3 Intriguing Stocks to Watch as Earnings Approach

As investors continue to digest quarterly results, several notable companies are reporting earnings on Thursday, May 18.

Here are three stocks investors will want to watch as they are instrumental to their respective industries and could rise on strong quarterly reports.

Applied Materials (AMAT)

We'll start with Applied Materials, out of the tech sector and a notable name among semiconductor stocks.

Many eyes will be on Applied Material as one of the world’s largest suppliers of equipment for the fabrication of semiconductors, flat panel liquid crystal displays (LCDs), and solar photovoltaic (PV) cells and modules.

At the moment Applied Materials stock lands a Zacks Rank #3 (Hold) with its Semiconductor Equipment-Water Fabrication Industry in the top 49% of over 250 Zacks industries.

Applied Materials’ fiscal second-quarter results and guidance will provide a broader context on the outlook for many semiconductor companies. Earnings are forecasted to be roughly on par with the prior-year quarter at $1.84 per share with Q2 sales expected to rise 2% to $6.40 billion.

Annual earnings are projected to decline -9% this year and dip another -5% in FY24 at $6.67 per share following exceptional years for EPS growth in 2021 and 2022. With that being said, earnings estimate revisions have gone up over the last quarter and strong Q2 results could catapult Applied Materials stock which is still up +129% over the last three years to largely outperform the broader indexes.

Image Source: Zacks Investment Research

Ross Stores (ROST)

Quarterly results from big retailers have highlighted this week’s earnings lineup and one company investors will not want to overlook is Ross Stores.

Ross Stores has carved a unique niche as an off-price retailer of apparel and home accessories and currently has a Zacks Rank #3 (Hold) with its Retail-Discount Stores Industry also in the top 49% of all Zacks industries.

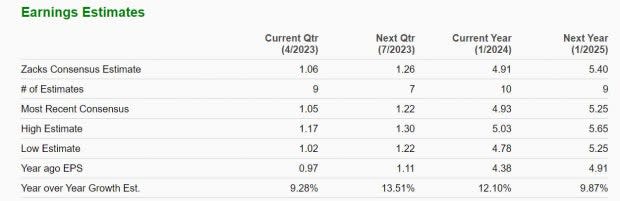

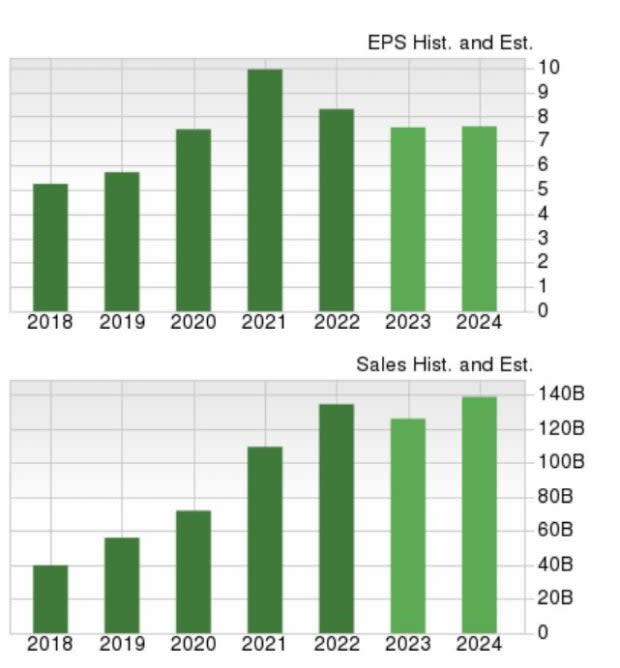

Ross Stores’ first-quarter earnings are expected to rise 9% YoY at $1.06 per share with sales projected to be up 4% from the prior-year quarter to $4.49 billion. Even better, Ross Stores’ annual EPS growth is very attractive at the moment.

Earnings are anticipated to jump 12% in Ross Stores’ current fiscal 2024 and rise another 10% in FY25 at $5.40 per share. If Ross Stores’ first-quarter report helps reconfirm this growth trajectory shares of ROST could gain some nice momentum.

Image Source: Zacks Investment Research

Alibaba (BABA)

Chinese e-commerce giant Alibaba is another company investors will want to watch on Thursday. There could be some nice upside potential for Alibaba stock as logistic and supply chain issues begin to subside with China’s economy back in full flux.

Alibaba also lands a Zacks Rank #3 (Hold) at the moment and its Internet-Commerce Industry is in the top 36% of all Zacks industries. The business conglomerate’s fiscal fourth-quarter earnings are expected to rise 4% from Q4 2022 at $1.30 per share. This is despite Q4 sales forecasted to dip -6% to $30.35 billion.

The earnings potential for Alibaba has always been intriguing with EPS now expected to be down -5% this year but rebound and rise 6% in FY24 at $8.31 per share. After a strong start to 2023 upon China reopening its borders Alibaba stock has since cooled off but a strong quarter and affirmation of a stable operating environment could get the rally going again.

Image Source: Zacks Investment Research

Takeaway

Alibaba (BABA), Applied Materials (AMAT), and Ross Stores (ROST) are three companies investors will definitely want to watch this week. As unique leaders in their space, strong quarterly results on Thursday could give a nice boost to these stocks and they are viable long-term investments worth holding onto at the moment.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance