3 Highly Ranked Stocks to Buy for Balanced Returns

One way to smooth out the returns of a stock portfolio is to diversify across sectors and industries. Using the Zacks Rank, I have identified three highly ranked stocks from three very different industries, which may provide investors with uncorrelated returns.

Additionally, each stock has outperformed the broad market over the last 12 months and offers reasonable valuations.

Image Source: Zacks Investment Research

Vistra

Vistra VST is a Dallas, Texas based electric and power utility company founded in 1882. VST retails electricity and natural gas to residential, commercial, and industrial customers across 20 states in the U.S. It serves approximately 4.3 million customers with a generation capacity of approximately 38,700 megawatts with a portfolio of natural gas, nuclear, coal, solar, and battery energy storage facilities.

Vistra, along with many other utility companies, has performed exceptionally well over the last two years. In the face of high inflation and rising interest rates, utilities, with their consistent earnings, and generous dividends, have acted as a haven.

Image Source: Zacks Investment Research

Even after that strong performance VST still trades at a very reasonable valuation. Today it trades at 9x one-year forward earnings, which is below its five-year median of 12x, and below the industry average of 15x. Vistra also offers a dividend yield of 3.2%. Management has increased the dividend by an average of 15% annually over the last three years.

Vistra boasts a Zacks Rank #1 (Strong Buy), indicating upward trending earnings revisions. Current and next quarter sales and earnings estimates are a bit finicky because of ongoing hedging losses, but current year estimates give a clear indication of analyst expectations. Current year sales are estimated to grow by 13% YoY to $15.5 billion, and earnings are projected to climb 195% to $2.79 per share.

VST offers a dividend yield of 3.2% and has increased the payment by at average of 12% annually over the last five years.

Image Source: Zacks Investment Research

Baidu

Baidu BIDU is a China based search engine and diversified technology company. Similar to its American counterpart Alphabet GOOGL, Baidu provides a litany of online services including video, maps, scholar, smart assistant and many others.

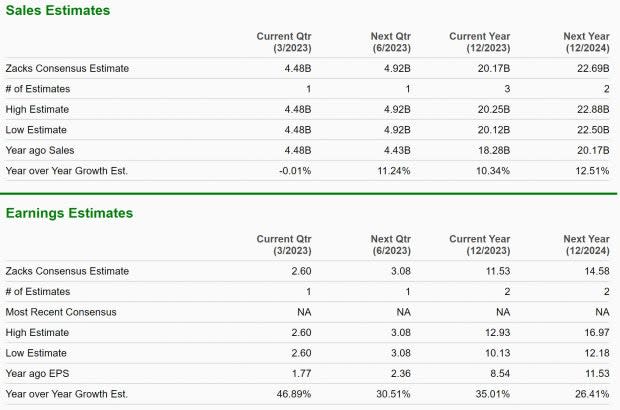

BIDU boasts a Zacks Rank #1 (Strong Buy), indicating upward trending earnings revisions. Current quarter sales estimates are tepid, projecting flat YoY growth, but earnings are still expected to jump 46% YoY to $2.60 per share. Current year sales are expected to grow 10% YoY to $20 billion, and earnings are projected to grow 35% to $11.53 per share.

Earnings estimates have been revised higher across the board, with the current quarter having been upgraded by 14% over the last 90 days.

Image Source: Zacks Investment Research

Baidu is trading at a significant discount to its historical valuation. Its one-year forward earnings multiple is 15x, which is well below its five-year median of 27x, and the industry average of 22x.

BIDU along with many other technology and Chinese stocks has had a very challenging two years. Over that period, it is down -42%. While that may make some investors nervous, it also creates opportunity and is the reason the stock is trading at such a historical discount.

Image Source: Zacks Investment Research

Investing in Chinese equities comes with some additional risk, but if you can stomach it, BIDU is a critical piece of China’s technology infrastructure. The company invests heavily in innovation and is a leader in AI technology.

Hershey

Hershey HSY, everyone’s favorite chocolate bar is a phenomenal business, and stock. Over the last 20 years, HSY stock has compounded at an annual rate of 13%, and 10x’d investors money over that time. This performance is nearly double that of the broad market. It was also a standout performer over the last 12 months, returning 20% compared to the market’s -10%.

Image Source: Zacks Investment Research

Hershey is a Zacks Rank #1 (Strong Buy) stock, indicating upward trending earnings revisions. Current year sales estimates are expecting 7.7% YoY growth to $11.2 billion and 10% earnings growth to $9.37 per share. HSY has been pumping out this kind of steady growth for decades.

Image Source: Zacks Investment Research

Today, Hershey stock is trading at a one-year forward earnings multiple of 25x, which is in line with its three-year median. HSY also offers a 1.7% dividend yield and has increased it by an average of 9% annually over the last five years.

Image Source: Zacks Investment Research

Conclusion

One of the greatest investment edges in the game is diversification. Finding uncorrelated sources of returns is an extremely effective way to smooth out long-term investing returns. Additionally, by utilizing the Zacks Rank savvy investors can consistently find stocks that are likely to outperform in the near term based on earnings revision trends.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hershey Company (The) (HSY) : Free Stock Analysis Report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Vistra Corp. (VST) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance