3 High-Yielding Dividend Stocks In France With Yields Up To 6.5%

Amidst a backdrop of fluctuating global markets and heightened geopolitical tensions, the French stock market has shown resilience, with the CAC 40 Index remaining relatively stable. In such an environment, high-yielding dividend stocks in France may offer investors a semblance of predictability and potential income stability.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Rubis (ENXTPA:RUI) | 5.85% | ★★★★★★ |

Samse (ENXTPA:SAMS) | 9.01% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.50% | ★★★★★★ |

Métropole Télévision (ENXTPA:MMT) | 8.63% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.26% | ★★★★★☆ |

Teleperformance (ENXTPA:TEP) | 4.26% | ★★★★★☆ |

Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 6.91% | ★★★★★☆ |

Jacquet Metals (ENXTPA:JCQ) | 5.56% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 3.58% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 6.99% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

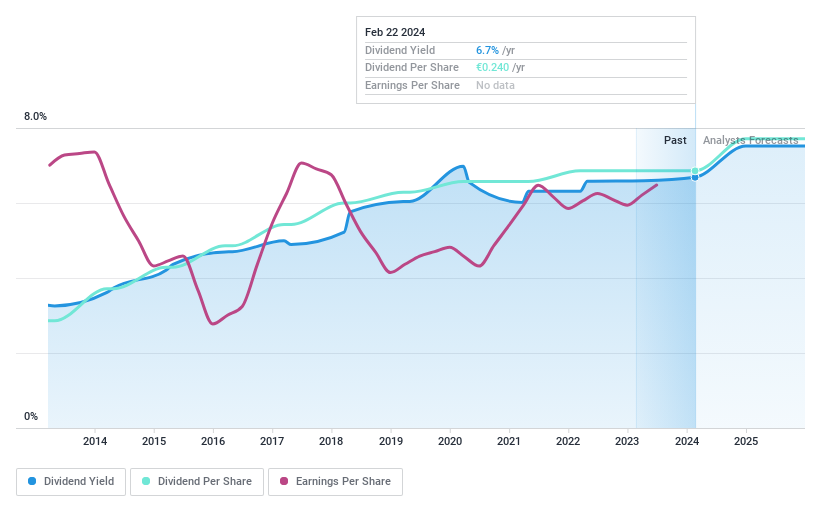

CBo Territoria

Simply Wall St Dividend Rating: ★★★★★★

Overview: CBo Territoria SA is a French company involved in urban planning and development, as well as property development and investment, with a market capitalization of approximately €132.14 million.

Operations: CBo Territoria SA generates revenue primarily from two segments: land sales, which brought in €25.51 million, and property promotion, contributing €58.08 million.

Dividend Yield: 6.5%

CBo Territoria maintains a stable dividend track record, with dividends per share consistent over the past decade and recent increases. The dividends are well-supported by earnings, with a payout ratio of 61%, and cash flows, indicated by a cash payout ratio of 25.4%. Despite a slight decline in net income from €16 million to €14.1 million in 2023, the company's dividend yield stands at an attractive 6.5%, higher than the French market average.

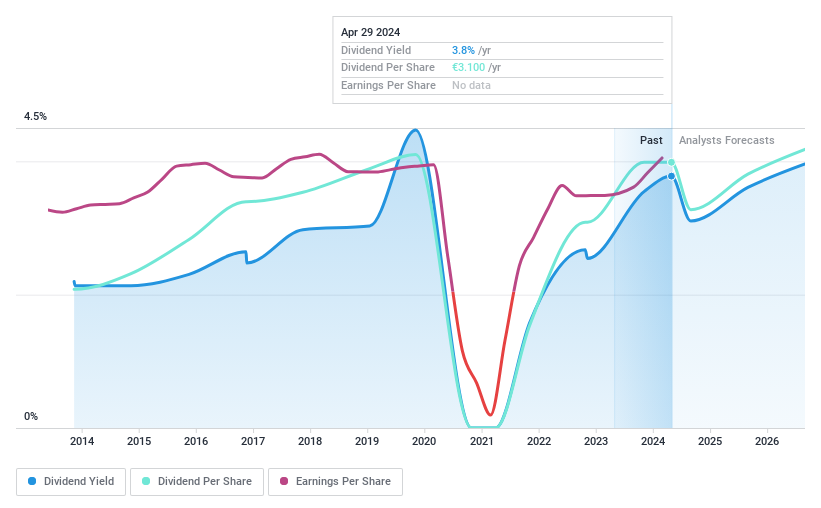

Sodexo

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sodexo S.A. operates globally, offering food services and facilities management, with a market capitalization of approximately €11.50 billion.

Operations: Sodexo S.A. generates its revenues primarily from Europe (€8.30 billion), North America (€10.74 billion), and the rest of the world (€4.12 billion).

Dividend Yield: 4%

Sodexo's recent financial performance shows a shift from a net income of €440 million to a net loss of €74 million as of February 2024, impacting its dividend reliability. Despite this, Sodexo maintains a reasonable payout ratio at 63.2%, ensuring dividends are covered by earnings, and an even lower cash payout ratio at 44%, indicating good coverage by cash flows. However, the company's high debt levels and share price volatility present challenges for dividend stability.

Unlock comprehensive insights into our analysis of Sodexo stock in this dividend report.

The valuation report we've compiled suggests that Sodexo's current price could be quite moderate.

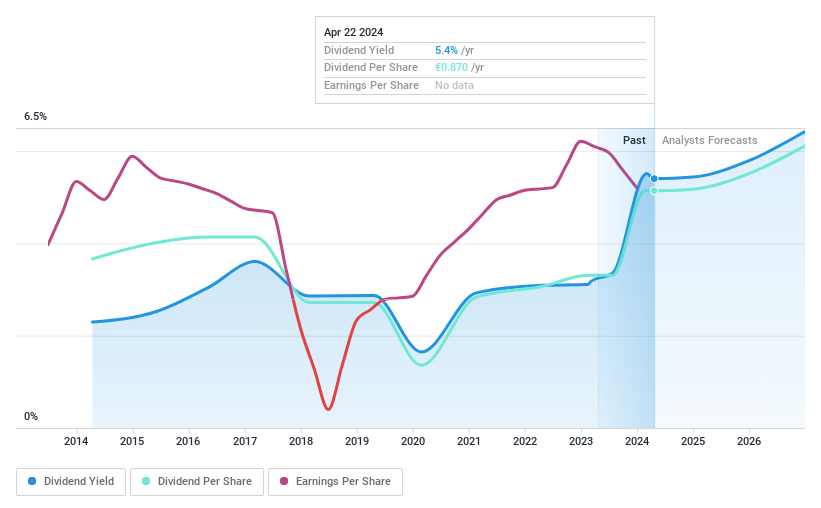

Carrefour

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Carrefour SA operates a diverse range of food and non-food retail stores across multiple formats and channels in Europe, Latin America, the Middle East, Africa, and Asia, with a market capitalization of approximately €11.13 billion.

Operations: Carrefour SA generates €39.02 billion in France, €24.27 billion in Europe excluding France, and €22.54 billion in Latin America from its retail operations.

Dividend Yield: 5.4%

Carrefour SA, despite a high debt level and unstable dividend history over the past decade, offers a competitive dividend yield of 5.4%, higher than the French market average. The dividends are well-supported by both earnings and cash flows, with payout ratios at 66.8% and 21.5% respectively. Recent activities include a significant share buyback program up to €700 million and reported annual revenue growth, with net income rising to €1.66 billion in 2023 from €1.35 billion in 2022.

Where To Now?

Click this link to deep-dive into the 33 companies within our Top Dividend Stocks screener.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:CBOT ENXTPA:SW and ENXTPA:CA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance