BCB Bancorp, Inc., a bank holding company for BCB Community Bank, offers banking products and services to businesses and individuals in the United States, with a market capitalization of approximately $166.35 million.

Operations: BCB Bancorp, Inc. generates its revenue primarily through its banking segment, which amounted to $100.03 million.

Dividend Yield: 6.4%

BCB Bancorp maintains a consistent dividend payment history, recently declaring a quarterly cash dividend of US$0.16 per share, payable on May 17, 2024. Despite a challenging quarter with net interest income and net income falling to US$23.14 million and US$5.87 million respectively, the company's dividends appear sustainable given its low payout ratio of 41.1%. Additionally, BCB Bancorp's stock trades at 63.8% below estimated fair value, suggesting potential undervaluation relative to intrinsic worth.

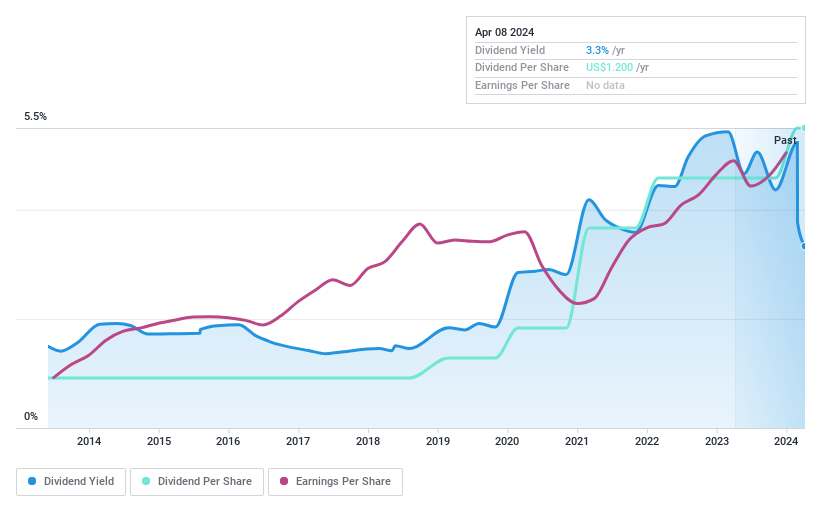

CompX International

Simply Wall St Dividend Rating: ★★★★★★

Overview: CompX International Inc., primarily operating in North America, focuses on manufacturing and selling security products and recreational marine components, with a market capitalization of approximately $283.96 million.

Operations: CompX International Inc. generates revenue through two main segments: marine components, which brought in $34.38 million, and security products, accounting for $123.73 million.

Dividend Yield: 5.1%

CompX International maintains a steady dividend, recently affirming a quarterly payout of US$0.30 per share. Despite a dip in Q1 sales to US$37.97 million and net income to US$3.75 million from the previous year, the company's dividends are well-supported by a 63.8% earnings payout ratio and 63.5% cash flow payout ratio, indicating financial prudence in dividend management. Its stock price has shown volatility recently but offers an attractive yield of 5.05%, ranking it among the top U.S dividend payers.

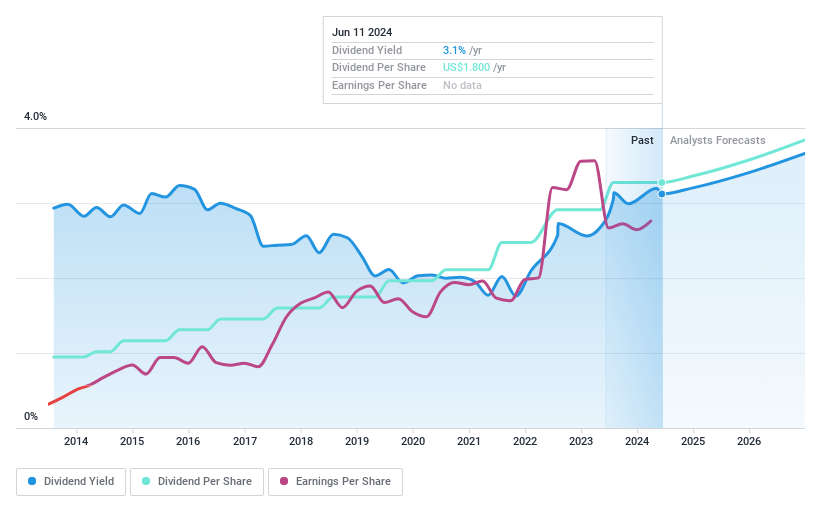

Terreno Realty

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Terreno Realty Corporation acquires, owns, and operates industrial real estate in six major coastal U.S. cities with a market cap of approximately $5.46 billion.

Operations: Terreno Realty Corporation generates revenue primarily through its real estate investments, totaling approximately $334 million.

Dividend Yield: 3.1%

Terreno Realty has recently expanded its board and industrial property portfolio, enhancing its strategic position. The company declared a stable quarterly dividend of US$0.45 per share, maintaining a consistent payout amidst growth. With recent acquisitions and developments like the Countyline Corporate Park, Terreno shows robust operational expansion but faces challenges with lower profit margins year-over-year. Its dividends are well-covered by earnings with a 73.8% payout ratio, though cash flow coverage is tighter at 92.6%, indicating potential pressure on payouts if not managed carefully.

Unlock comprehensive insights into our analysis of Terreno Realty stock in this dividend report.

Our valuation report here indicates Terreno Realty may be overvalued.

Summing It All Up

Reveal the 211 hidden gems among our Top Dividend Stocks screener with a single click here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGM:BCBP NYSEAM:CIX and NYSE:TRNO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance