3 Promising MedTech Stocks to Snap Up in Second-Half 2021

After a volatile 2020, economies globally exhibited signs of sustained recovery in the first half of 2021. Although there are concerns regarding the highly-transmissible Delta variant in some parts of the United States and the world, case counts have been on the decline. However, certain states are grappling with rise in the variant cases as the country heads toward fall season and colder weather.

Nevertheless, with 70% of adults in the United States having received at least one shot of a COVID-19 vaccine (according to the Centers for Disease Control and Prevention data), the optimism is palpable.

The MedTech sector has shown tremendous strength since the beginning of this year. It has been exhibiting recovery and gaining traction on the back of economy rebounding and normalization based on mass vaccinations.

The lingering effects of the pandemic might impact the MedTech space in both positive and negative ways in 2021. It is worth mentioning that the sector showed considerable strength last year despite the pandemic-induced disruption. Therefore, it would be a prudent decision to capitalize on the MedTech space. Let us delve deeper.

MedTech Space Gaining Steam

Although companies involved in diagnostic testing experienced high demand during the peak of the pandemic, these players saw a substantial decline in demand for COVID-19 testing due to the changing testing landscape on account of a significant reduction in coronavirus cases and the rollout of vaccines globally.

The Delta variant, however, has brought about changes as President Joe Biden announced a new mandate on Sep 9 aimed at curbing the surge in COVID-19 infections, which signals a sharp rise in testing. The President’s plan on the diagnostic side of the mandate calls for the government to work on ramping up test supply. According to a Reuters report, QIAGEN QGEN has already shown support for this mandate. At the same time, Abbott ABT stated that it is rapidly working to scale up manufacturing of its BinaxNOW and ID NOW test kits, and hiring additional employees.

Apart from this, digital health will continue to gain immensely on the back of last year’s momentum. This year is likely to see companies involved in telemedicine and artificial intelligence make necessary technological advancements to better serve patients.

The pandemic led to a change in the business models with companies leaning toward virtualized, remote-operated business models for medical care, which in turn, have helped the companies recover and attain pre-COVID-19 levels.

With the increasing dependence on self-monitoring tools, the wearable devices space continues to show strength, thereby instilling further optimism in investors.

Elective procedures, although, are expected to remain under pressure this year. J.P. Morgan analysts projected (as published in a MedTech Dive report) that vaccination might help in driving volumes but procedure comebacks are not likely to be seen until the second half of 2021.

3 Lucrative Picks

Given the MedTech space’s resilience and prevailing prospects, investors can choose to invest in MedTech stocks that have shown tremendous promise despite challenging market conditions and are fundamentally strong. To narrow down the list, we have selected three stocks with a Zacks Rank #2 (Buy) and a VGM Score of B. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Merit Medical Systems, Inc. MMSI: In the second quarter of 2021, Merit Medical displayed considerable strength with better-than-expected results. The company saw revenue growth not only in both its segments but also across all product categories within its Cardiovascular unit. Strong execution and improving customer demand trends owing to the gradual business recovery fueled the overall top-line performance. The company stands to benefit from the execution of its global growth and profitability plan. A robust product line and other internally developed products raise investors’ optimism on the stock. Expansion of both margins bodes well. A raised financial outlook for the full year also augurs well. The company’s long-term earnings growth rate is projected at 12.7%.

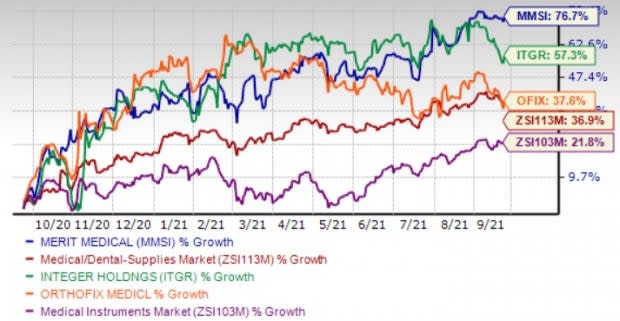

Shares of the company gained 76.7% in the past year, compared with the industry’s growth of 36.9%.

Image Source: Zacks Investment Research

Integer Holdings Corporation ITGR: Integer Holdings exited the second quarter of 2021 with better-than-expected results. Robust segmental performances and strength in the majority of the product lines are impressive. Continued business recovery, despite U.S. labor constraints and global supply chain disruptions, is encouraging. Expansion of both margins also bodes well for the stock. A raised financial outlook raises our optimism. Management, during the second-quarter 2021 earnings call in July, reiterated its stance of sustained investment in the execution of its strategy to drive above-market top-line growth and continued margin expansion. For 2021, the company’s earnings growth rate is projected at 43.7%.

In the past year, shares of the company appreciated 57.3% compared with the industry’s rally of 21.8%.

Orthofix Medical Inc. OFIX: Orthofix Medical exhibited robust second-quarter 2021 results, wherein it delivered top-line growth on a year-over-year basis and above pre-COVID levels. The company saw significant improvement in U.S. Spinal Implant net sales, and solid performance from its U.S. M6-C artificial cervical disc and FITBONE limb lengthening system with about $9 million in combined sales. A raised 2021 revenue outlook buoys optimism in the stock. For 2021, the company’s earnings growth rate is projected at 200%.

In the past year, shares of the company climbed 37.6% compared with the industry’s rise of 21.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

ORTHOFIX MEDICAL INC. (OFIX) : Free Stock Analysis Report

QIAGEN N.V. (QGEN) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance