3 SEHK Stocks That May Be Trading Below Their Estimated Value In September 2024

As global markets react to the recent rate cuts by the U.S. Federal Reserve, investors are closely watching how these changes will impact various economies, including Hong Kong. The Hang Seng Index has shown positive movement despite mixed economic data from China, suggesting potential opportunities for discerning investors. In this context, identifying undervalued stocks can be particularly rewarding. For those looking to capitalize on market inefficiencies, here are three SEHK stocks that may be trading below their estimated value in September 2024.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

Name | Current Price | Fair Value (Est) | Discount (Est) |

China Resources Mixc Lifestyle Services (SEHK:1209) | HK$27.25 | HK$54.13 | 49.7% |

Yadea Group Holdings (SEHK:1585) | HK$11.88 | HK$23.17 | 48.7% |

Shanghai INT Medical Instruments (SEHK:1501) | HK$28.60 | HK$56.51 | 49.4% |

Hangzhou SF Intra-city Industrial (SEHK:9699) | HK$10.78 | HK$20.14 | 46.5% |

Tencent Holdings (SEHK:700) | HK$405.40 | HK$774.53 | 47.7% |

Digital China Holdings (SEHK:861) | HK$3.15 | HK$6.02 | 47.7% |

Innovent Biologics (SEHK:1801) | HK$42.35 | HK$80.88 | 47.6% |

DPC Dash (SEHK:1405) | HK$68.20 | HK$134.21 | 49.2% |

AK Medical Holdings (SEHK:1789) | HK$4.31 | HK$8.41 | 48.8% |

Weimob (SEHK:2013) | HK$1.40 | HK$2.60 | 46.2% |

Let's take a closer look at a couple of our picks from the screened companies.

Weimob

Overview: Weimob Inc., with a market cap of HK$4.31 billion, is an investment holding company that offers digital commerce and media services in the People's Republic of China.

Operations: Weimob Inc. generates revenue from its digital commerce and media services in the People's Republic of China.

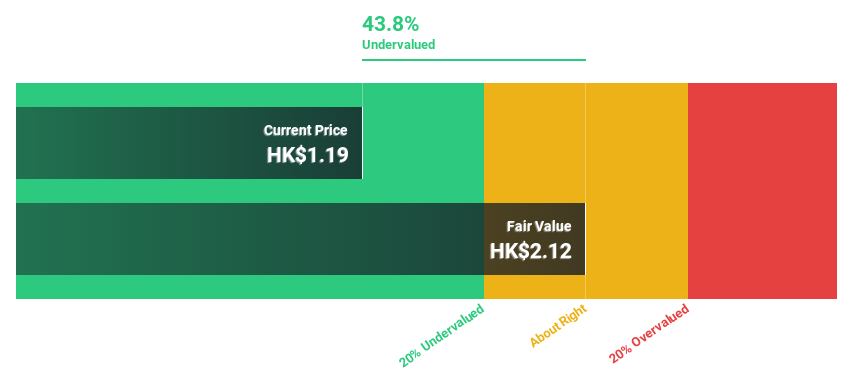

Estimated Discount To Fair Value: 46.2%

Weimob Inc. is trading at HK$1.4, significantly below its estimated fair value of HK$2.6, indicating it may be undervalued based on cash flows. Despite a net loss of CNY 550.78 million for H1 2024, revenue is forecast to grow at 13.7% per year, outpacing the Hong Kong market growth rate of 7.3%. Additionally, Weimob is expected to become profitable within the next three years and currently trades at 46% below its fair value estimate.

Insights from our recent growth report point to a promising forecast for Weimob's business outlook.

Unlock comprehensive insights into our analysis of Weimob stock in this financial health report.

Binjiang Service Group

Overview: Binjiang Service Group Co. Ltd., with a market cap of HK$4.95 billion, offers property management and related services in the People’s Republic of China.

Operations: Revenue segments (in millions of CN¥) include property management services at CN¥1.23 billion and related services at CN¥0.56 billion.

Estimated Discount To Fair Value: 35.8%

Binjiang Service Group, trading at HK$17.9, is significantly undervalued with an estimated fair value of HK$27.89. The company's earnings grew by 16.4% over the past year and are forecast to grow annually by 15%, outpacing the Hong Kong market's growth rate of 11.6%. Recent earnings report shows a net income increase to CNY 265.32 million for H1 2024 from CNY 231 million a year ago, reinforcing its strong cash flow position despite an unstable dividend track record.

Vobile Group

Overview: Vobile Group Limited is an investment holding company that offers software as a service for digital content asset protection and transactions across the United States, Japan, Mainland China, and internationally, with a market cap of HK$3.82 billion.

Operations: Revenue from software as a service for digital content assets protection and transaction amounted to HK$2.18 billion.

Estimated Discount To Fair Value: 35.7%

Vobile Group Limited, trading at HK$1.7, is significantly undervalued with an estimated fair value of HK$2.64. Recent earnings for H1 2024 show sales of HK$1.18 billion and net income of HK$41.47 million, up from last year’s figures, indicating robust cash flows despite lower profit margins (0.2% vs 2.5%). The company’s earnings are forecast to grow significantly by 59.4% annually over the next three years, outpacing the Hong Kong market's growth rate.

Make It Happen

Dive into all 32 of the Undervalued SEHK Stocks Based On Cash Flows we have identified here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:2013 SEHK:3316 and SEHK:3738.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com