3 High-Yielding Dividend Stocks On Euronext Paris With Up To 4.2% Yield

In recent trading sessions, France's CAC 40 Index has experienced a modest decline of 0.89%, reflecting broader European market uncertainties and mixed signals regarding future interest rate cuts. Amidst this backdrop, dividend stocks on Euronext Paris continue to attract attention for their potential to offer investors steady income streams in a fluctuating market environment. A key consideration for selecting strong dividend stocks involves not just the yield but also the sustainability and growth prospects of these payouts, especially in current economic conditions where market sentiment and monetary policies are in flux.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Rubis (ENXTPA:RUI) | 6.08% | ★★★★★★ |

Samse (ENXTPA:SAMS) | 8.40% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.38% | ★★★★★★ |

Fleury Michon (ENXTPA:ALFLE) | 5.51% | ★★★★★☆ |

Métropole Télévision (ENXTPA:MMT) | 9.31% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.24% | ★★★★★☆ |

Teleperformance (ENXTPA:TEP) | 3.69% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.04% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 3.72% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 7.14% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Publicis Groupe

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Publicis Groupe S.A. is a global marketing and communications firm offering digital business transformation services, with a market capitalization of approximately €26.70 billion.

Operations: Publicis Groupe S.A. generates €14.80 billion in revenue from its Advertising and Communication Services segment.

Dividend Yield: 3.2%

Publicis Groupe's dividends, with a yield of 3.19%, are modest compared to the top French payers but have shown growth over the past decade despite a history of volatility. Trading at 42.9% below estimated fair value and supported by earnings and cash flows—with payout ratios at 65% and 45.5% respectively—its dividend sustainability appears reasonable, though impacted occasionally by significant one-off items. Recent strategic appointments and reaffirmed earnings guidance suggest an ongoing focus on operational efficiency and ESG commitments.

Unlock comprehensive insights into our analysis of Publicis Groupe stock in this dividend report.

Upon reviewing our latest valuation report, Publicis Groupe's share price might be too pessimistic.

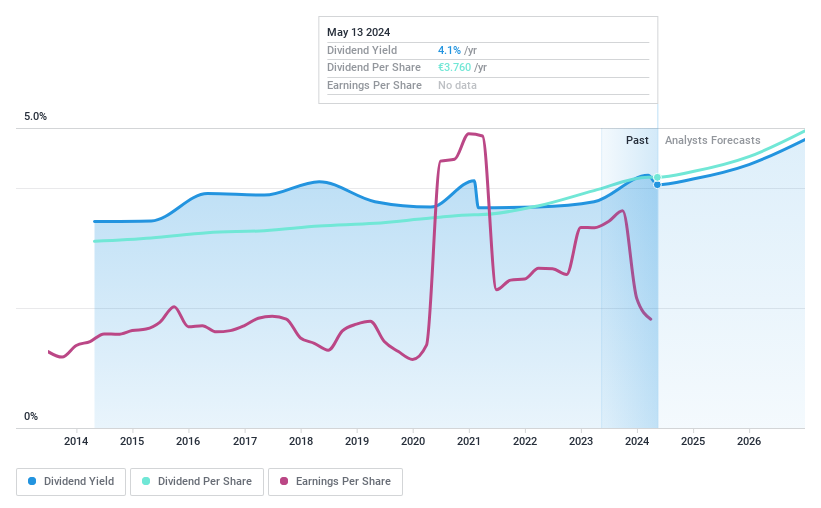

Sanofi

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sanofi is a global healthcare company involved in researching, developing, manufacturing, and marketing therapeutic solutions, with a market capitalization of approximately €110.74 billion.

Operations: Sanofi generates €38.12 billion from its Biopharma segment and €5.21 billion from Consumer Healthcare.

Dividend Yield: 4.2%

Sanofi, a notable player in the pharmaceutical sector, announced a €3.76 dividend per share for 2023, reflecting its commitment to returning value to shareholders. Despite a challenging environment with lower profit margins compared to the previous year (9.8% versus 18.1%), Sanofi maintains a robust dividend profile with an attractive yield of 4.24%. The dividends are well-covered by earnings and cash flows, with payout ratios at 87.2% and 65%, respectively, underscoring sustainability amidst ongoing strategic expansions and product innovations like the recent FDA priority review for Sarclisa in multiple myeloma treatment.

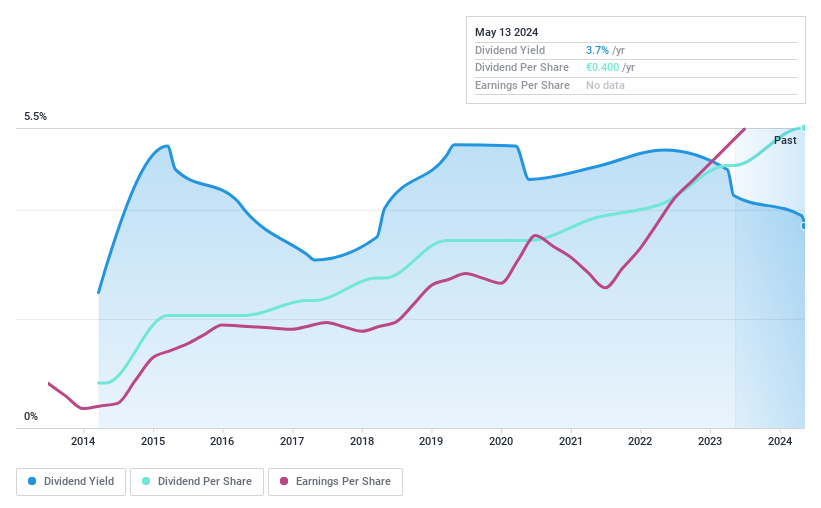

VIEL & Cie société anonyme

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: VIEL & Cie société anonyme operates as an investment company, offering interdealer broking, online trading, and private banking services across various global regions with a market capitalization of approximately €656.19 million.

Operations: VIEL & Cie société anonyme generates revenue through professional intermediation, which brings in approximately €1.01 billion, and stock exchange online services, contributing about €66.60 million.

Dividend Yield: 3.8%

VIEL & Cie société anonyme reported a notable increase in annual revenue to €1.08 billion and net income to €98.1 million for 2023, up from previous years. Despite a dividend yield of 3.77%, which is below the top French dividend payers, VIEL’s dividends have shown consistency and growth over the past decade, with a low payout ratio of 27% indicating strong coverage by earnings. However, data is insufficient to fully assess the sustainability of payouts from cash flow perspectives.

Taking Advantage

Click through to start exploring the rest of the 30 Top Euronext Paris Dividend Stocks now.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:PUB ENXTPA:SAN and ENXTPA:VIL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance