3 SGX Stocks Estimated To Be Undervalued By At Least 43%

Amidst a stable regulatory environment in the financial sector, as evidenced by Visa and Mastercard's commitment to maintain capped tourist card fees, the Singapore market presents intriguing opportunities. Understanding what constitutes an undervalued stock is crucial, especially in a market where strategic financial operations can influence overall economic conditions.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

Name | Current Price | Fair Value (Est) | Discount (Est) |

LHN (SGX:41O) | SGD0.33 | SGD0.38 | 12.2% |

Singapore Technologies Engineering (SGX:S63) | SGD4.26 | SGD8.20 | 48.1% |

Hongkong Land Holdings (SGX:H78) | US$3.22 | US$5.82 | 44.7% |

Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD0.93 | SGD1.65 | 43.8% |

Digital Core REIT (SGX:DCRU) | US$0.595 | US$1.11 | 46.3% |

Seatrium (SGX:5E2) | SGD1.44 | SGD2.63 | 45.2% |

Nanofilm Technologies International (SGX:MZH) | SGD0.835 | SGD1.46 | 43% |

Let's dive into some prime choices out of from the screener

Seatrium

Overview: Seatrium Limited specializes in engineering solutions for the offshore, marine, and energy sectors with a market capitalization of SGD 4.91 billion.

Operations: The company's revenue is primarily generated from rigs and floaters, repairs and upgrades, offshore platforms, and specialized shipbuilding, totaling SGD 7.26 billion, with an additional SGD 31.63 million from ship chartering.

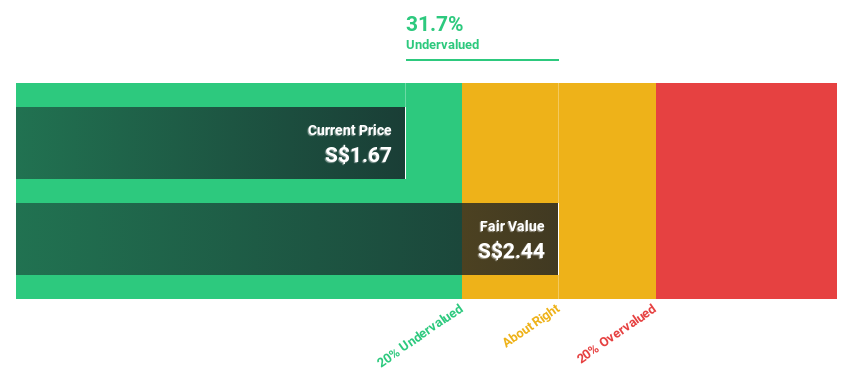

Estimated Discount To Fair Value: 45.2%

Seatrium is currently trading at SGD1.44, significantly below the estimated fair value of SGD2.63, indicating a potential undervaluation based on discounted cash flows. Despite expectations of becoming profitable within three years and earnings projected to grow 72.23% annually, concerns linger due to its low forecasted return on equity (7.9%) and high share price volatility recently. Analyst consensus suggests a substantial upside with an 88.4% potential increase in stock price, aligning with positive revenue growth forecasts that outpace the broader Singapore market.

Digital Core REIT

Overview: Digital Core REIT (SGX: DCRU) is a Singapore-listed real estate investment trust specializing in data centers, with a market capitalization of approximately $775.96 million and backed by Digital Realty, the world's largest data center owner and operator.

Operations: The company generates its revenue primarily from its commercial REIT segment, totaling $71.10 million.

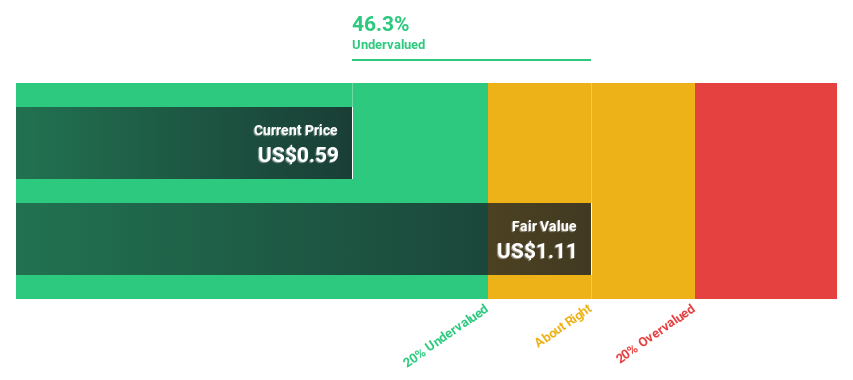

Estimated Discount To Fair Value: 46.3%

Digital Core REIT is trading at US$0.6, considerably under its calculated fair value of US$1.11, suggesting it may be undervalued based on cash flows. Despite a recent exit from the S&P Global BMI Index and changes in company secretaries, its financial performance shows resilience with an increase in net income to US$8.71 million from US$7.18 million year-over-year for Q1 2024. However, its return on equity remains low at 4.9%, and revenue growth projections are modest compared to the broader market expectations.

Nanofilm Technologies International

Overview: Nanofilm Technologies International Limited offers nanotechnology solutions across Singapore, China, Japan, and Vietnam with a market capitalization of SGD 543.59 million.

Operations: The company generates revenue through four primary segments: Sydrogen (SGD 1.05 million), Nanofabrication (SGD 16.05 million), Advanced Materials (SGD 141.54 million), and Industrial Equipment (SGD 37.17 million).

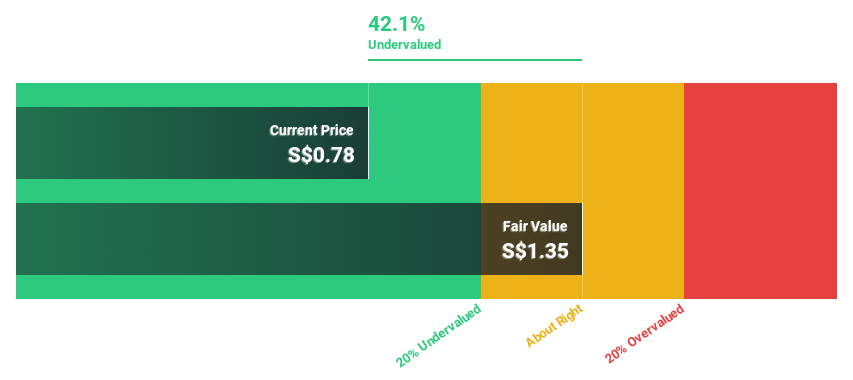

Estimated Discount To Fair Value: 43%

Nanofilm Technologies International, priced at SGD0.84, appears undervalued with a fair value estimate of SGD1.46. The company forecasts robust earnings growth of 50.7% annually, outpacing the Singapore market's 8.9%. Despite this, its return on equity is expected to remain low at 9% in three years, and recent profit margins have declined to 1.8% from last year's 18.5%. Recent corporate guidance confirms optimism for FY2024 with an anticipated increase in revenue and profits.

Seize The Opportunity

Click here to access our complete index of 7 Undervalued SGX Stocks Based On Cash Flows.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:5E2SGX:DCRUSGX:MZH and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com