3 Leading Dividend Stocks With Yields Up To 6.7%

In recent sessions, U.S. stock markets have experienced volatility as investors reacted to the Federal Reserve's decision to maintain interest rates, amidst ongoing concerns about inflation and economic stability. This backdrop of uncertainty makes it an opportune time to consider the resilience and potential steady returns of dividend stocks, particularly those with substantial yields.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.29% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.23% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.00% | ★★★★★★ |

AGCO (NYSE:AGCO) | 5.57% | ★★★★★★ |

Regions Financial (NYSE:RF) | 4.89% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.87% | ★★★★★★ |

Citizens Financial Group (NYSE:CFG) | 4.80% | ★★★★★★ |

Ennis (NYSE:EBF) | 4.93% | ★★★★★★ |

Bank of Marin Bancorp (NasdaqCM:BMRC) | 6.58% | ★★★★★★ |

Union Bankshares (NasdaqGM:UNB) | 5.34% | ★★★★★☆ |

Click here to see the full list of 205 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

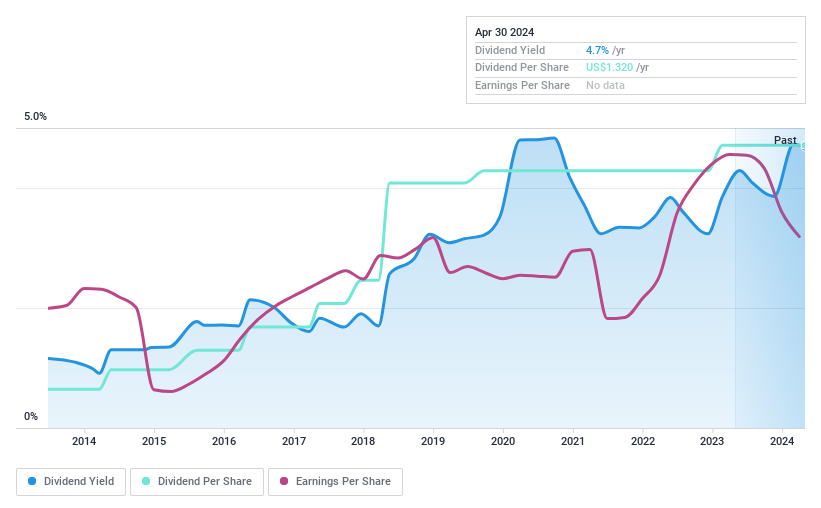

Virginia National Bankshares

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Virginia National Bankshares Corporation serves as the holding company for Virginia National Bank, offering a variety of commercial and retail banking services, with a market capitalization of approximately $153.57 million.

Operations: Virginia National Bankshares Corporation generates its revenue through diverse commercial and retail banking services.

Dividend Yield: 4.5%

Virginia National Bankshares offers a consistent dividend yield of 4.48%, slightly below the top quartile in the U.S. market. The company has demonstrated a stable and growing dividend over the past decade, with payments well-supported by a payout ratio of 41.4%. Despite recent financial results showing a decline in net interest income and net income from US$13.41 million and US$5.79 million to US$10.94 million and US$3.65 million respectively, its long-term dividend reliability remains intact due to prudent financial management evidenced by ongoing share buybacks.

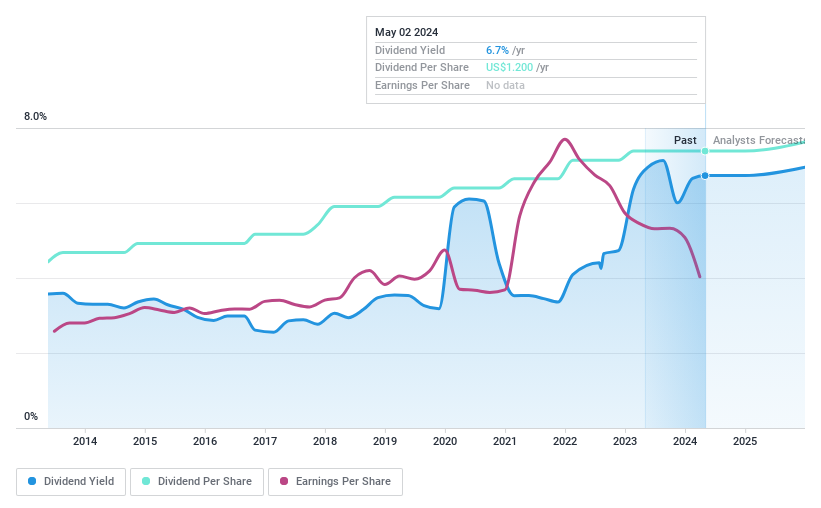

Financial Institutions

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Financial Institutions, Inc., with a market cap of approximately $269.24 million, serves as the holding company for Five Star Bank, which offers banking and financial services to individuals, municipalities, and businesses throughout New York.

Operations: Financial Institutions, Inc. generates its revenues through Five Star Bank by providing banking and financial services across New York.

Dividend Yield: 6.7%

Financial Institutions, Inc. is currently undervalued by 63.8% and analysts expect a potential price increase of 20.6%. It offers a robust dividend yield of 6.73%, ranking in the top 25% of U.S. dividend payers, supported by a payout ratio of 47.6%, indicating sustainability from earnings coverage over the past decade. However, recent financials reveal challenges: Q1 net interest income and net income fell to US$40.08 million and US$2.07 million from previous year's figures, alongside increased charge-offs totaling US$3,121,000.

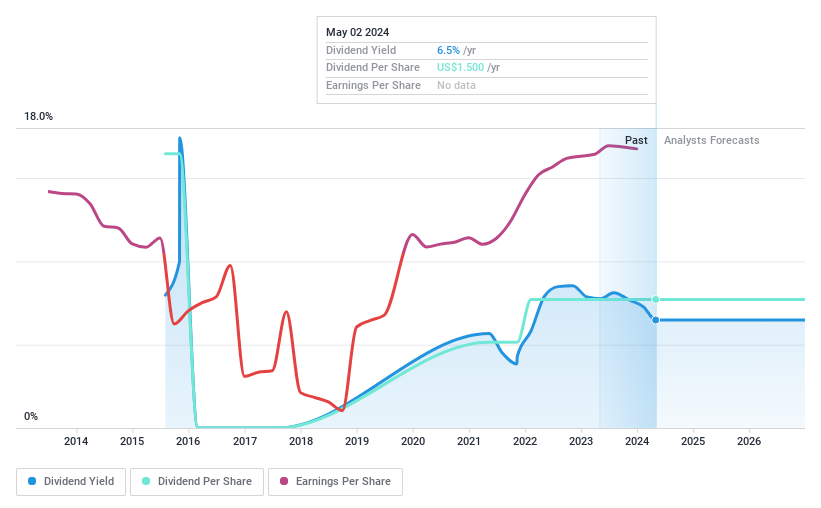

Global Ship Lease

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Global Ship Lease, Inc. operates globally, owning and chartering containerships to shipping companies under fixed-rate charters, with a market capitalization of approximately $801.74 million.

Operations: Global Ship Lease, Inc. generates its revenue primarily from the transportation and shipping segment, totaling $666.72 million.

Dividend Yield: 6.5%

Global Ship Lease has declared dividends recently, including $0.546875 per preferred share and $0.375 for common shares, reflecting its commitment to shareholder returns despite a volatile dividend history over nine years. The company's financial performance shows resilience with revenue rising to US$674.8 million and net income at US$304.5 million in the past year, supported by a low payout ratio of 18%, ensuring dividend coverage from earnings and cash flows (23.7%). However, future earnings are expected to decline significantly by an average of 28.4% annually over the next three years, challenging the sustainability of future dividends amidst high debt levels.

Key Takeaways

Unlock more gems! Our Top Dividend Stocks screener has unearthed 202 more companies for you to explore.Click here to unveil our expertly curated list of 205 Top Dividend Stocks.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqCM:VABK NasdaqGS:FISI and NYSE:GSL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance