3 High Yield Dividend Stocks On KRX With Up To 5.8% Yield

The South Korean market has shown robust performance recently, rising 3.3% over the last week and achieving a 9.8% increase over the past year, with earnings expected to grow by 30% annually. In this context, high-yield dividend stocks can be particularly appealing for investors looking for both growth potential and steady income in a flourishing market environment.

Top 10 Dividend Stocks In South Korea

Name | Dividend Yield | Dividend Rating |

Kia (KOSE:A000270) | 4.59% | ★★★★★★ |

LOTTE Fine Chemical (KOSE:A004000) | 4.40% | ★★★★★☆ |

NH Investment & Securities (KOSE:A005940) | 6.27% | ★★★★★☆ |

Industrial Bank of Korea (KOSE:A024110) | 7.09% | ★★★★★☆ |

KT (KOSE:A030200) | 5.56% | ★★★★★☆ |

Shinhan Financial Group (KOSE:A055550) | 4.12% | ★★★★★☆ |

KB Financial Group (KOSE:A105560) | 3.66% | ★★★★★☆ |

Kyung Nong (KOSE:A002100) | 4.90% | ★★★★★☆ |

HANYANG ENGLtd (KOSDAQ:A045100) | 3.13% | ★★★★★☆ |

Cheil Worldwide (KOSE:A030000) | 6.11% | ★★★★☆☆ |

Click here to see the full list of 72 stocks from our Top KRX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

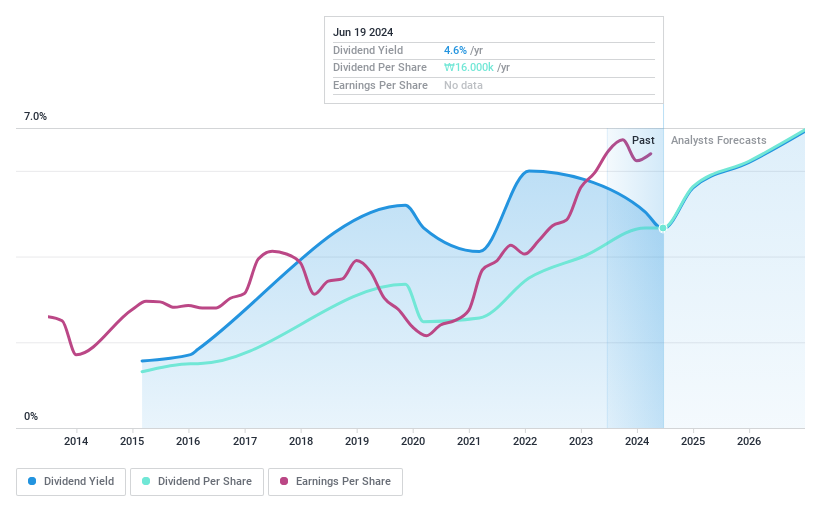

Samsung Fire & Marine Insurance

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samsung Fire & Marine Insurance Co., Ltd. operates in the provision of non-life insurance products and services both domestically in Korea and internationally, with a market capitalization of approximately ₩15.81 billion.

Operations: Samsung Fire & Marine Insurance Co., Ltd. generates its revenue primarily from the insurance business, which amounted to ₩18.57 billion.

Dividend Yield: 4.2%

Samsung Fire & Marine Insurance Co., Ltd. offers a dividend yield of 4.23%, ranking in the top 25% in the South Korean market. While dividends are covered by both earnings and cash flows, with payout ratios at 38.9% and 50.5% respectively, the company's dividend history is less stable, having experienced significant volatility over its nine-year dividend-paying period. Despite trading at a substantial discount to its estimated fair value (64.2% below), investors should note the unstable track record in dividend payments alongside forecasted annual earnings growth of 9.65%. Recent financials show an increase in net income to KRW 701 billion for Q1 2024 from KRW 611.8 billion a year prior, indicating positive momentum.

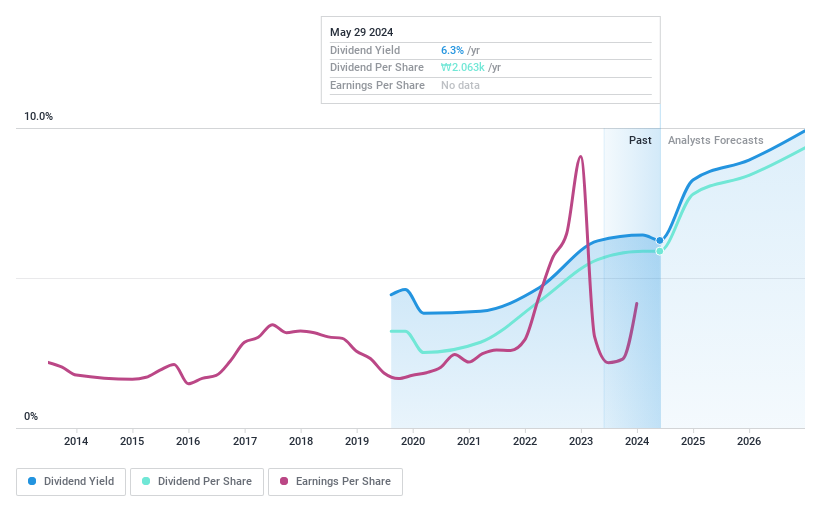

Hyundai Marine & Fire Insurance

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hyundai Marine & Fire Insurance Co., Ltd. is a South Korean company specializing in marine and fire insurance, with a market capitalization of approximately ₩2.74 trillion.

Operations: Hyundai Marine & Fire Insurance Co., Ltd. generates revenue primarily from the financial industry, contributing ₩1.36 billion, and a smaller segment in the non-financial industry at approximately ₩17.52 million.

Dividend Yield: 5.9%

Hyundai Marine & Fire Insurance Co., Ltd. has seen a significant rise in net income, reaching KRW 373.25 billion in Q1 2024, up from KRW 213.56 billion the previous year. Despite a short dividend history of five years with volatile payments, recent increases and low payout ratios (21.6% from earnings and 7.5% from cash flows) suggest improving sustainability. The stock trades at an attractive valuation, 87.5% below estimated fair value, yet concerns remain about its unstable dividend track record and lower profit margins year-over-year (5.2%).

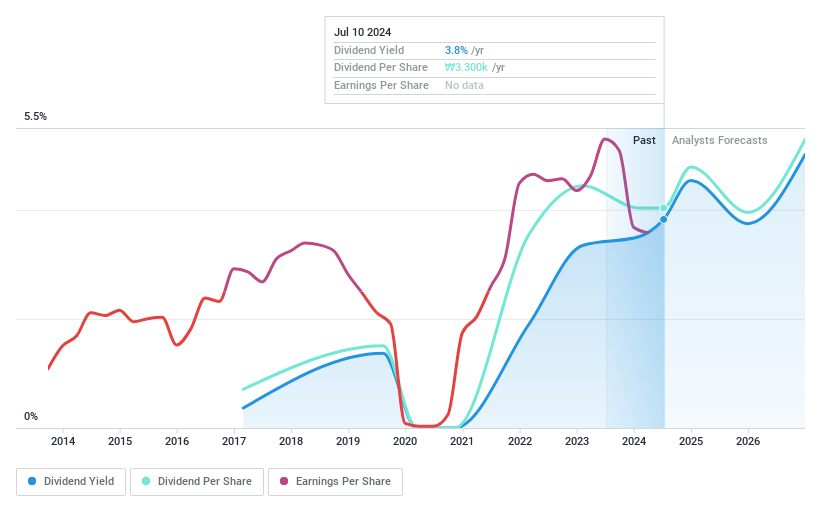

OCI Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OCI Holdings Company Ltd. operates globally, offering a diverse range of chemical products and energy solutions across South Korea, the United States, China, other parts of Asia, and Europe, with a market capitalization of approximately ₩1.69 trillion.

Operations: OCI Holdings Company Ltd. generates revenue primarily through three segments: Basic Chemical Division (₩1.30 billion), Energy Solution Division (₩0.54 billion), and Urban Development Business Sector (₩0.62 billion).

Dividend Yield: 3.8%

OCI Holdings, despite a recent share buyback of KRW 31.52 billion, shows mixed signals for dividend investors. With a declining net profit margin from 28.2% to 15.7%, and earnings forecasted to grow at 14.29% annually, the sustainability of dividends appears supported by a low payout ratio of 15.3% and cash payout ratio of 25.6%. However, dividend reliability is questionable due to volatility over its seven-year history, with significant annual drops exceeding 20%. The stock trades significantly below estimated fair value and analysts predict a potential price increase of 62.8%.

Navigate through the intricacies of OCI Holdings with our comprehensive dividend report here.

Our valuation report here indicates OCI Holdings may be undervalued.

Make It Happen

Gain an insight into the universe of 72 Top KRX Dividend Stocks by clicking here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSE:A000810 KOSE:A001450 and KOSE:A010060.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance