3 Solid Dividend Stocks In The UK Offering Up To 6.7% Yield

In the last week, the United Kingdom's stock market has remained steady, mirroring its performance over the past year. However, with earnings forecasted to grow by 12% annually, investors may find opportunities in solid dividend stocks that offer attractive yields in this stable yet growing environment.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 8.71% | ★★★★★★ |

Keller Group (LSE:KLR) | 4.36% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 7.30% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 7.01% | ★★★★★☆ |

DCC (LSE:DCC) | 3.31% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.67% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.65% | ★★★★★☆ |

James Latham (AIM:LTHM) | 3.25% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 4.40% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.74% | ★★★★★☆ |

Click here to see the full list of 61 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

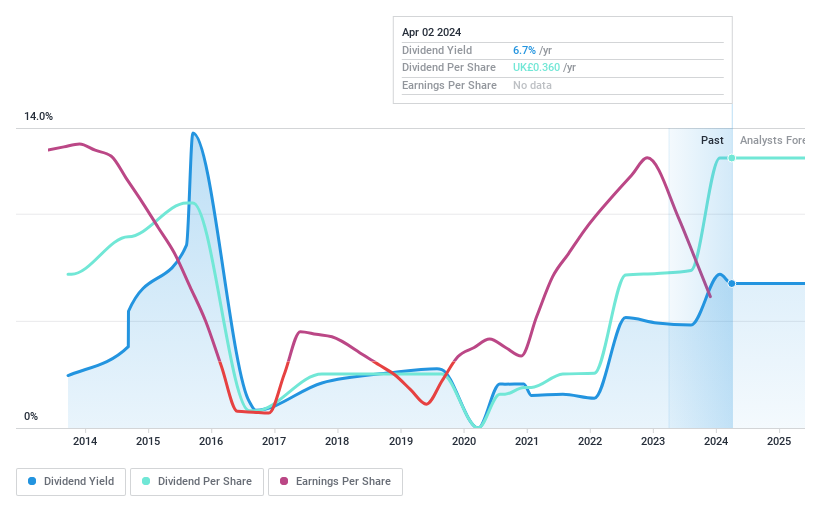

Hargreaves Services (AIM:HSP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hargreaves Services Plc is a company that offers environmental and industrial services across the United Kingdom, Southeast Asia, and South Africa, with a market capitalization of £175.19 million.

Operations: Hargreaves Services Plc generates its revenue primarily through Services and Hargreaves Land segments, amounting to £205.29 million and £2.58 million, respectively.

Dividend Yield: 6.7%

Hargreaves Services Plc's recent financials show a decline in net income to GBP 1.71 million from GBP 16.96 million year-over-year, with earnings per share also decreasing. Despite this, the company has significantly increased its interim dividend to 18 pence, demonstrating confidence in its cash generation and future cash returns. This move aligns with a broader analysis indicating Hargreaves Services' dividends are among the top quartile in the UK market by yield but notes past volatility and an unreliable growth pattern over ten years. The dividend coverage is deemed sustainable, supported by both earnings and cash flows, amidst concerns over profit margins and one-off financial impacts.

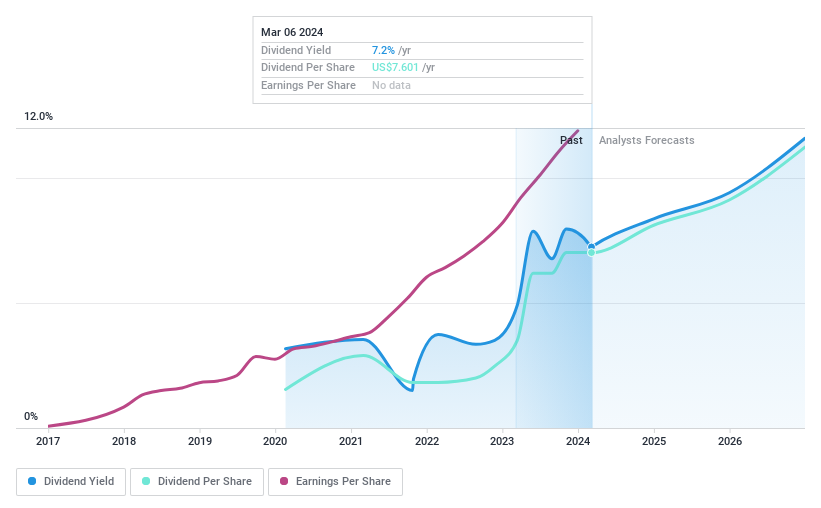

Kaspi.kz (LSE:KSPI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Joint Stock Company Kaspi.kz operates in the Republic of Kazakhstan, offering payments, marketplace, and fintech solutions to consumers and merchants, with a market capitalization of approximately $22.83 billion.

Operations: Kaspi.kz generates revenue through its fintech (₸1.03 billion), payments (₸478.68 million), and marketplace (₸448.22 million) segments in Kazakhstan's dynamic market.

Dividend Yield: 6.3%

Kaspi.kz, despite its recent delisting from the London Stock Exchange on 25 March 2024 due to low trading volumes and a shift towards Nasdaq, continues to demonstrate strong financial performance with a notable year-over-year earnings growth of 43.8% for the year ended December 31, 2023. The company's dividend yield of 6.27% ranks in the top quartile within the UK market, supported by a payout ratio of 72.2% and cash payout ratio of 61%, indicating sustainability from both earnings and cash flows perspectives. However, it's worth noting Kaspi.kz has had an unstable dividend track record over its short four-year dividend-paying history, marked by volatility in payments.

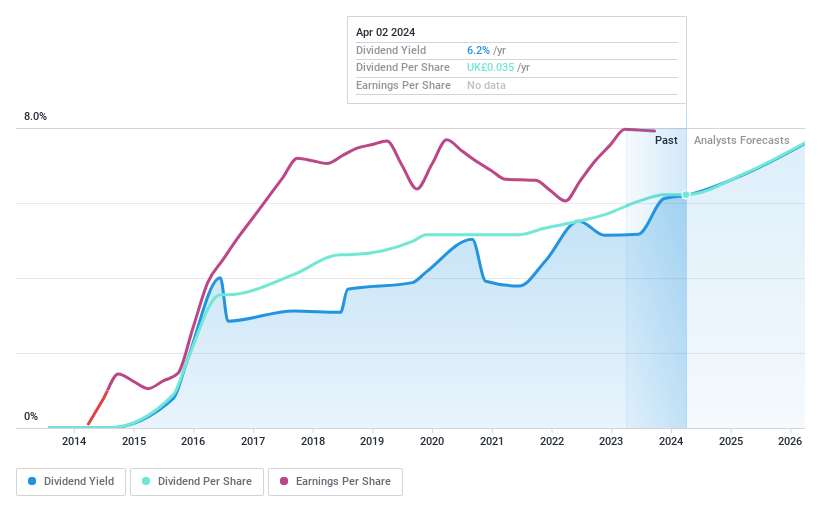

Severfield (LSE:SFR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Severfield plc operates in the structural steelwork industry, focusing on design, manufacturing, fabrication, construction, and erection of steelwork activities across the United Kingdom, Republic of Ireland, Europe, and India, with a market capitalization of approximately £174.58 million.

Operations: Severfield plc generates its revenue primarily through core construction operations, amounting to £471.97 million.

Dividend Yield: 6.2%

Severfield showcases a promising outlook for dividend investors, with earnings expected to grow by 7.46% annually. Its dividend yield of 6.21% places it in the top 25% of UK dividend payers, supported by a sustainable payout ratio of 50.6% and an even more reassuring cash payout ratio of 18.5%. Despite this, Severfield's history as a dividend payer spans just under a decade with some instability noted in its track record, bringing some caution to its otherwise attractive profile for those seeking income through dividends.

Take a closer look at Severfield's potential here in our dividend report.

Upon reviewing our latest valuation report, Severfield's share price might be too pessimistic.

Summing It All Up

Access the full spectrum of 61 Top Dividend Stocks by clicking on this link.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

Explore small companies with big growth potential before they take off.

Fuel your portfolio with fast-growing stocks poised for rapid expansion.

Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance