3 Renewable Energy Stocks to Buy as Wind and Solar's Market Share Climbs

Something big happened earlier this year. For the first time ever, wind and solar energy surpassed the 10% mark in total contribution to U.S. electricity generation. According to the EIA's Electric power Monthly, wind produced 8% of the nation's electricity and solar added 2%.

This milestone was practically inevitable, but still remarkable when one considers that in 1990, the United States generated just 88 TBTU's (trillion British Thermal Units) of energy from solar and wind. Last year, wind and solar yielded 2,701 TBTU -- a 2,969% increase! In March 2017 alone, they produced a whopping 405 TBTU's.

Image Source: Getty Images.

This is a big deal. Renewable energy is the future, and investors would be downright foolish not to capitalize on this massive trend. Here are the three top stocks to buy today in the solar and wind industries today.

1. Pattern Energy

As long as the wind is blowing, Pattern Energy (NASDAQ: PEGI) makes money. The company owns 20 wind turbine farms generating more than 2,700 MW of electricity. It isn't even confined to the United States as it has assets in Canada and South America. The solar power industry continues to grow thanks to efficiency gains, but there are large swaths of our planet's surface that experience fairly consistent wind patterns. A prime example of this is the Great Planes. It's no coincidence that the biggest wind farm of 2017 was built right outside Topeka, Kansas.) The sun is only up for so long, whereas wind is an ever-present phenomenon.

Pattern sells the power its turbines generate to local utilities via long-term contracts, the average life of which is 14 years. Dividend investors will also like Pattern Energy. It shares currently yield 7.4%, despite having rallied more than 20% year-to-date. As one of the few pure-play wind stocks, it's a fantastic way to invest in the future of renewable energy.

2. First Solar

One of the few, if only, American solar manufacturers that continues to thrive despite a surge of cheap imported panels is First Solar (NASDAQ: FSLR). The massive oversupply from countries like China has led a few in the industry -- notably Suniva and SolarWorld -- to call for tariffs on imported solar cells. As one of the few manufacturers based in the U.S., First Solar would be a huge beneficiary if the Section 201 trade case they have filed leads President Trump to impose those tariffs. But while we await his decision, it's important to recognize that First Solar is primed to deliver no matter what the outcome.

First Solar makes its solar cells and modules out of cadmium telluride (CdTe), not silicon. This makes them less efficient in ideal settings, but these modules perform better under less favorable conditions, like on overcast days. And counter-intuitively, pure efficiency on a power-per-square-foot basis isn't always the prime consideration when picking solar panels. While it matters when space is limited -- residential solar systems, for example -- the economic arguments shift away from silicon when real estate isn't a problem, or when one is worried about a lack of consistent direct sunshine. That's is why First Solar is the manufacturer of choice for many systems in states like Minnesota, and why it's the market-leader in utility-scale solar power systems.

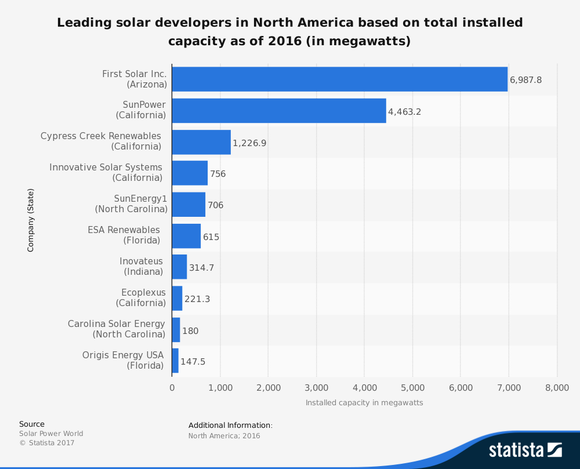

Data Source: Solar Power World.

With a pristine balance sheet, and its status as the utility-scale solar leader in the U.S., First Solar is a great way for investors to participate in the continuing growth of the sector.

3. NextEra Energy Partners

Florida based NextEra Energy one of the few U.S. utilities diving headfirst into the renewable future. As the owner of Florida Power and Light (FPL), it continues to invest in wind and solar projects while shuttering coal-burning plants. In order to aid the development of renewable energy assets, it created a partially owned subsidiary, NextEra Energy Partners (NYSE: NEP). That pure–play renewable energy master limited partnership (MLP) -- controlled by NextEra Energy -- buys projects from the parent and pays out the profits to unitholders in the form of distributions.

NextEra Energy Partners owns 17 wind farms, five utility-scale solar projects, and four natural gas pipelines. (Natural gas is the cleanest fossil fuel and is frequently used as a complementary fuel source to renewables.) As icing on the cake, the market is starting to catch on. NEP's units are up 51% year-to-date, yet despite those gains, still yield 4%. To top it all off, management projects that its payout will grow in the 12% to 15% range through fiscal 2022. For a fast-growing dividend stock with a foothold in renewable energy generation, it's hard to beat NextEra Energy Partners.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Sean O'Reilly owns shares of First Solar. The Motley Fool recommends First Solar. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance