3 Reasons to Retain Ecolab (ECL) Stock in Your Portfolio

Ecolab Inc. ECL is well-poised for growth in the coming quarters, courtesy of its solid product portfolio. The optimism led by a solid fourth-quarter 2022 performance, along with its strong business, is expected to contribute further. Compliance risks and data security threats persist.

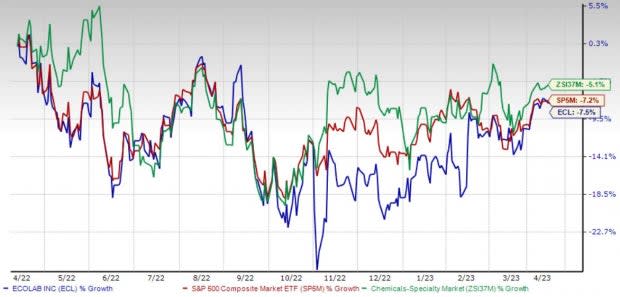

Over the past year, this Zacks Rank #3 (Hold) stock has lost 7.5% compared with a 5.1% decline of the industry and a 7.1% fall of the S&P 500 composite.

The renowned water, hygiene and infection prevention solutions and services provider has a market capitalization of $47.24 billion. It projects 12.7% growth for the next five years and expects to maintain a strong performance. Ecolab’s earnings surpassed the Zacks Consensus Estimate in two of the trailing four quarters, missed the same in one and matched in the other, the average earnings surprise being 0.3%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Product Portfolio Solid: We are upbeat about Ecolab’s solid product portfolio, which has enabled it to fortify its foothold in a niche space globally. Ecolab delivers comprehensive solutions, data-driven insights and personalized service to advance food safety and maintain clean and safe environments.

The company also provides products and services that optimize water and energy use, and improve operational efficiencies and sustainability for customers in the food, healthcare, hospitality and industrial markets in more than 170 countries around the world.

Strong Business: Ecolab’s consistent delivery of considerable earnings growth despite the current challenging business environment continues to impress. Ecolab witnessed a strong fourth-quarter 2022, which reflected strong sales growth with double-digit pricing despite substantial delivered product cost inflation. Per management, the volumes outside Europe remained stable year over year, while the total pricing continued to accelerate on a sequential basis in the fourth quarter.

On the fourth-quarter earnings call in February, management also stated that Ecolab’s net new business pipeline reached a record high at the end of 2022.

Strong Q4 Results: Ecolab’s solid fourth-quarter results buoy our optimism. The company registered a robust year-over-year uptick in its top line and solid performances across all its segments. Strong volume and pricing momentum were also seen. The company’s digital capabilities are also continuing to broaden, develop and add competitive advantages. During the quarter, Purolite delivered a very strong performance, benefiting from its recent capacity additions.

Downsides

Compliance Risks: Ecolab’s business is subjected to various laws and regulations relating to the environment, including evolving climate change standards and the conduct of its business. Compliance with these laws and regulations exposes the company to potential financial liability and increases operating costs.

Data Security Threat: Ecolab relies, to a large extent, upon information technology systems and infrastructure to operate its business. The size and complexity of the company’s information technology systems make them potentially vulnerable to failure, malicious intrusion and random attacks. Acquisitions have resulted in further de-centralization of systems and additional complexity in its systems infrastructure.

Estimate Trend

Ecolab is witnessing a negative estimate revision trend for 2023. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 2.2% south to $4.96.

The Zacks Consensus Estimate for the company’s first-quarter 2023 revenues is pegged at $3.47 billion, suggesting a 6.2% improvement from the year-ago quarter’s reported number.

This compares to our first-quarter revenue estimate of $3.34 billion, suggesting a 2.3% improvement from the year-ago quarter’s reported number.

Key Picks

Some better-ranked stocks in the broader medical space are Hologic, Inc. HOLX, Henry Schein, Inc. HSIC and Masimo Corporation MASI.

Hologic, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 15.2%. HOLX’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 30.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hologic has gained 8.6% against the industry’s 13.9% decline in the past year.

Henry Schein, sporting a Zacks Rank #1 at present, has an estimated long-term growth rate of 8.1%. HSIC’s earnings surpassed estimates in three of the trailing four quarters and matched the same in the other, the average beat being 2.9%.

Henry Schein has lost 7.9% compared with the industry’s 3.9% decline over the past year.

Masimo, flaunting a Zacks Rank #1 at present, has an estimated growth rate of 3.5% for 2023. MASI’s earnings surpassed estimates in all the trailing four quarters, the average beat being 9%.

Masimo has gained 35.9% against the industry’s 13.9% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

Masimo Corporation (MASI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance