3 High Yield Dividend Stocks On TSX With Yields Up To 8.6%

As global markets navigate through evolving economic landscapes, the Canadian market remains a focal point for investors seeking stability and growth amidst technological advancements and shifting sector dynamics. With diversification emerging as a key strategy in response to broadening market leadership, high-yield dividend stocks on the TSX present an appealing option for those looking to enhance portfolio resilience and income in these dynamic times.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.68% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 6.90% | ★★★★★★ |

Secure Energy Services (TSX:SES) | 3.54% | ★★★★★☆ |

Power Corporation of Canada (TSX:POW) | 5.74% | ★★★★★☆ |

Enghouse Systems (TSX:ENGH) | 3.66% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.64% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.52% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.08% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.92% | ★★★★★☆ |

Sun Life Financial (TSX:SLF) | 4.80% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top TSX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

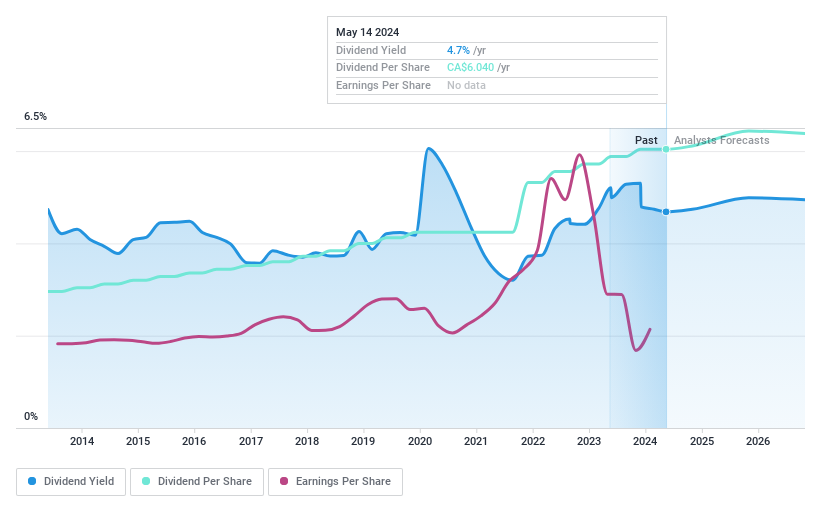

Bank of Montreal

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Montreal offers a range of financial services mainly in North America and has a market capitalization of approximately CA$95.60 billion.

Operations: Bank of Montreal generates revenue through several key segments: BMO Capital Markets with CA$6.33 billion, BMO Wealth Management at CA$7.57 billion, U.S. Personal and Commercial Banking contributing CA$9.40 billion, and Canadian Personal and Commercial Banking leading with CA$9.97 billion.

Dividend Yield: 5.1%

Bank of Montreal recently declared a modest increase in its quarterly dividend to CAD 1.55 per common share, reflecting a stable commitment to returning value to shareholders. The bank also reported significant year-over-year earnings growth for the first half of 2024, with net income rising sharply to CAD 3.16 billion. However, it's worth noting that despite these positive indicators, BMO's dividend yield remains relatively low compared to the top Canadian dividend payers. Additionally, recent financials show a dip in profit margins compared to the previous year and an increased payout ratio suggests careful monitoring is required for future sustainability.

Click here to discover the nuances of Bank of Montreal with our detailed analytical dividend report.

Our valuation report unveils the possibility Bank of Montreal's shares may be trading at a premium.

North West

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The North West Company Inc. operates as a retailer offering food and everyday products and services in northern Canada, rural Alaska, the South Pacific, and the Caribbean, with a market cap of CA$1.79 billion.

Operations: The North West Company Inc. generates CA$2.47 billion from its core operations in retailing food and everyday items across various remote regions.

Dividend Yield: 4.2%

North West Company has demonstrated a consistent ability to grow earnings, with a 5.9% increase over the past year and stable dividends for the last decade. Its dividend yield of 4.16% is below the top Canadian payers but remains attractive due to reliability and growth over time. The dividends are well-covered by both earnings, with a payout ratio of 56.8%, and cash flows at 82.8%. Recent financial results show continued revenue growth to CAD 2.47 billion and net income up to CAD 129.39 million, reinforcing its solid performance foundation despite trading at a significant discount to estimated fair value.

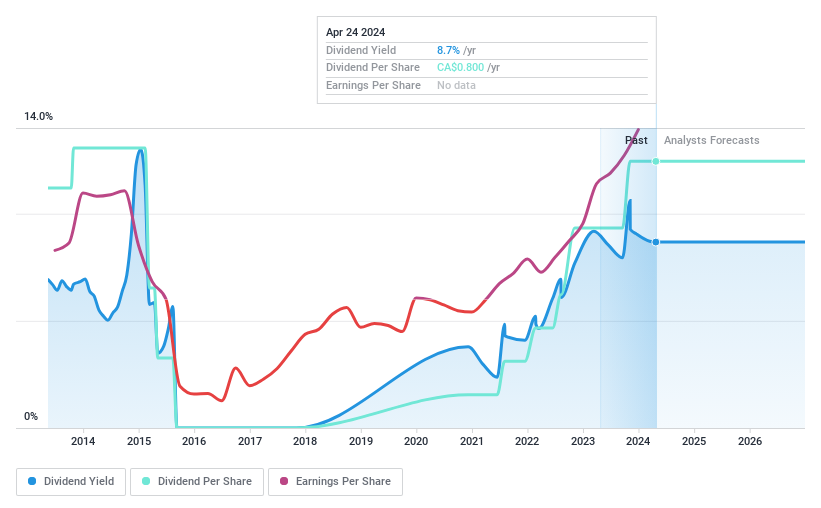

PHX Energy Services

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PHX Energy Services Corp. operates in the provision of horizontal and directional drilling services, rental of performance drilling motors, and sales of motor equipment and parts to oil and natural gas companies across Canada, the United States, Albania, the Middle East, and other global regions, with a market capitalization of approximately CA$439.26 million.

Operations: PHX Energy Services Corp. generates CA$656.44 million primarily from horizontal oil and natural gas well drilling services.

Dividend Yield: 8.6%

PHX Energy Services offers a dividend yield of 8.6%, ranking it among the top 25% of Canadian dividend payers. Despite this, its dividends have shown volatility over the past decade and are currently under pressure from both earnings and cash flow perspectives, with a payout ratio of 36.5% but a cash payout ratio at an unsustainable 139.1%. Recent financials indicate a slight increase in sales but a drop in net income year-over-year, suggesting potential challenges ahead in maintaining its dividend payouts without adjustments.

Get an in-depth perspective on PHX Energy Services' performance by reading our dividend report here.

Next Steps

Take a closer look at our Top TSX Dividend Stocks list of 31 companies by clicking here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:BMO TSX:NWC and TSX:PHX.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance