3 mREIT Stocks to Bet on Despite Lackluster Origination Scenario

The Zacks REIT and Equity Trust is not immune to interest rate volatility and uncertainty in the macro-economic conditions due to regional banks’ collapse, high rates, below-average market liquidity and limited fixed-income demand. This has resulted in a rise in mortgage rates, which has significantly reduced originations. The mREIT industry should see book value erosion in the near term, as wider spreads in the Agency market affect asset prices.

While rising rates have hindered origination volumes, it continues to be a tailwind to servicing businesses, as the two segments are operational hedges for each other. Low prepayment spreads offer respite by supporting asset yields and margins, whereas business diversification will help keep companies afloat. Companies with primarily floating-rate loan books should see a rise in net interest income (NII). Hence, industry players like Arbor Realty ABR, Ladder Capital Corp LADR and Invesco Mortgage Capital Inc. IVR are well-poised to navigate the market blues.

About the Industry

The Zacks REIT and Equity Trust industry comprises mortgage REITs, also known as mREITs. Industry participants invest in and originate mortgages and mortgage-backed securities (MBS), and provide mortgage credit for homeowners and businesses. Typically, these companies focus on either residential or commercial mortgage markets, although some invest in both markets through the respective asset-backed securities. Agency securities are backed by the federal government, making it a safer bet and limiting credit risk. Also, such REITs raise funds in both debt and equity markets through common and preferred equity, repurchase agreements, structured financing, convertible and long-term debt, and other credit facilities. The net interest margin (NIM), the spread between interest income on mortgage assets and securities held, as well as funding costs, is a key revenue metric for mREITs.

What's Shaping the Future of the mREIT Industry?

Purchase Volume Deterioration to Continue: The SVB fallout has resulted in incremental volatility in mortgage rates and served as another hurdle for any potential recovery in purchase originations, with both buyers and sellers remaining on the sidelines. According to Freddie Mac's Primary Mortgage Market Survey, the 30-year mortgage rate has increased to 6.32% as of Mar 29, 2023, from 4.67% a year ago. Housing inventory has fallen and affordability challenges have increased due to the ongoing increase in rates, which has also affected seasonal buying trends.

Amid this lackluster housing market, mortgage originations are likely to continue their free fall. The MBA forecast now calls for an 18% decline in mortgage originations in 2023. This has caused operational and financial challenges for originators and may reduce the gain on sale margin and new investment activity.

Industry Resorts to Dividend Cuts as Book Values Erode: High volatility in the fixed-income markets, the spike in interest rates, and the widening of the spread between the 30-year Agency MBS and 10-year treasury rate are affecting valuations of Agency mortgage-backed securities. Hence, mREITs will continue to see book value pressure in the upcoming period. Also, liability-sensitive mREITs will see funding costs repricing faster than assets yields. Hence, we anticipate the cost of funds to be a headwind and reduce net interest spreads and profitability.

This scenario has reduced dividend coverage and companies like Invesco Mortgage and Annaly Capital Management, Inc. have resorted to dividend cuts to preserve book value. This may discourage mREIT investors and result in capital outflows from the industry, potentially resulting in even greater book value declines for companies in the upcoming period.

Conservative Approach to Temper Returns: The Federal Reserve’s aggressive rate hikes to slow persistent inflation has made financial markets extremely volatile, restricting financial conditions and resulting in negative fixed-income fund flows. Given these macro worries, as strain grows on credit-risky assets, we expect mREITs to be selective in their investments, resulting in lower portfolio growth. Also, numerous companies have resorted to a higher hedge ratio to reduce interest rate risks. While such moves may seem prudent in the ongoing uncertain times, it will temper mREITs’ growth expectations. As companies prioritize risk and liquidity management over incremental returns, at least in the short term, we expect robust returns to remain elusive.

Zacks Industry Rank Indicates Dismal Prospects

The Zacks REIT and Equity Trust industry is housed within the broader Zacks Finance sector. It carries a Zacks Industry Rank #179, which places it in the bottom 28% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates underperformance in the near term. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is an outcome of the disappointing earnings outlook for the constituent companies. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group's earnings growth potential. The industry’s current-year earnings estimate has moved 14.8% down since April last year.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

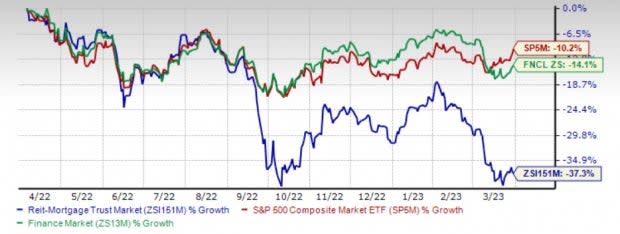

Industry Lags Sector and S&P 500

The Zacks REIT and Equity Trust industry has lagged the broader Zacks Finance sector and the S&P 500 composite in the past year.

The industry has slumped 37.3% in the above-mentioned period against the broader sector’s decline of 14.1%. The S&P Index has fallen 10.2% over the past year.

One-Year Price Performance

Image Source: Zacks Investment Research

Industry's Current Valuation

Based on the trailing 12-month price-to-book (P/BV), which is a commonly used multiple for valuing mREITs, the industry is currently trading at 0.75X compared with the S&P 500’s 5.66X. It is also below the sector’s trailing-12-month P/BV of 2.99X. Over the past five years, the industry has traded as high as 1.12X, as low as 0.42X and at the median of 0.96X.

Price-to-Book TTM

Image Source: Zacks Investment Research

3 mREIT Stocks Worth Betting On

Arbor Realty: The New York-headquartered mREIT primarily focuses on originating and servicing loans for multi-family, single-family and other commercial real estate assets. Arbor Realty’s diversified investment focus on commercial real estate debt investments, mortgage servicing and commercial mortgage-backed securities is likely to enable it to generate stable income in the upcoming quarters despite the challenging economic environment.

Its loan book is 97% floating rate, positioning it well to benefit from high interest rates. Further, multi-family mortgage loan securitization and originations are expected to expand ABR’s fee-based servicing portfolio, driving servicing revenues.

Last month, ABR’s board of directors approved a $50-million share repurchase program. This is likely to boost shareholder confidence in the stock.

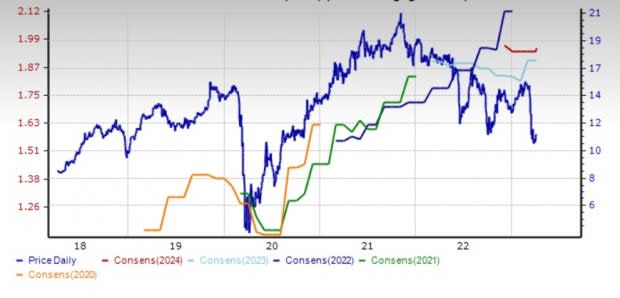

The company currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for ABR’s 2023 earnings has been revised 5% upward to $1.90 in the past two months. Moreover, 2023 NII estimates of $1.31 billion indicate a year-over-year uptick of 39%. ABR has a market cap of $2.2 billion.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Price and Consensus: ABR

Image Source: Zacks Investment Research

Ladder Capital: This commercial REIT, with $5.9 billion of assets as of the third-quarter end, is a preeminent commercial real estate capital provider, specializing in underwriting commercial real estate and offering flexible capital solutions within a sophisticated platform. It originates and invests in a diverse portfolio of commercial real estate and real estate-related assets, with a focus on senior secured assets.

The company’s balance sheet is well-positioned to benefit from a rising rate environment. Its lending book consists of 90% floating-rate first mortgage loans, while 48% of liabilities are fixed-rate. With this, its earnings seem positively correlated to rising interest rates. We see LadderCapital’s conservative capital structure and modest leverage as a favorable fit amid the ongoing market disruption. Also, its negligible losses on originated investments since 2008 underline an impressive credit record.

In contrast to certain mREITs resorting to dividend cuts to navigate the choppy waters, LADR dividends seem well-covered, with 1.35X coverage based on Distributable EPS.

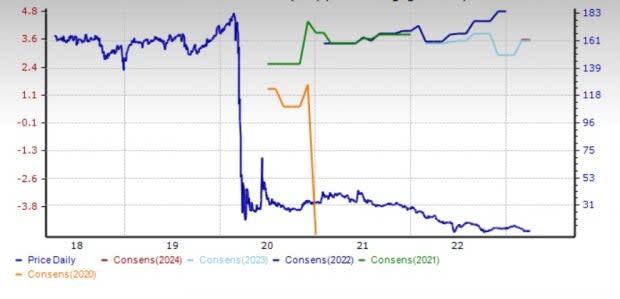

The company currently sports a Zacks Rank #1. The Zacks Consensus Estimate for Ladder Capital’s 2023 earnings has been revised marginally upward in the past two months. Moreover, for 2023 and 2024, earnings are projected to grow 2.6% and 7.6%, respectively.LADR has a market cap of $1.18 billion.

Price and Consensus: LADR

Image Source: Zacks Investment Research

Invesco Mortgage: The company primarily focuses on investing in, financing and managing MBSs and other mortgage-related assets. Amid headwinds for Agency MBSs, the company has been actively managing its portfolio. It has reduced exposure to such securities, as the current macro situation continues to weigh on Agency RMBS valuations. IVR is shifting its Agency RMBS portfolio to higher coupon investments by selling lower coupon ones.

As of Mar 17, its investment portfolio of $5.5 billion included $5.3 billion of Agency RMBS. It had unrestricted cash and unencumbered investments aggregating around $454 million. IVR estimates a debt-to-equity ratio of 5.9X and a book value per common share of $11.96-$12.44.

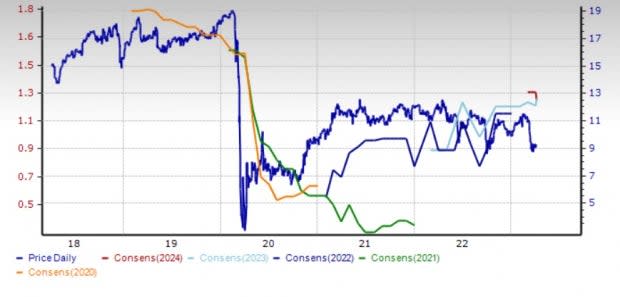

The company sports a Zacks Rank of 1 at present. The Zacks Consensus Estimate for IVR’s 2023 earnings has been revised 22.5% upward over the past two months to $3.54. Also, the company has an impressive earnings surprise history, having surpassed the Zacks Consensus Estimate in all four trailing quarters. IVR has a market cap of $454.3 million.

Price and Consensus: IVR

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Arbor Realty Trust (ABR) : Free Stock Analysis Report

INVESCO MORTGAGE CAPITAL INC (IVR) : Free Stock Analysis Report

Ladder Capital Corp (LADR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance