3 Shipping Stocks to Bet On From a Prospering Industry

The Zacks Transportation - Shipping industry is suffering from headwinds like raging inflation, higher interest rates, increased fuel price and supply-chain disruptions. Despite the headwinds, positives like the re-opening of the Chinese economy, improvement in the demand scenario of goods and commodities from pandemic lows and the resultant favorable shipping rates bode well for this key industry.

The prevalent scenario makes stocks like FLEX LNG Limited FLNG, Global Ship Lease GSL and Ardmore Shipping Corporation ASC attractive investment options.

Industry Overview

The companies housed in the Zacks Transportation - Shipping industry, which is cyclical in nature, offer liquefied natural gas and crude oil marine transportation services under long-term, fixed-rate contracts with energy and utility bigwigs. Most participants focus on the seaborne transportation of crude oil and other oil products, globally.

The industry also includes players that own, operate and manage liquefied natural gas carriers. Some participants are owners and operators of containerships for charter. The change in the e-commerce landscape following the coronavirus impact has made shippers rely more on third-party logistics providers.

The well-being of the industry participants is directly proportional to the health of the economy. The resumption of economic activities after coming to a standstill during the pandemic bodes well for the industry.

3 Key Investing Trends to Watch in the Transportation-Shipping Industry

Reopening of the Chinese Economy: With the reopening of the Chinese economy, the entire shipping industry has heaved a sigh of relief. In fact, ocean shipping is hugely dependent on China. This is because China is not only a key manufacturing hub but also sees significant high demand for goods and services, courtesy of the country’s large population. With the shipping industry responsible for transporting the bulk of the goods involved in global trade, the improvement in travel to and from China bodes well as it increases the demand for the vessels transporting various commodities like oil.

Supply-Chain Disruptions & High Costs: Although economic activities picked up from the pandemic gloom, supply-chain disruptions continue to dent stocks in the industry. Increased operating costs are also limiting bottom-line growth. Costs will likely continue to be steep going forward due to supply-chain troubles. The spike in fuel costs is also flaring up the operating expenses of industry players.

Strong LNG Market: Upbeat demand for liquefied natural gas (LNG) represent a huge positive for stocks like FLEX LNG. The elevated levels of inflation raised oil and natural gas prices. Moreover, amid the prolonged Russia-Ukraine war, Europe is likely to seek gas supplies outside Russia. This is expected to drive demand for LNG vessels.

Zacks Industry Rank Indicates Sunny Prospects

The Zacks Transportation - Shipping industry is a 35-stock group within the broader Zacks Transportation sector. The industry currently carries a Zacks Industry Rank #108, which places it in the top 43% of 250 plus Zacks industries.

The group’s Zacks Industry Rank, basically the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually gaining confidence in this group’s earnings growth potential. The industry’s earnings estimate for 2023 has increased 10.8% since January-end.

Before we present a few stocks that you may want to add to your portfolio, let’s look at the industry’s recent stock-market performance and its valuation picture.

Industry Underperforms S&P 500 but Outperforms Sector

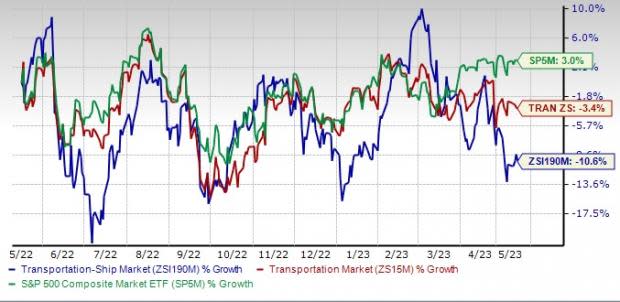

The Zacks Transportation - Shipping industry has underperformed the Zacks S&P 500 composite index but outperformed the broader sector over the past year.

Over this period, the industry has declined 3.4% against the S&P 500 Index’s northward movement of 3%. The broader sector has declined 10.6% in the same timeframe.

One-Year Price Performance

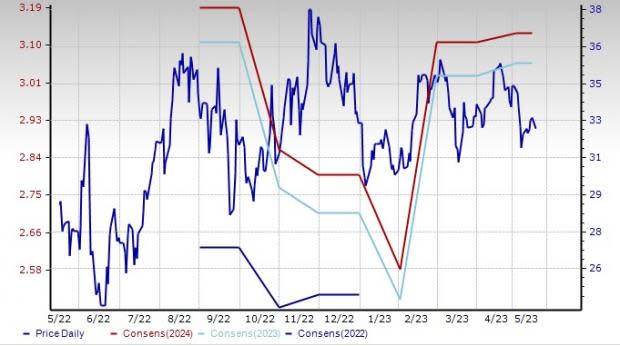

Industry's Current Valuation

On the basis of the forward 12-month price-to-earnings (P/E- F12M), a commonly used multiple for valuing shipping stocks, the industry is currently trading at 4.84X, compared with the S&P 500’s 18.35X. It is also below the sector’s P/E (F12) ratio of 13.43X.

Over the past five years, the industry has traded as high as 40.41X, as low as 3.76X and at the median of 5.82X as the chart below shows.

P/E Ratio (Forward 12-Month)

3 Transportation - Shipping Stocks Worth Adding to Your Portfolio

Global Ship Lease is being aided by the bullish sentiment surrounding the containership market. GSL’s strong balance sheet is an added positive. GSL’s expected earnings growth rate for 2023 is 87.65% from the 2022 actuals.

The Zacks Consensus Estimate for current-year earnings has moved up 40.09% over the past 60 days. GSL currently sports a Zacks Rank #1 (Strong Buy). Shares of GSL have gained 13.1% so far this year.

You can see the complete list of today’s Zacks #1 Rank stocks here

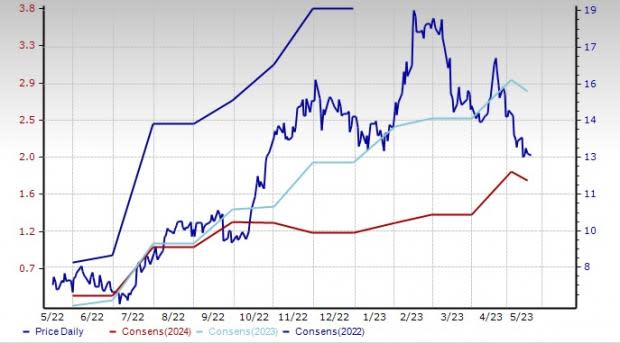

Price and Consensus: GSL

Ardmore Shipping is being well-served by the bullishness surrounding the tanker market as both crude and product tanker rates are currently at healthy levels. The resumption of economic activities and an uptick in world trade boosted ASC’s top-line performance.

The optimism surrounding the stock can be gauged from the fact that ASC shares have surged 75.3% in a year’s time. Over the past 60 days, the Zacks Consensus Estimate for 2023 earnings has moved 12.5% north. GSL currently sports a Zacks Rank #1.

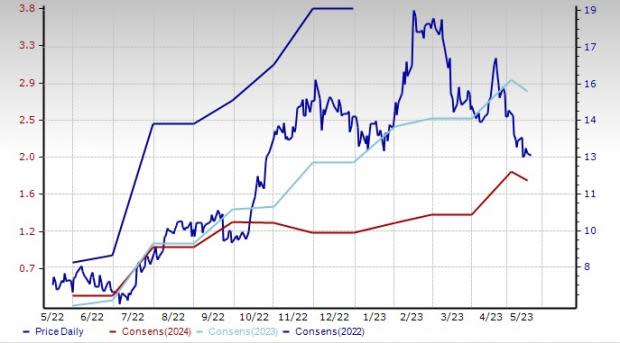

Price and Consensus: ASC

FLEX LNG: Upbeat demand for LNG bodes well for FLNG. Efforts to reward its shareholders through dividends attests to the company’s financial well-being.

FLEX LNG currently carries a Zacks Rank #2 (Buy). FLNG shares have surged 12.3% in a year’s time. Over the past 60 days, the Zacks Consensus Estimate for 2023 earnings has inched up 1%.

Price and Consensus: FLNG

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Flex LNG Ltd. (FLNG) : Free Stock Analysis Report

Global Ship Lease, Inc. (GSL) : Free Stock Analysis Report

Ardmore Shipping Corporation (ASC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance